As we reach the conclusion of this Research Series, we explain the firm’s Investment Process as a differentiating force. This process allows us to distill a global outlook into discrete security selections. The result is a portfolio with a high probability of achieving returns for a controlled amount of risk.

For context, a review of the Series:

Part I: Investment Returns Matter: The primary goal of an investor should be to increase their chances of safely increasing the value of wealth. The difference between average and above average returns can have dramatic effects on your net worth over time.

Part II: LIM Investment Returns are Superior: We outlined the rigorous reporting process of GIPS compliance and stressed how vital compliant performance is to investors. Given the foundation of compliant returns, we shared our strong out-performance of our peers and relative benchmarks.

Part III: Explains how we are able to achieve superior returns through the firm’s foundational tenets. In other words – The LIM Investment Edge.

Part III: LIM Investment Edge

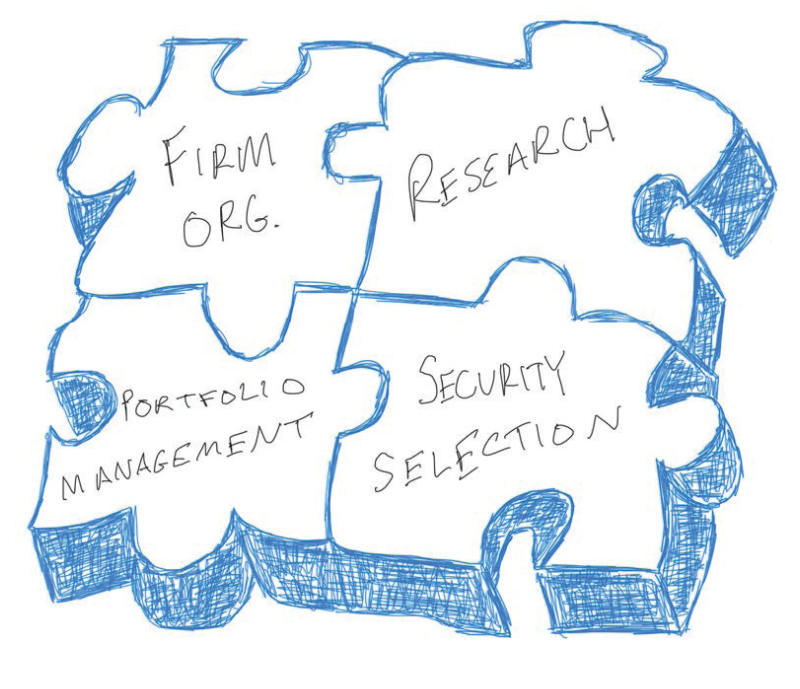

We use the four puzzles pieces to the right as illustration of the four key tenets of our investment process.

While some firms share parts of the puzzle, we do not know of any that combine all for the benefit of their clients. This is the difference – this is the innovation.

Firm Organization

The firm believes in creative thinking and is structured to incentivize new ideas from our professionals. LIM is a flat organization that stresses the integration of global research into an overall theme for a portfolio. We are not organized to have separate profit centers and do not encourage fiefdoms that only laud the parts of the world that they research.

Under these conditions, we can be collaborative without pride of authorship to deliver the best possible outcome regardless of asset class or industry. Because we are compensated with a flat fee, with no incentives to taint our investment outlook, we are a true advocate for our clients.

This structure emphasizes the selection of securities that are complimentary rather than cherry picked from competing themes resulting in a harmonious arc to your portfolio.

Further, LIM is 100% employee-owned. We are not a publicly traded company and have no shareholders demanding we sell more products or add ancillary fees. There is not a sales or marketing department which allows us to dedicate the majority of resources to research efforts. Our largest single expense has been the development of a proprietary software system (named Conrad) to fuel our research, portfolio management and security selection process.

When placed in an organization that fosters creative thinking, intellectual freedom and a client-first paradigm, our research can take center stage.

The trick to investing is seeing something others don’t. The Investment Edge is aimed at understanding the price of a security and why it will be different in the future.

Research

This process begins with a view of global economic factors. We investigate and forecast global trends in interest rates, commodity prices, currency, human behavior, demographics and geopolitical landscape. In addition, we have an intense focus on the role of technology as a key component of the world's economy and future growth.

As general themes emerge, we integrate more innovative tactics like satellite imaging, behavior nance and web traffic data. The research is further refined to form a set of investment theses.

Upon settling on our global themes, we can best select regions and industries with the highest likelihood for success while, just as importantly, listing areas we want to avoid. This step leads us to portfolio management.

Portfolio Management

This process integrates our research-based themes and translates them to a level of quantifiable metrics. How much, where and in what industries?

The thoughtful combination of di erent investments is the key to risk management. We have a strict discipline of position size, number of positions, downside protection, correlation of securities and other factors vital to risk control.

Once a portfolio is established, each of the 30 positions is monitored with perpetual vigilance. We impose strict limits to position size and downside protection measures. Our 30-position limit ensures that, for every new position we believe merits capital, it must be more worthy than its portfolio brethren – more worthy of your irreplaceable wealth.

After our Global Research has dictated our Portfolio Management allocations, the painstaking process of security selection begins.

Security Selection

Picking securities to express our research conclusions is an art unto itself. Countless times we have seen managers get the global theme right and allocate capital to an investment that fails to represent their premise. It is common to overweight or underweight a theme by falling in love with it or lacking conviction. Some investment themes are tainted with securities that include ancillary risks like currency and interest rates. We remain vigilant that we are not investing in themes that cancel each other out or that can be better expressed in a different part of a capital structure.

We primarily consider individual stocks, bonds, exchange traded funds, closed end or open-end mutual funds while weighing their liquidity, execution and ability to express our trends.

We question at each turn whether the security is reflecting our global themes and has the best chance of success with a decipherable downside. Only at the end of this rigorous process, do we choose to make an investment while assuring that the execution price is reasonable.

A Word on Perpetual Vigilance – It is important to note that this process, our Investment Edge, is a living and breathing entity. Our views change as the world changes. Our theses are mobile and we delight in learning and evolving with the investing world around us.

These four pieces of the puzzle combine to create an effort focused on our clients’ goals – investment returns for a controlled amount of risk.

Evidence of our Investment Edge is not just available in our performance numbers, but upon review of our previous research notes. The goal of notes is to display the results of the four pieces of the puzzle and are available here.

LIM claims compliance with the Global Investment Performance Standards (GIPS®). LIM has not been independently verified.

Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments or investment strategies. Bloomberg is the source of market data. Investments involve risk and are not guaranteed. Past performance is not indicative of future returns. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein.

| Composite Name | Year | Firm Assets Under Mgmt^ | Composite Assets | % of Firm Assets | # of Accounts | Gross of Fees | Net of Fees | Benchmark | Dispersion |

|---|---|---|---|---|---|---|---|---|---|

| LIM Composite | 2017* | $90,454,861 | $82,232,314 | 90.9% | 80 | 9.6% | 9.0% | 5.5% | |

| LIM Composite | 2016 | $80,902,422 | $60,233,652 | 74.5% | 32 | 8.4% | 7.3% | 4.5% | 2.3% |

| LIM Composite | 2015** | $77,587,731 | $76,415,938 | 98.5% | 52 | -2.7% | -3.6% | -1.8% | 1.4%*** |

* Composite and benchmark performance are for the period 1/1/2017 through 5/15/2017

** Composite and benchmark performance are for the period 2/2/2015 through 12/31/2015

*** Dispersion was calculated using partial year data

^ Total does not include assets under sub-advisory

Lear Investment Management (“LIM”) claims compliance with the Global Investment Performance Standards (GIPS®) and has prepared and presented this report in compliance with the GIPS standards. LIM has not been independently verified.

Firm Information: LIM is a Registered Investment Advisor based in Dallas, Texas and registered with the State of Texas. Registration does not imply a certain level of skills or training. LIM is a company with purpose, dedicated to creative and unique thinking. We focus on portfolio valuation and research, along with a superior client experience. We seek to identify investment opportunities by looking at economic factors, security valuation and human behavior. We start with the fundamentals of portfolio management and valuation. Then we build on these fundamentals with unique thinking and creative intelligence-gathering to form a viable investment thesis. We believe this approach leads to dynamic global portfolios with increased return and managed risk. LIM utilizes Charles Schwab & Co. Inc (“Schwab”), a FINRA-registered broker-dealer, member SIPC, as its custodian of assets. LIM is independently owned and operated and not affiliated with Schwab.

Composite Characteristics: The LIM Global Vigilance Composite is a collection of separate accounts managed by LIM. Currently the composite holds approximately 60% equities, 35% fixed income and 5% money market. The composite is tracked by Black Diamond (an Advent company). The composite is $82 million of total assets and made up of 80 accounts. These are actual clients of the firm and are all managed by the Lear Investment Management portfolio management team. The strategy is global (US and abroad) equities, fixed income, and cash - depending on market conditions. The composite reinvests dividends. Individual account performance will differ. Past performance is not indicative of future results. The composite was created on February 2, 2015. The composite includes accounts over $100,000, one to three months after inception (depending on how the assets were received). The firm’s list of composite descriptions is available upon request.

Calculation Methodology: Composite returns are calculated by asset-weighting the individual portfolio returns using beginning-of-period values. Composite returns are calculated on a daily basis and geometrically linked to calculate the monthly return. Cash flow timing method, contributions are recorded at the beginning of the day (AM) and distributions are recorded at the end of the day (PM). LIM may use leverage up to 150% of the portfolio net assets as part of investment strategy. Derivatives are not used. Depending on the conditions in the financial markets, the firm may utilize options to hedge entire portfolios or a specific security within a portfolio. LIM calculates the asset weighted standard deviation of the annual gross returns for composites that have six or more portfolios in the composite for the entire year using Black Diamond. LIM’s policies for valuing portfolios, calculating performance and preparing compliant presentations are available upon request. The three-year annualized standard deviation measures the variability of the composite and the benchmark returns over the preceding 36-month period. The three-year annualized standard deviation is not presented for 2015 through 2017 due to less than 36 months of composite and benchmark data.

Benchmark: The customized Composite Benchmark is currently 50% Bloomberg Barclays Aggregate Bond Index & 50% FTSE Global Equity All-World, calculated monthly.

Net-of-fee Performance: Net-of-fee performance shown is calculated by Black Diamond (an Advent Company) and reflects the deduction of actual management fees charged by LIM and any applicable trade fees charged by Charles Schwab. Valuations and performance are computed in US dollars, and individual portfolios are revalued daily.

Fee Schedule: For Private Client: 1.00% on the first $10 million of assets under management. 0.90% on assets from $10 million to $30 million and 0.80% on assets of $30,000,001 or more. Institutional Clients’ fee schedule may vary.