Objective: In response to a low interest rate environment that is punishing “savers” and a municipal bond market experiencing historically low yields, we have endeavored to find investments with the following characteristics:

- Low risk

- Medium return

- Stable to high income

- Strong principal protection

We have identified an asset class and investment vehicle that meet our criteria for investment while adding two significant upside metrics — without enhancing risk.

Trend Identified: We believe that the Bank Loan space is misunderstood and has created a dislocation in prices. Closed-end funds are orphaned investment products that do not receive the same analysis as other revenue-producing funds for the large investment banks.

Investments Targeted: Senior-Secured, Floating Rate, Bank Loans Vehicle to Invest: Closed-end Investment Funds that reflect our investment thesis and are trading at a discount to their Net Asset Value.

Portfolio Structure: Separately Managed Account to most efficiently help each investor achieve their income, risk and tax objectives.

Research Variant View: We are able to leverage our analytical advantage of the bank loan market and the portfolio companies to select the most appropriate asset pools for our investors.

Our independence from pushing revenue-producing investments for a parent bank allows us to identify and analyze products that do not garner the attention of other advisors.

We recognize the temporary dislocation in the prices of this stable asset class and are poised to take advantage for significant capital appreciation.

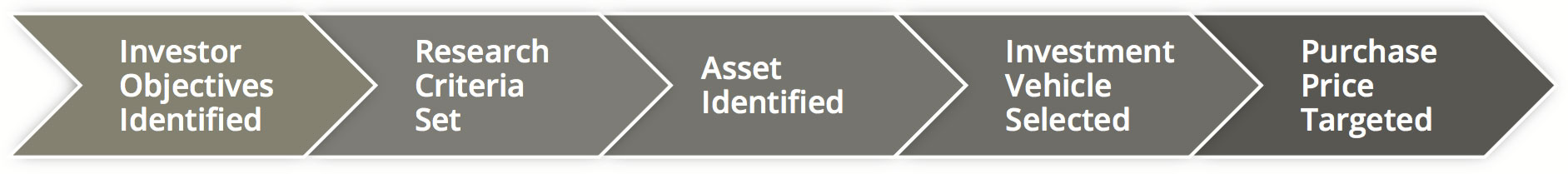

Investment Process Summary

Asset Class Overview

The following explains exactly what Senior Floating Rate Bank Loans are and why they are such an interesting asset class.

“Bank Loans” — These loans are made from a group of banks to a large corporate client. The loan is senior in repayment to other obligations of the Company. As an example, when a Fortune 500 company gets a bank loan, it is arranged by a lead bank and pieces of the overall loan are then distributed amongst other large banking institutions or funds.

This corporate loan is considered “Senior” because it holds legal claim to the borrower's assets above all other debt or equity obligations. In the event of a bankruptcy, the senior bank loan is the first to be repaid, before all other interested parties receive repayment. In the capital structure of a Corporate entity, we believe this is the safest investment available.

The loans are “Floating Rate” in that they have an interest rate that is determined by a base rate and a spread. The base rate is the London InterBank Offering Rate (LIBOR) and the spread is a pre-determined amount to add to the base rate. Example - Libor +400bps would equal the Libor rate (.33%) + 4.00% = 4.33%. As interest rates increase, you will receive more interest and not be punished by owning a fixed rate security. As an example, if LIBOR were at 3%, your interest payment would move to 7% in this example.

Additional advantages of bank debt is that they receive monthly financial updates from their borrowers so they are better informed and on a more timely basis than the general public, they pay interest monthly and they have very low default rates.

Investment Vehicle Overview

A Closed-end fund is a publicly traded investment company that raises a fixed amount of capital through an initial public offering (IPO). The fund is then structured, listed and traded like a stock on a stock exchange.

These funds allow the investing public to participate in an asset class that would otherwise be unavailable (bank loans trade in large minimum sizes and require institutional ownership).

They trade daily offering greater liquidity than owning actual bank debt and pay interest monthly.

These funds are incredibly well diversified with over 400 separate corporate positions across 40 industries. This breadth of holdings greatly reduces risk of principal loss in underlying securities.

Closed-end funds are required to fully disclose their holdings twice a year and to provide a daily value of their holdings. This daily value is the NAV or Net Asset Value and is released as a per-share number.

Closed-end Bank Loan Price Dislocation

When these funds first come to market the brokers and advisors of the underwriter work diligently to place the shares with their clients and garner their significant underwriting fees. After the offering, there is very little incentive for these brokers to stay abreast of the performance of these shares or to recommend them to new clients.

Unlike an Open-end fund, which continues to take in new money (and provide underwriting commissions, load fees and management referral payments), these funds cease to be a profit center for the underwriting banks and more importantly, their brokers. As a result of this lack of coverage, there is no constituency lauding the merits of these funds and they can trade below their actual value (the NAV).

There are funds that trade at a discount to their NAV as ordinary course. We believe that certain Municipal Closed- end funds regularly trade at a discount to NAV and that this has become their long-term reality. This discount is unlikely to close and there is very little capital appreciation available to the investor.

Other funds may trade at a discount to NAV because the assets in their fund are suspect in nature and carry substantial risk. Some of these funds include those that carry currency risk or whose holdings include volatile stocks or below investment grade junk bonds or Convertible securities.

We believe that Senior Loan Closed-end funds have a low risk profile of underlying securities and have been painted with the broad brush of “bonds” and that their discount is temporary.

In the asset class we have chosen and with the specific funds we have identified, ALL of them have traded at a PREMIUM to their NAV within the last two 1⁄2 years and have done so in 5 of the last 7 years and 7 of the last 11 years respectively. These funds are currently trading at discounts approximating 10% which translate to purchases of Senior Corporate Floating Rate Bank Loans at 90 cents on the dollar.