By Rick Lear, Lear Investment Management

This classic rock-n-roll tune was made famous by Led Zeppelin when released on their first album in 1969. It remains a timeless anthem and holds a special place in music history. The title reminded us of how many investors are feeling after the social, political, and economic hurricane of 2020.

The most common question in the investment community today: “How can the stock market be at these levels with all the troubles in the world?”

Lots of people talk and few of them know

This week we shed some light on the current investment landscape for those left Dazed and Confused by the S&P 500 Index’s 32% decline and ensuing 44% rebound. Much like the psychedelic blues delivered by Zeppelin, the market can take investors on a wild ride, but usually makes sense in the end.

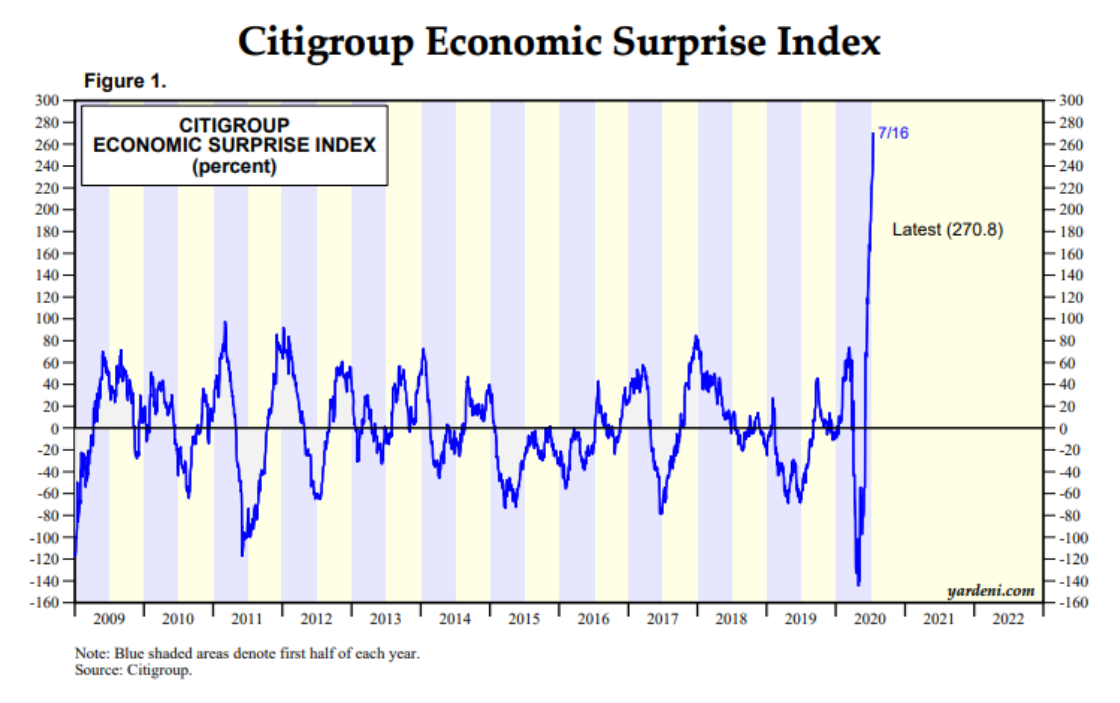

The S&P 500 declined in March after the COVID-19 crisis swept the nation causing massive economic damage. Economic forecasters began to plan for a doomsday scenario and stock investors panicked. Evidence of this overreaction is displayed by the Citigroup US Economic Surprise Index.

The Index measures actual economic results versus consensusestimates. TheindexdippedinMarchas the data was worse than the economists expected due to the COVID-induced economic shutdowns. But then, a large spike in the line over the past month indicating historically positive upside surprises. Not great, but better than expected.

The economy rebounded much faster than the majority of economists expected. In fact, the upside surprises wer e off-the-charts. These surprise economic readings do NOT imply the economy is healthyorbacktofullsteam. ButDOESimplythat the damage done may not have been as permanent as forecasted.

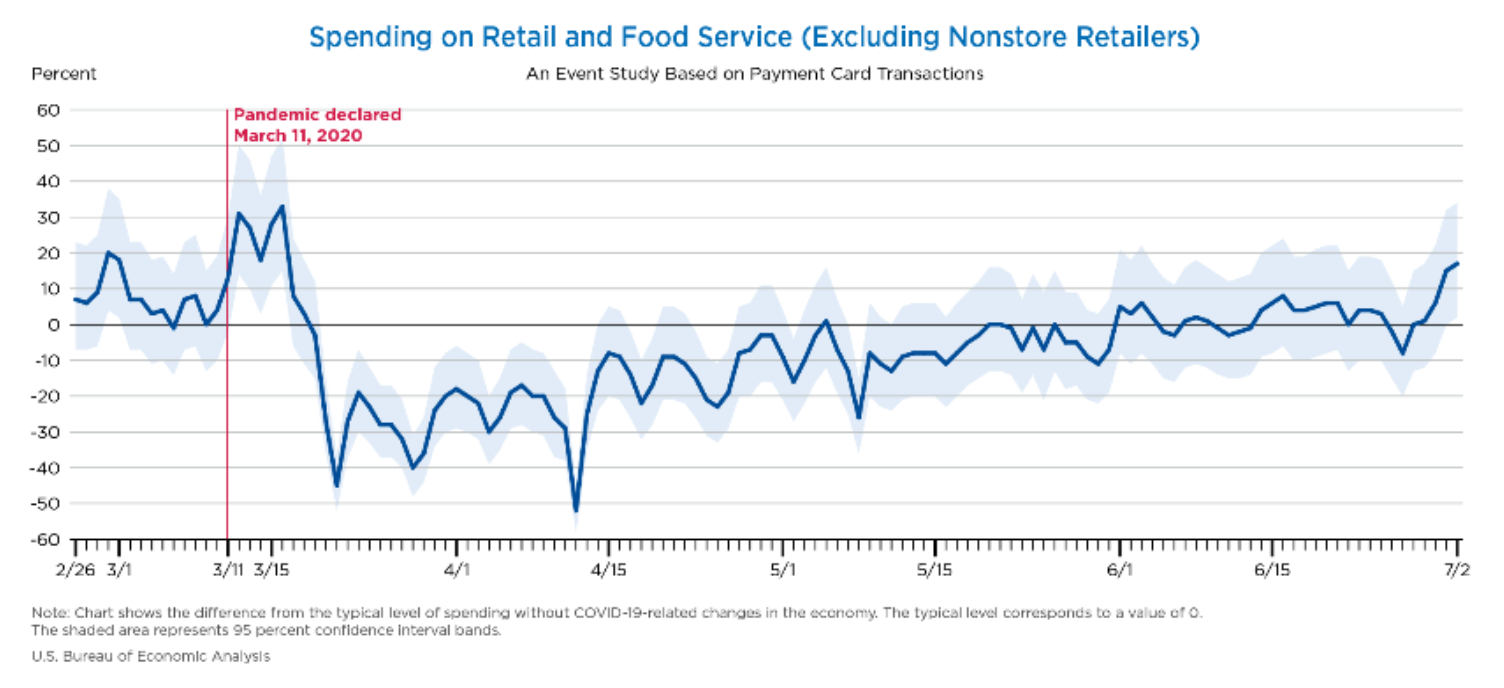

One example of the improving economic data is displayed on the next page in a chart by the US Bureau of Economic Analysis. The blue line tracks spending on retail and food services (excluding non- store retailers). The chart begins at the end of March and concludes on July 2, 2020.

The chart indicates a mind-blowing resurgence from the lows in March as spending resumed – perhaps fueled by government stimulus and millions going back to work.

In Conclusion - Many stocks were sold off in March to levels that implied a long, very deep recession. When the economy rebounded faster than expected, the stock market rallied back to more normalized levels. The rise left many dizzy and scratching their heads trying to understand what to do now with stocks.

Short-term stock market moves can be unpredictable, but we do feel confident the swift and massive actions by the Government can continue to help the economic healing process. It is important to note that there will be setbacks along the way. There is still real economic damage to come, but perhaps not as bad as many have forecasted.

We believe in the power of science and that a vaccine to COVID will be created. Further, the power of the technology business model has been battle-tested and deserves a higher valuation.

While 2020 has been a crazy, bad trip thus far, there will be brighter days ahead. We wish you and your family much health, peace, and happiness.

Rick Lear is the Founder and Chief Investment Officer of Lear Investment Management. Lear is a pure investment firm founded in 2015 with focus on generating returns with measured risk. With over two decades of experience, his ability to identify global investment trends has resulted in superior outcomes for clients.

The Lear Global Vigilance Strategy is rated 5 Stars by Morningstar and ranks in the 5th percentile of managers in the Tactical Allocation category.

INFORMATION PRESENTED IS FOR EDUCATIONAL PURPOSES ONLY AND DOES NOT INTEND TO MAKE AN OFFER OR SOLICITATION FOR THE SALE OR PURCHASE OF ANY SPECIFIC SECURITIES, INVESTMENTS OR INVESTMENT STRATEGIES. BLOOMBERG IS THE SOURCE OF MARKET DATA. INVESTMENTS INVOLVE RISK AND ARE NOT GUARANTEED. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RETURNS. BE SURE TO FIRST CONSULT WITH A QUALIFIED FINANCIAL ADVISER AND/OR TAX PROFESSIONAL BEFORE IMPLEMENTING ANY STRATEGY DISCUSSED HEREIN.