- Part 1: The Current Investment Environment

- Part 2: How and Where to Invest Today

We begin the analysis of the current investment environment and how we arrived here with the question: How do you stop a runaway train?

The first instinct to stop a runaway train may be to jump in front of the mighty engine with both arms extended out. After getting run over a couple times, the next tactic may be to pull the opposite direction from behind the train to slow the momentum. This effort is also a waste of energy. We believe the best way to stop a runaway train is to jump in to gain an understanding from the inside.

We begin this Note by discussing the workings of the runaway stock market from the inside to gain understanding of the levers driving the direction.

“Thinking is the hardest work there is, which is probably the reason why so few engage in it.”

Henry Ford

How we Arrived: The financial crisis of 2008 gave birth to economic stimulus packages around the globe. The stimulus created low (and even negative) interest rates in much of the developed world. The days of the risk free 5% CD are no longer. Today, the amount of risk taken to achieve this type of return has forced many investors into much riskier assets. This is especially true for the baby boomers looking to shift from the accumulation phase of life to the spending phase.

The low interest rates have forced investors into stocks resulting in outsized gains for equity investors and punishing traditional “savers”. While our investors have thoroughly enjoyed the ride up, we believe it is now time to revisit your strategy. The World in Transition requires a portfolio in transition. The late stage of this market cycle requires Precision Investing with focus on returns for controlled amount of risk.

The Current Stock Market: The US bull market cycle is in the 86th month of the cycle. The longest market cycle was 100 months (in the 2000 cycle) and the average is 55 months. It is clear we are in the later stages. It is said bull markets do not die of old age, but they do when the Federal Reserve tightens monetary policy or by a global economic shock. We are early in the tightening process, but the turn in monetary policy has begun.

The rise of Exchange Traded Funds (ETFs) in this bull market has led to many investors getting their stock and bond exposure by owning a large basket of securities regardless of the fundamentals of the holdings. In a mature market, more thought is required to decide which stocks or bonds to own in the index. As a rising tide lifts all ships, a receding tide will expose the truly buoyant from the artificially inflated. Owning the most vulnerable securities in the index is not optimal in the mature stage. This seems intuitive, but it takes hard work and deep understanding of the data to understand where the real risk lies and to keep your portfolio afloat.

Our proprietary collection of research metrics does not indicate a recession this year, but we are beginning to notice warning signs.

Example of Data: We combine traditional, fundamental research with cutting edge intelligence-gathering techniques (like web search trends, satellite imaging, social media monitoring and machine learning) to gain an informational advantage.

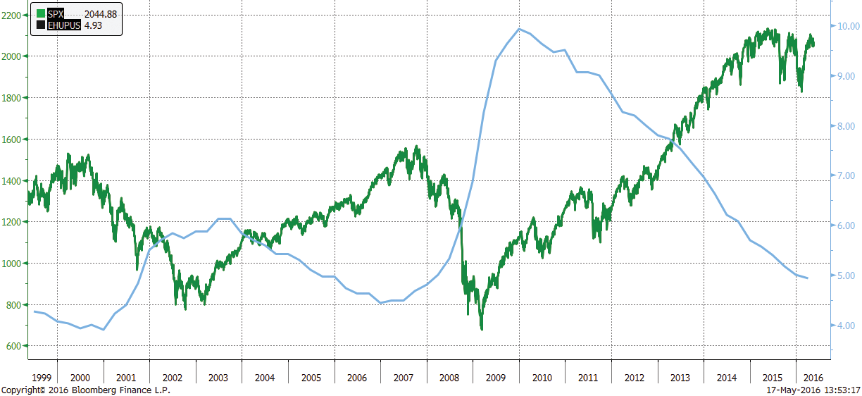

One traditional data point which may seem counter-intuitive is the unemployment rate. The market, media and politicians are obsessed with the unemployment data. As you will note in the chart below, the last two times the unemployment rate hit 4.5% (in 2000 and 2008) the S&P 500 experienced steep declines. If unemployment reaches 4.5%, we will become even more cautious on stocks. The rate is 4.9% as of July 31, 2016.

The following is further evidence of the relationship between the unemployment rate and stock market returns.

| Unemployment Rate | S&P 500 Annualized Returns |

|---|---|

| Above 9% | 24.5% |

| 7-9% | 15.1% |

| 5-6% | 8.3% |

| Below 5% | 3.9% |

Conclusion: We are not fearmongers. In fact, we are not even pessimists. We are optimists with a realistic tilt. Our indicators do not point to a recession in the near term, but we believe it is a time for prudent investing. We are NOT suggesting investors sell everything and take cover.

We believe there is a transition occurring requiring close attention to your investments as the upside in the equity market is limited. It is important to note that factors can change quickly as the US presidential election, oil prices, European politics and Chinese economics could cause disruptions to markets.

Our focus has turned to be in the position to take advantage of dips in good securities caused by broad market sell-offs, preserving the massive gains achieved in bull market run and capturing returns for a controlled amount of risk. It is time for precision investing.

The following is a summary of the current market environment:

- Low interest rates, low oil prices, low growth

- US stock market is trading at a high valuation

- Earnings growth is negative but possibly rebounding

- Globally connected economy = events in other countries are important

- Near full employment

- US Elections could cause volatility

In the next note we will discuss how and where to invest in this World in Transition. We discuss fundamental research and several of our creative intelligence-gathering metrics including satellite images of retail parking lots in America, satellite images of Chinese factories and global web search trends.