Developments in China this year have served as a good example of this belief.

As readers of these previous musings are aware, we have been staunch students of the Chinese markets. This month, we take an in-depth look at the potential factors to consider in this fascinating country.

Desire Lines – Exploring China, Landscape Architecture and Human Nature

The most popular question we fielded recently is “Why was the team investing in China when the GDP growth was slowing and many said to stay away?” We recently read an antidote that helps explain our thinking on investing and China:

In the late 1940’s, Columbia University was faced with a problem. The University was committed to beautifying the campus with the springtime action of planting grass seedlings. After sprinkling the seeds and “KEEP OFF GRASS” signs in the target areas, the University quickly realized the grass was not growing as people continued to walk on the lawn (the paths they took were often referred to, appropriately, as “Desire Lines”). The heated debate on how to keep the students from walking across the lawn made its way to the head of the University – General Dwight D. Eisenhower.

Ike came to the conclusion that students were going to take the shortest path to their classes – which, of course, was across the lawn. He suggested the school stop fighting human nature and adjust. The school paved paths at a diagonal across the lawn where the grass was not growing and everyone was pleased.

The citizens and economy of China are evolving, and it will be awfully tough to keep them off the grass. It is human nature to drive to a better life and advance. It is clear the 1.4 billion people in China (along with their government) are carving their own path to a mature, developed, sustainable economy - leading to better lives for all Chinese citizens.

Our China Thesis

Despite the 18% return of the MSCI China Stock Index in April, we remain constructive on the long-term outlook for China with near-term volatility probable.

We have summarized our research into eight general topics. (“8” is a lucky number in Chinese, due to its ying-and-yang duality). Because China is a vast, complicated country, the economy and stock markets are no different. And going off the path can be intimidating. We hope these points will encourage you further to discover exciting “Desire Lines” within the space:

1. Favorable Demographics: Health vs. Wealth

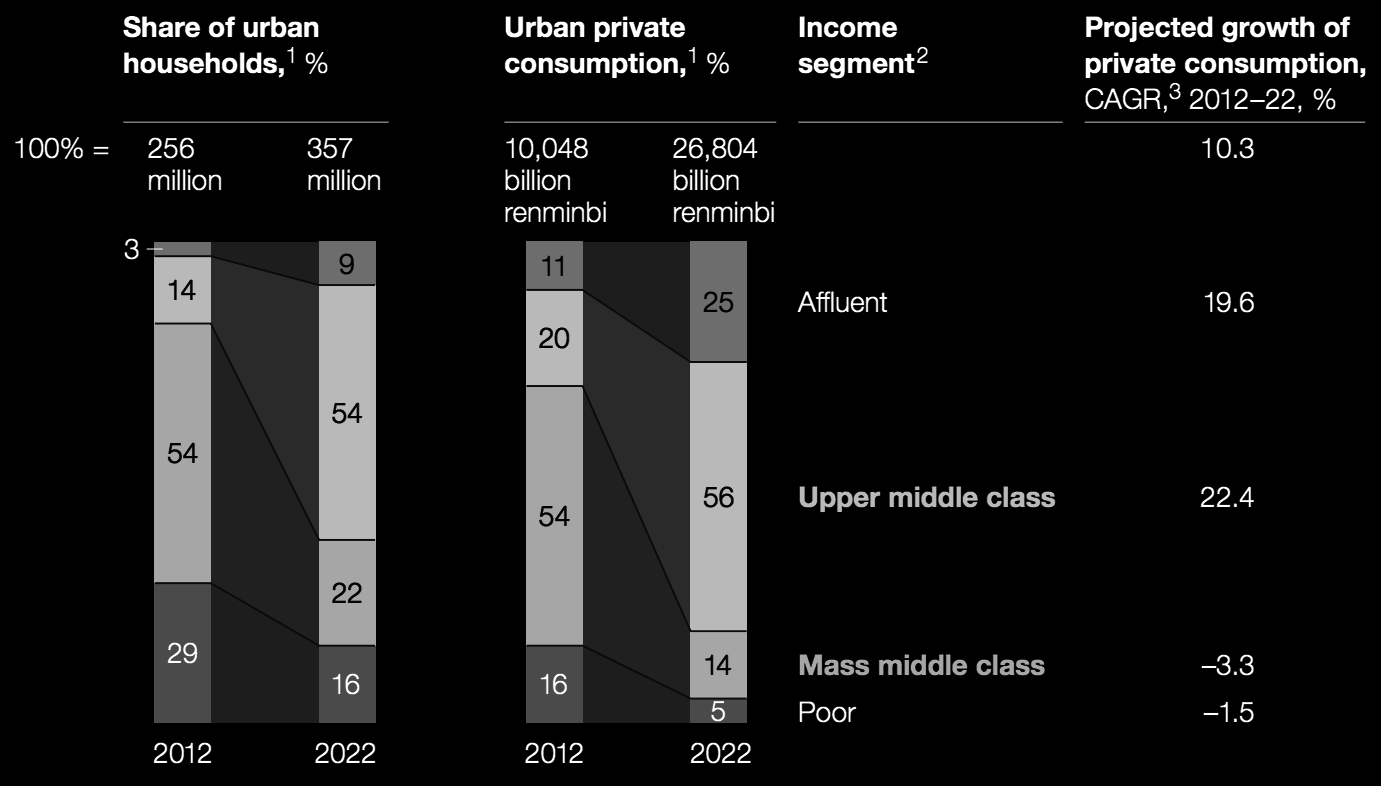

In addition, the amount of Chinese moving above the poverty line and into middle class (and even upper middle class) has grown rapidly. McKinsey & Company forecasts that by 2022, 80% of the urban population will be upper middle class or affluent. This is a profound amount of consumption and spending. We’ve built our thesis upon this exciting information. The following is an illustration by McKinsey summarizing their research:

2 Defined by annual disposable income per urban household, in 2010 real terms; affluent, >229,000 renminbi (equivalent to >$34,000); upper middle class, 106,000 to 229,000 renminbi (equivalent to $16000 to $34,000); mass middle class, 60,000 to 106,000 renminbi (equivalent to $9,000 to $16,000); poor, <60,000 renminbi (equivalent to <$9,000).

3 Compound annual growth rate.

2. Growth of Economy: Dollars vs. Percentages

A popular headline this year has been: China’s growth is slowing. The GDP of China was $9 trillion in 2014 (compared to $17 trillion in the US). We believe that simple math will reveal a path across the lawn – demonstrating a mathematical lesson: dollars matter as much as percentages. Let’s take a look at the growth of China’s GDP in terms of dollars:

While it is accurate the percentage change in the growth has slowed, the actual dollar amount of growth has been very meaningful. The approximate $1 trillion change in GDP from 2013 to 2014 was a lower percentage growth at 7%, but is 3x the growth of the US. In fact, it is more than US, Japan and Europe combined. This slowing percentage growth is appropriate for a country looking to mature and have a seat at the table of global economic powers.

Also important to note – an investor is not buying the GDP of a country, they are buying future earnings of stocks. In fact, the US market has appreciated over 200% in the past several years while GDP has been closer to 20%. (Cumulative numbers are estimated.)

3. Economic Transition

There has been a meaningful shift in the drivers of the GDP toward a more consumer-driven economy. This is a sign of a more sustainable, mature economy and not one in rapid growth mode. China has historically exported goods and looked to government spending to fuel its growth. The recent shift in the economy is a natural evolution.

4. Ghost Towns – Red Flag?

Much has been written about the large cities the government constructed in anticipation of the massive urbanization. While some of the towns are empty, we believe the government spending will serve the country well in the future. This is an example of building and planning for the future. The government must also complete the building of transportation and other infrastructure before cities can be inhabited. While these cities will not become Beijing overnight, we believe their existence is not as big a red flag as once thought.

5. Structural Changes by Government

The government is committed to opening investment in China to foreign investors and making the capital markets more accessible. The structural changes have been targeted at the banking system and the stock markets. On April 17, the Chinese government announced new regulations on margin and short selling to normalize markets. The next business day, they lowered the reserve requirements of banks in their banking system. This was a one-two punch to demonstrate their commitment to making structural changes.

6. Chinese Stock Markets – Greed is Global

The Chinese stock market can be difficult to navigate. There are several stock exchanges with varying degrees of liquidity and share classes. A portion of the recent run-up in stocks can be attributed to funds flowing to these sections of the stock market just opened to foreign investors. In addition, the citizens of China have been opening brokerage accounts at a dizzying pace. The focus has turned from investing in Real Estate to the stock market and the saving culture has seen a glimpse of a new wave of stock market investors.

We believe the greed of Chinese investors and foreign investors will continue to drive growth in the Chinese stocks which are under allocated in global portfolios. The GDP of China is approximately 10% of global economy while the weighting in global index is less than 5%.

7. Xi Jinping – Restore Chinese Dominance

The President of China is committed to the Chinese Dream. He has implemented and enforced many structural reforms to restore the country back to its glory. One major area which required attention was corruption.

2014 was a year with numerous examples of Chinese commitment to crack down as 100,000 officials were charged with corruption.

8. Valuation Matters

The price to earnings of the MSCI China Index was approximately 10x earnings at the beginning of the year (12/31/2014). It is now closer to 13x (compared to 17.5x for S&P 500). This valuation makes it attractive compared to other countries in the world.

WARNING – TRED LIGHTLY

This is a risky market. Any market that can go up 18% in one month can also go down. There are great challenges in China. The market’s complexity and illiquidity create potential issues. We are not blind to these matters, but we feel the opportunity is worth the risk for a portion of an investor’s longer-term assets.

Another note, China has financed much of their growth raising the debt to GDP ratio to around 280%. This puts it on a level now with the USA and Japan.

In Summary, we hope you are inspired to:

- Walk naturally and not always on the path…the world is too dynamic for old, staid paths.

- Have an open mind to new ideas, solutions and opportunities in your life and in investing.

- Grow closer to, and be aware of human nature as opposed to fighting it.

- Have courage to create your own “Desire Lines.”