In Part I of our Research Note titled The Present and Future of Investing, we set the stage for precision investing in the later stage of this market cycle.

The World in Transition (WIT) is characterized by the following three factors:

- Global Demographic Shift – emerging economies grow middle class while developed markets age

- Lower for Longer Trifecta (LLT) – lower oil prices, interest rates and economic growth

- Adjustment to Returns and Risk – causing mispricings in select securities

The current investment environment is one of the most challenging of the past two decades. However, we believe there are pockets of mispriced securities today in the US and abroad. We have selected three opportunities to discuss. In each, we explain our investment thesis on the undervalued asset, as well as the antithesis - or the overvalued asset.

Mature Technology and Automotive Technology

Antithesis – Consumer Staples and Utilities

At first glance, it may appear the US stock market is steady and fairly valued. A deeper dive will reveal that the 2016 stock market was driven higher by defensive names in a search for yield. This chasing of yield created opportunities as investors fled several consumer cyclical and mature technology names. According to a recent Wall Street Journal article, Utilities and Consumer Staples are the most crowded industries for stock investors in the past 18 years.

The other side of the market reveals a different picture. Several technology companies, with strong growth and fortress-like balance sheets, are trading at attractive valuations. When compared to the low growth metrics of the consumer staple and utilities names, these mature technology titans look even more attractive.

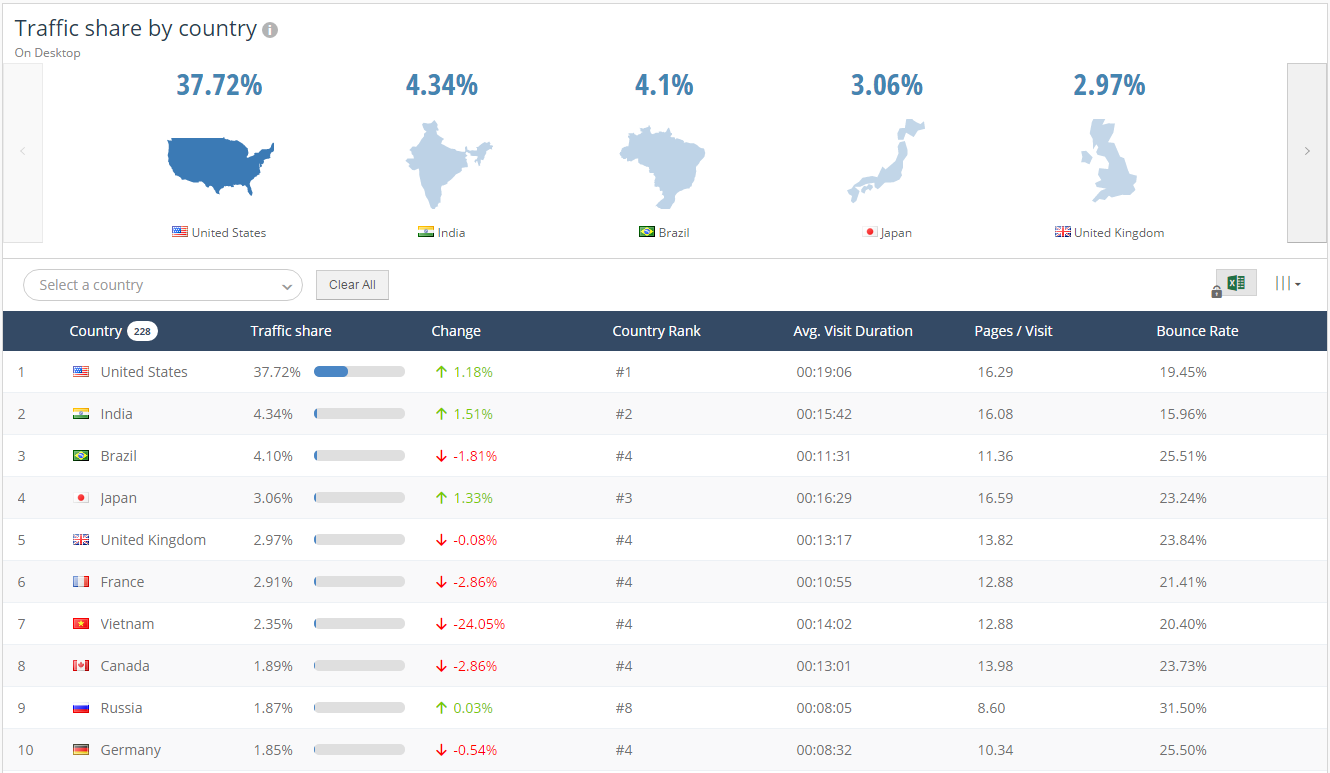

Alphabet (formerly Google) and Apple are two examples of mature technology companies that present opportunities. As part of our research, we analyze web traffic around the world. The following chart illustrates the dominance of Google as a global brand. It is the number one most visited website in the US, second in India and top 5 in most major countries. These data points, in addition to our fundamental research on the company, give us confidence in owning this stock opposed to owning a broad index.

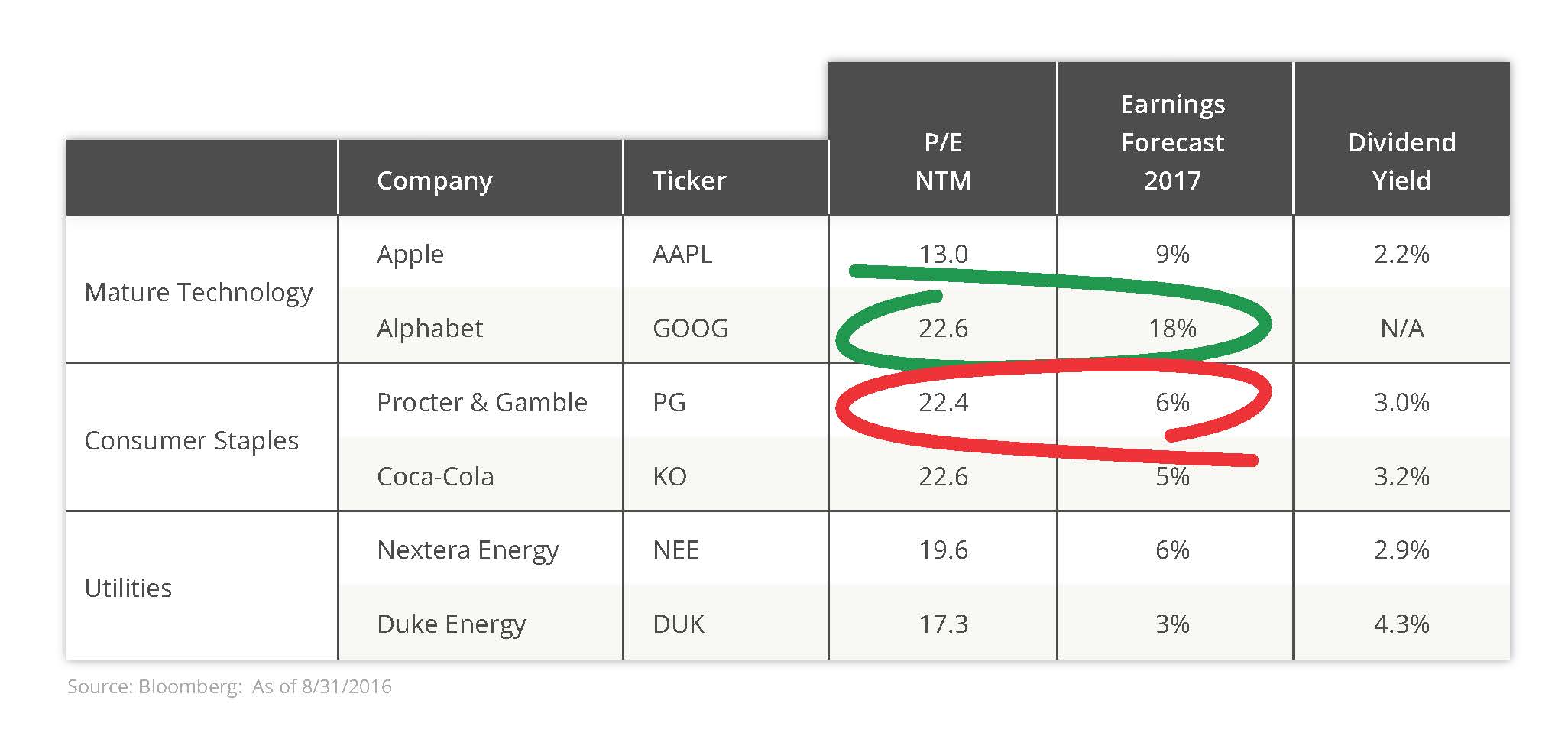

Apple is another example of opportunity created from rotation into defensive stocks. The Price-to-Earnings (P/E) ratio, 2017 earnings growth forecast, and dividend yield are displayed in a chart below for the two stock examples in comparison to the two largest stocks in the Consumer Staple and the Utility sectors. The mature technology stocks have lower prices for the amount of expected growth. Is the higher dividend yield worth the lack of growth and higher valuation?

Alphabet (Google) and Apple are innovators. Few spaces have captured the attention of innovators more than automobiles. Our vision for the future of autos is becoming a reality. In addition to being connected to the internet and cloud, the technology in vehicles allows the car to drive itself. This has broad implications as the data collected from the car will continue the explosion in cloud computing and cloud storage.

In a recent Bloomberg article, it was stated that AT&T had more new car mobile connections than net new mobile phone connections. While we find opportunities in the technology of autos, we remain cognizant that the new fleet of cars must be manufactured. This leads us to General Motors. GM is trading at a P/E ratio of 5 and a yield of 6%.

Some in this space lean toward the headlines of Tesla, despite their inability to mass produce a car and make a profit. For example, Tesla struggles to produce 60,000 cars in a year while GM produces 330,000 in a MONTH. We believe in disruption of the industry, but also in making a profit. Our research and thesis creation is built on valuation, thus we do not own Tesla.

Fixed Income – Senior-Secured Bank Loans & Short-Term High Yield

Antithesis – Government and Municipal Bonds

Holding US Treasuries at this stage of the market is a fool’s errand. The 1.6% yield offers de minimus returns that are below the projected inflation rate. Municipal securities also offer miniscule short-term returns (under 5 years) and any increase in interest rates will punish the prices of longer-term bonds. In other words, if you hold these securities until maturity, you will receive the prescribed return, but you may see long periods of time where you are locked in to a low-yielding security and not able to access the funds without taking a loss.

In contrast, we are taking advantage of price dislocations in high-yield and senior-secured bank loans. We are endeavoring to be ‘senior’ in capital structures by utilizing one of the following three credit enhancements:

- We are buying senior-secured securities. These securities are backed by real collateral and are paid first in priority in the case of any bankruptcy filing. We are, quite literally, owning the corporate ‘mortgages’ of these companies.

- We are investing in shorter-maturity securities. While not being ‘structurally senior’ in the capital structure, they are first in line to be paid on a chronological basis. Given the quality of the companies in which we invest, we can see they have ample liquidity to meet the refinancing of their debts over a shorter-time horizon. The longer-term maturities (5 years or more) have less clarity; we have great confidence in holding these shorter-term quality high-yield names.

- We are investing in industries with very low exposure to metals and mining and oil and gas. The majority of defaults in the corporate debt arena are coming from these industries, and we are limiting our exposure. We are reducing risk by mitigating our exposure to the highest beta names in the corporate debt universe and will keep our diligence towards limiting downside for our clients by averting more volatile industries.

The lower-for-longer interest rate environment has created an unprecedented shift in risk and reward in the fixed-income sector. Careful attention to this area can greatly benefit investors in the WIT.

Namaste: India

Antithesis – Brazil and Russia

Economies are driven by a few key factors:

- Demographics – size, age and quality of life of the population

- Consumption – people buying goods and services

- Governmental Spending – favorable governmental policies and commitment to growth (often infrastructure spending)

- Favorable Economic Backdrop – low interest rates, commodity prices and favorable GDP momentum

India has all of these factors working to its advantage. There are 1.3 billion people in India and a pro-growth government in place. A large amount of the country lives in extreme poverty, however, the government is committed to making a better life. This has resulted in a massive transformation as many citizens move above the poverty line and begin to consume. This has made India the fastest growing economy in the world at +7%.

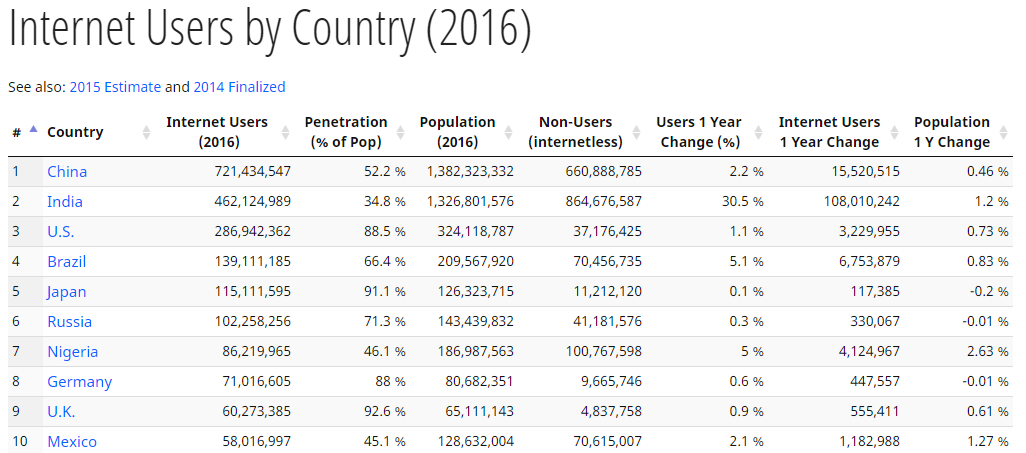

The internet and mobile phone are great equalizers in our modern world, as access to a mobile phone and a road allow for consumption in remote areas of the world. This shift has opened markets to more consumers and has changed the nature of growth in the world. Today, India boasts the most people under the age of thirty in the world, the most mobile phone connections, the most Facebook users outside the US and the highest growth in internet users.

The following chart displays the growth of internet users by country. Note India is experiencing the most rapid growth by a significant margin.

The growth forecasted for the corporations in India’s broad stock market (Sensex) is forecasted to be 17% in 2017. The Sensex stock market is as equally valued as the US S&P 500 Index (as a multiple of earnings). Please note, in any emerging country there are risks of declines. However, we believe investors looking for growth over a reasonable time horizon will be well served with a portion of assets in India.

Many investors use Emerging Market (EM) indexes to gain exposure. Or, they select a mutual fund which closely tracks the index. The EM funds have broad exposure to all EM markets with weightings to Brazil, Russia and China. We believe, in this stage of the market cycle, it is appropriate to select the most attractive country instead of owning every country in the index, regardless of outlook to the economic factors of the country. Russian and Brazilian political and currency risk is not something we would like to have in our investors’ portfolios.

In Conclusion to the two-part Research Note:

The World in Transition is characterized by lower interest rates, oil prices and growth. These factors have lifted US stock prices over the past 8 years. Today we are in the later stage of the cycle. The transition has caused a shift in the level of risk investors are taking to get returns. The investment landscape is littered with broad-market strategies. We believe the present and future of investing is a research-driven, precise investment approach.