The longest period in history without a 5% decline in the S&P 500 index ended in February. The S&P 500 was down -3.7% for the month. This does not tell the entire story as the market was down 10% at the lows. As of 2/28/18, the S&P 500 was up +1.8% for the year.

It has been a remarkable run for stocks. A pullback was necessary and should not be a surprise. The question today is - Is this recent pullback a normal market adjustment or is the bull market over?

One thing is clear - volatility has returned. The main culprit is the rise in interest rates and fear of inflation. In March, a third concern entered the picture – a potential trade war caused by steel tariffs.

In this Note below we discuss these three concerns:

Tariffs

Just as the market began to cope with the fear of rising interest rates and inflation, the announcement of potential tariffs on steel and aluminum grabbed the headlines.

The steel tariffs are NOT a surprise. The tariffs were part of the economic agenda and have been in the works since day one of the new administration. This is one reason for our investment in Steel Dynamics (Ticker: STLD). While we were anticipating the tariffs, we remain cognizant of implications for the rest of the portfolio.

Steel tariffs affect a small portion of the US economy. Steel is $9 billion of the $19 trillion economy. The tariffs are more of a symbolic move that could trigger future challenges. The main question an investor must ask is:

Will the actions of the administration have adverse effects on the global economy or is the saber-rattling part of a negotiation process?

Concern: Retaliation from other countries is possibly causing US goods to be less competitive when sold in another country.

The top trade partners with the US are Europe, China, Canada, and Mexico. In addition to understanding what countries are potential players, we also need to understand what is exported. The top exports in 2017 were Airplanes (do not own these stocks), Gasoline (do not own energy), Motor Vehicles (do not own US car makers – anymore), Computer Chips (do have exposure) and cell phones (do own Apple).

Conclusion: There is simply not enough information available yet to know the implications on the countries and companies involved. In fact, there are very few details on the steel tariffs much less other possible tariffs.

This past weekend, there were Tweets from the President about tariffs on European cars. Also, there were statements from Europeans about taxing Harley Davidson (do not own), bourbon (do not own) and Levis (do not own). Today, we do NOT believe this “talk” will cripple the strong global economy.

We do believe a shift in foreign trade policy has been occurring for the past year. So far, we have not been surprised by the tariffs on solar panels, washing machines, and now steel and aluminum. We are also not surprised by the presidents' protectionist Tweets.

We are surprised by how little talk there is about the potential benefits to US companies if tariffs are lowered for US products entering foreign countries. For example, US cars entering the EU have a 10% tariff. EU cars entering the US have a 2.5% tariff.

As we take time to understand the unfolding details of tariffs, we turn to interest rates.

Interest Rates

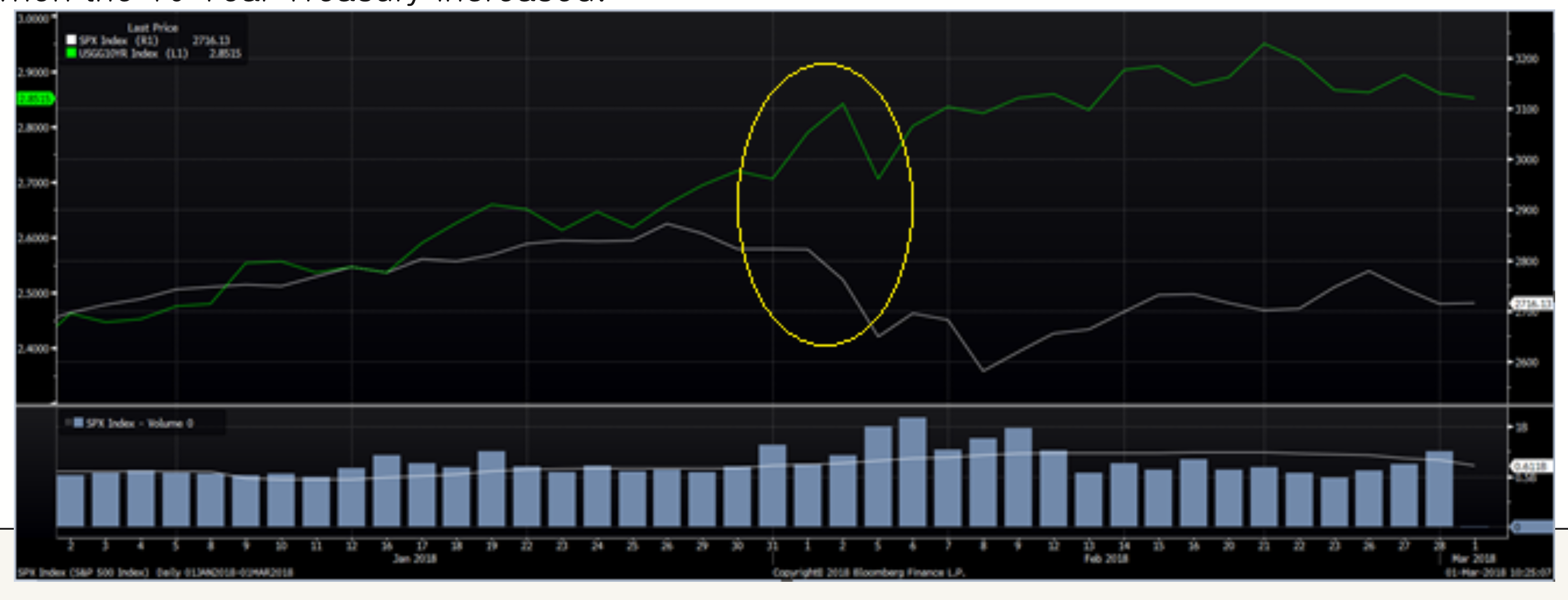

The chart below displays the 10 Year US Treasury (green line on top) vs. the S&P 500 Index (white line on bottom) for 2018. The yellow circle displays the decline in stocks at the time when the 10 Year Treasury increased.

We have been watching interest rates closely and were prepared for the recent moves. As example, we held short duration bonds. This paid off as our fixed income investments are positive for the year in the face of rising rates while the US Bloomberg Barclays Aggregate Bond Index is down -2.2% for the year.

Inflation

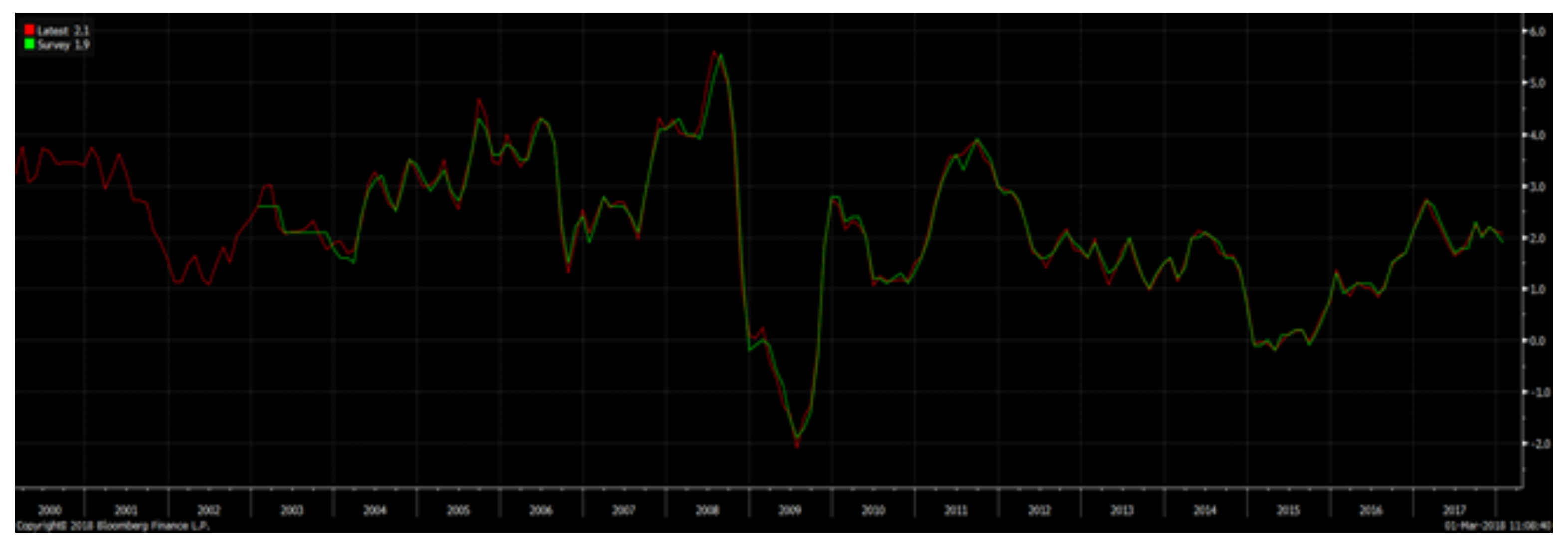

The chart below displays the CPI Inflation growth rate since 2000. While inflation is growing, it is now in-line with long term averages.

To prepare for future inflation we own investments in Gold and Steel. We are closely monitoring inflation and plan to further add to commodities as opportunities are presented. The inflation watch has been heightened with the introduction of tariffs.

In Conclusion

Today, there is not enough evidence to declare an end to the strong global economic growth. However, it is clear more factors are being introduced to make navigating the market more challenging.

Today, more than ever it is vital to select the securities that will benefit in the transitioning global economy. Our investment in steel serves as an example of our ability to execute in this challenging environment. Further, the investments we do NOT own are critical.

We are closely monitoring the tariff situation and will make changes, when appropriate. Global trade is an area we carry deep expertise and are excited to find ways to profit in this new global trade puzzle.

INFORMATION PRESENTED IS FOR EDUCATIONAL PURPOSES ONLY AND DOES NOT INTEND TO MAKE AN OFFER OR SOLICITATION FOR THE SALE OR PURCHASE OF ANY SPECIFIC SECURITIES, INVESTMENTS, OR INVESTMENT STRATEGIES. BLOOMBERG IS THE SOURCE OF MARKET DATA. INVESTMENTS INVOLVE RISK AND ARE NOT GUARANTEED. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RETURNS. BE SURE TO FIRST CONSULT WITH A QUALIFIED FINANCIAL ADVISER AND/OR TAX PROFESSIONAL BEFORE IMPLEMENTING ANY STRATEGY DISCUSSED HEREIN.