Faster Horses, Portmanteaus and the Euro: Henry Ford’s Advice on Opportunity and the European Economy.

Henry Ford did not invent the car, nor did he invent the assembly line, but he is one of the greatest innovators in history. At a time when people were looking for “faster horses” to solve their transportation issues, his vision allowed the automobile to be affordable to the middle class - changing mass production, transportation and human behavior forever.

Always Be Jumping

We recently read a statement by Henry Ford – “My success is through nothing but catching the right opportunity at the right moment. People either think of opportunities that are in the future, you cannot catch hold of them, or they think of opportunities that have passed.” Somebody asked, “but if you don’t think of an opportunity in the future and you don’t think of an opportunity that passed, how suddenly can you get hold of it when it comes?“ Ford responded, “One has to be jumping. When it comes, jump on it!”

We think of investing in a similar manner. As an opportunistic global investor we are not tied to any one strategy - we are tied to opportunity. We do not focus on any one specific asset class. Our goal is to find the best opportunity for our investors and jump on it when appropriate - with a reasonable portion of their assets. (We define “reasonable” as crucial enough to make a difference in a portfolio without compromising tolerance for loss.)

Our readers and current investors are aware we have jumped on opportunities in global autos and China. (Previous notes at Learim.com) Since the turn of the year, we’ve noticed similar opportunities in Europe.

In 2015, the European Central Bank (led by Mario Draghi) began a large-scale economic stimulus package to fuel growth in the region.

Our Thesis

We believe European equities present a tremendous opportunity for growth compared to other asset classes around the world.

Paving the Way

In 2008, the US Fed embarked on a massive stimulus program called Quantitative Easing (QE). Since the purchase of an estimated $3 trillion of bonds, the US stock market is up approximately 200% and the economy is running closer to full employment. There are people who still doubt the Fed’s actions. We speculate they have not taken Ford’s advice and did not jump. The following is a chart of the S&P 500 (SPX) from 2008 (year the Quantitative Easing began) to today:

As the US Fed begins the process of raising interest rates, we remain grateful we jumped on this opportunity, but realize the easy money and large returns in US stocks are a thing of the past. (US equities are still an important part of our portfolio, but we have trimmed at these valuation levels.) Now, we turn the page to opportunity in Europe. Lear Research Notes – May 2015 Learim.com

In 2015, since the beginning of a similar stimulus program in Europe, the unhedged European stock market index (EZU) is up approximately 8% (ending 5/29/15). The currency hedged index (HEZU) is up 17% for the same time period. Let’s explore how such a stimulus works in theory with a sketch from our note pad to explain the general idea:

The European Central Bank buys bonds. This is aimed at lowering interest rates and lowering the value of the currency by flooding the market with liquidity of Euros. When the currency is lower, the goods of a country are more attractive to foreign consumers. The factories in Europe begin producing more goods, more are employed and the economy grows. The economic growth generates tax revenues for the government.

Perhaps the largest beneficiary of the recent stimulus is Germany, the largest economy in Europe. Some facts about Germany:

- GDP of $2.8 trillion in 2014.

- Third largest exporter in the world with $1.5 trillion of goods and services sold. (US and China hold the 1st and 2nd spots)

- Main trade partners are France, UK, US and China (the consumers in China and US are alive and well)

- Cars and machinery are largest export. (Produced 6 million cars in 2014; we believe car sales will continue to grow)

- Largest import is oil (oil prices remain low)

- Has a highly skilled and efficient workforce.

- 30% of land is covered by forests, large producer of chemicals and paper.

- 74% GDP/debt (half that of the US and China)

Distinct Differences

Many of the factors in the EU differ from those in the US. And the most glaring difference is the diversity of social and political issues of the various countries that make up the EU An example of this challenge can be seen in the potential of a “Grexit” (i.e. Greece’s exit from the EU). This catchy phrase is uttered hourly on CNBC and makes for a good headline. However, while we are big fans of a clever portmanteau, we do not believe a “Grexit” will be the end of Europe’s recovery. We created a few word combinations of our own to describe what we believe could happen.

- “Gercovery” (German fueled recovery)

- “Dricochet” (Draghi induced ricochet in growth)

The countries in some EU nations will-be and have-been forced to make structural changes if they are to last in the union. These changes are not easy and will come with sacrifice for the citizens. Our suggestion is that the lowering currency will create growth for exports and lead to cheaper borrowing costs for companies to fuel growth. The benefits are not reserved for just Germany, as we believe the entire region will benefit.

Not their First Bullfight

(or rodeo for those of us in Texas)

Spain, Italy and France are implementing structural changes of their own, brought on by the financial crisis in 2011. The region has seen this before with Greece and Cyprus back in 2011.

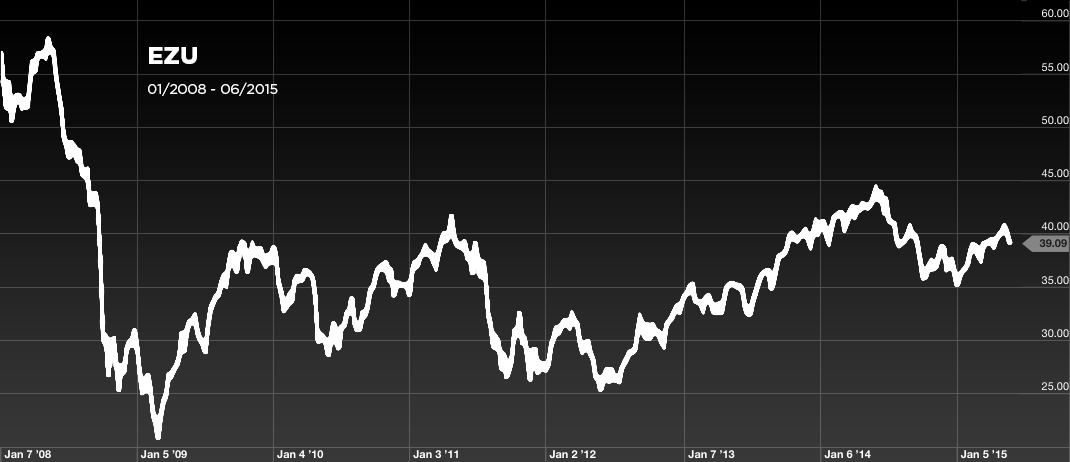

Currently, the European market is trading at price levels seen in 2006. The valuation (as measured by Price-to-Earnings ratio) is below the S&P 500. Unlike the US, the market has not fully recovered from the 2008 crisis. The market did take a dip again in 2011, with a modest recovery. We feel it is poised to grow. The following is a chart of the European stock market (EZU):

Conclusion

We believe the European stock market can move higher as equities become attractive relative to bonds and other markets around the world, including the US.

For those concerned about the commitment of the EU to QE, please consider the following comments by Mario Draghi made on this month. In regards to the stimulus program he stated “our monetary policy stimulus will stay in place as long as needed for its objective to be fully achieved on a truly sustained basis.”

We believe the bankers in Europe will make the right moves to stimulate their economy while the US will make the right moves to slowly end our QE program. Much like a golfer reading the line of the player putting before them, the EU has the luxury of watching the US and Japan go first. Let’s not forget, the EU has also lived thru crisis twice - in 2008 and 2011.

Rethink Your Strategy – The EU thesis is important, but even more important than the “Europportunity” is the overall strategy and mindset to jump on opportunities when you see them. If you find yourself wondering why many opportunities are behind you or in the future, you need to rethink your strategy. Ours? Be Jumping. Now is the time. The world is moving fast and the opportunities are everywhere… Be ready to jump on the right one for you. Be nimble, unbiased and focused on your purpose. “Faster horses” are not always the answer.