As we approach the end of this remarkable decade, we turn our sights to the 2020’s. If the 00’s was the “Lost Decade”, 10’s the “Found Decade”…. perhaps the 20’s will be “Roaring”. We have never been more excited about a decade, but proceed with caution as there are still obstacles to overcome.

Below we eulogize 2018, tackle 2019 and then anoint the 2020’s.

2018 – Twelve Manic Months

We began the year with the discussion of the life cycle of a butterfly. In 2017, the caterpillar economy entered the adult phase with animal spirits and we looked for signs the cycle would continue or end in 2018. While the economy remained strong, the stock market signaled an end was near. The following is a chart of the S&P 500 for the year of 2018 to illustrate the journey (source Bloomberg):

After a swift start to the year, the stock market quickly corrected 15% - only to rebound back to all-time highs in the third quarter. October was a window into what would become a correction of 20% from the all-time high to the Christmas Eve low. The year ended with the worst December in fifty years and the first negative year for the S&P 500 in a decade.

The year began with concerns over North Korea and then transitioned to a trade scrum with a far larger power – China. The concerns over China slowing combined with the Federal Reserve’s relentless tightening of monetary policy, slowing emerging market growth, and a botched Brexit are all attributed to a fear of a global economic crisis.

In other global news, our thesis that the human race moves to better outcomes over time took a stride forward. The Wall Street Journal reported: “The global population living in extreme poverty has fallen below 750 million for the first time since the World Bank began collecting global statistics in 1990, a decline of more than 1 billion people in the past 25 years.”

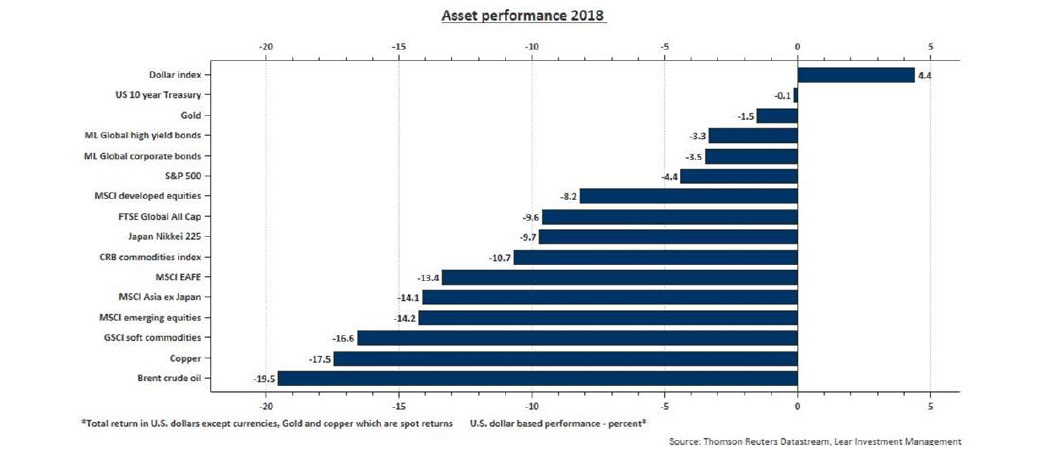

Further good news, the earnings of the S&P 500 were the highest in history – growing at 22% (Source Yardini.com). As the year progressed, we moved from a more equity-oriented portfolio to larger fixed income, cash, and gold allocations. However, there were few places to hide. A recent Bloomberg article stated: “Ned Davis Research puts markets into eight big asset classes — everything from bonds to U.S. and international stocks to commodities. And not a single one of them is on track to post a return this year of more than 5 percent, a phenomenon last observed in 1972”.

2019 – The Year of Patience and Balance

After decades of experience, we have rarely witnessed an investor not achieve their goals at the hands of the stock market. We have witnessed self-inflicted wounds which would impact investor’s wealth forever. The financially catastrophic event occurs when an investor sells at lows and does not buy back into stocks. Thus, understanding psychology is important to achieving investment goals.

We turned to Psychology Today for a deeper dive into the subject of “patience”. The first two of the seven laws of impatience are highly applicable to investing. Below is exert from psychologytoday.com:

1. Impatience is not a lack of patience. Impatience, it turns out, is a very particular mental and physical process that gets triggered under specific circumstances, and which motivates specific kinds of decisive action. The patient person simply wasn’t triggered to impatience when others normally would have been, or she found a way to overcome the impatience that did arise.

2. Impatience is triggered when we have a goal, and realize it’s going to cost us more than we thought to reach it.

The “cost” in investing is the ability to process declines in assets prices. How do we know when to trigger “impatience” and sell a stock or not? There are three levels of controls on the portfolio- 1) understanding market cycles; 2) understanding portfolio risk; 3) having a set of rules for buying and selling. Below we begin the discussion of the market cycle and possible scenariosin 2019:

2019 Scenarios

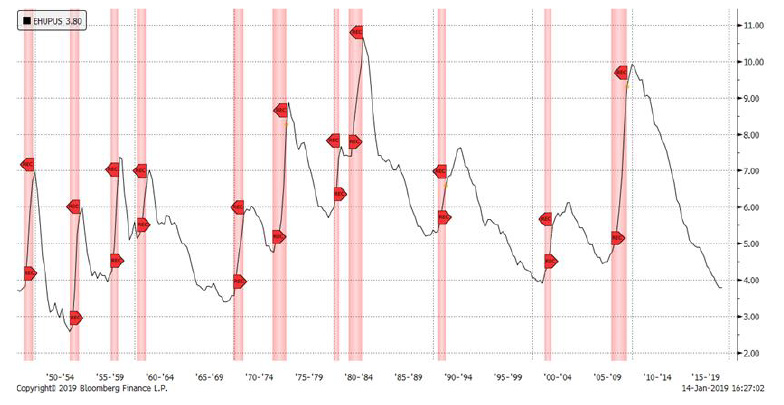

The economic cycle can be controlled, influenced, and forecasted by observing a set of variables and indicators. We monitor a wide variety of indicators; today we believe the economy is in the later stage. As an example of a useful indicator, we present the unemployment rate. Please note the low unemployment is an accurate predictor of recessions. When rate gets low, the cycle is near an end. The following chart is the U.S. unemployment rate since 1940 – indicated by blue line. The shaded red areas are recession periods. (Source: Bloomberg)

The question of the year – When will the economy fall into a recession?

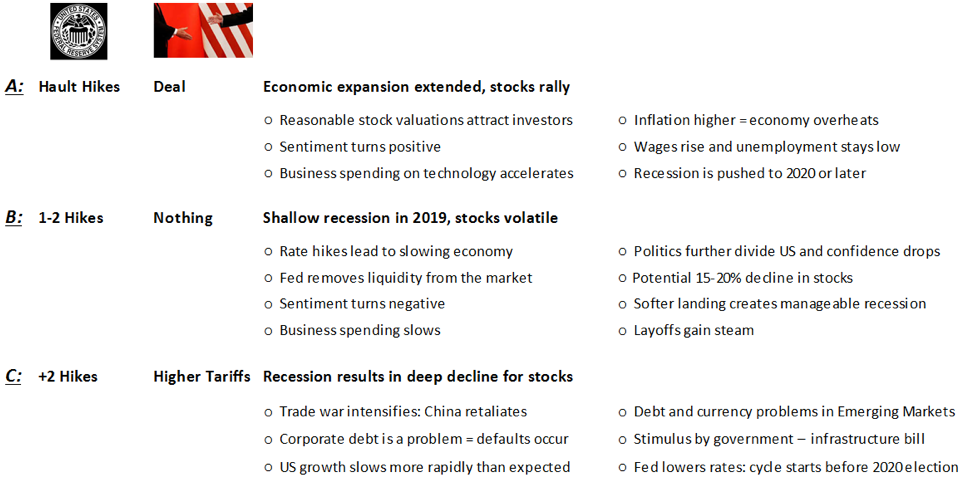

It is difficult to predict the exact timing of the next recession as the movement of each variable is unknown. However, research can provide clues. The largest variables today are the Fed’s interest rate policy and China trade war. Below are three scenarios based on different outcomes in these two, key matters:

The following are themes we believe could shape the next decade:

1) 4th Industrial Revolution - Data is new oil and will fuel the expansion of the economy.

- AI/Machine Learning/ Analytics

- Internet of things and 5G

- Cloud – Edge – Kubernetes

- Cybersecurity

- Self-Driving cars

- Fin tech

- SubSea Cables

- Online Retail

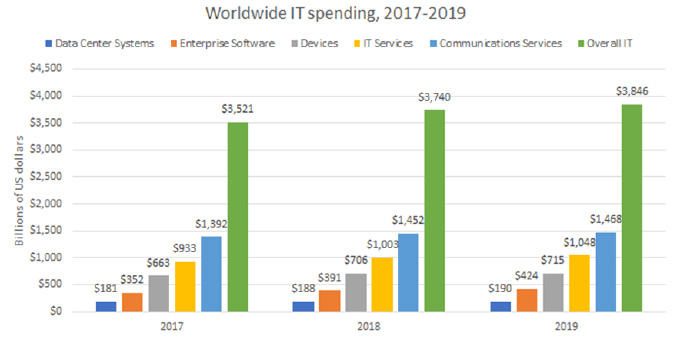

The following is a chart detailing projected technology spending in 2019 broken down by category. (Source: Gartiner / ZD Net)

Smart technology spending leads to better business outcomes. We believe spending will remain strong into the next decade. In order to spend, corporations need less uncertainty. In Scenario A above (pause in interest hikes and China trade deal) a portion of uncertainty is removed, and companies are more willing to spend some of the cash on their balance sheets with the intent of better business outcome.

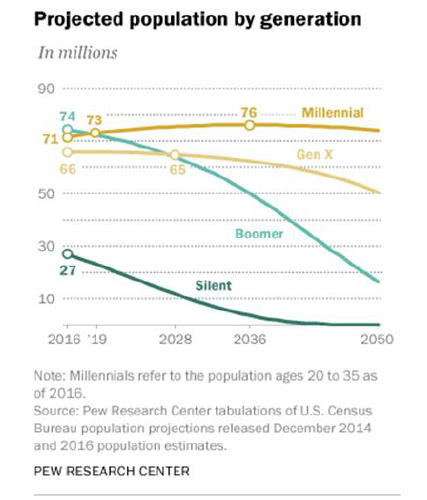

2) Demographic Shift – U.S. Census Bureau forecast Millennials overtake boomers in 2019 - growing from 71 million in 2016 to 73 million in 2019.

a. Rise of Millennials - Coming of age of more tech savvy consumer.

- House buying years and growing family.

- Fin tech – more comfortable without traditional banks (trust stranger Uber driver more than traditional banks).

- Online buying – peak spending years.

b. Baby Boomers - Remain a very important part of the economy but spending patterns transitions.

- Healthcare –The latest estimatesfrom the Centers for Medicare and Medicaid Services predicts healthcare spending in the U.S. will increase by 5.8% over the next 10 years. That's one of the largest increases on record.

3) Return of Emerging Markets after lost decade – The rise of the middle class continues and citizens demand a better life. Look for further consumption and spending on infrastructure.

- Brazil – country emerges from recession with pro-business government.

- India – fastest growing economy in the world sees results of government reforms

In Conclusion:

The unique negotiation style of the U.S. President has put the later-stage U.S. economy in position for a binary outcome in 2019– either up or down. Thus, we remain balanced in the portfolio as we look for more clarity.

We believe thoughtful research and fundamentals will win over a static investing style. Investors with the ability to understand data and navigate this stage of the market cycle will prevail in 2019 and into the next decade.

The team at Lear Investment Management will continue to work tirelessly on your behalf to help achieve your financial goals. Wishing you and your family much peace, health, and happiness in 2019.

THIS MATERIAL REPRESENTS AN ASSESSMENT OF THE MARKET AND ECONOMIC ENVIRONMENT AT A SPECIFIC POINT IN TIME AND IS NOT INTENDED TO BE A FORECAST OF FUTURE EVENTS, OR A GUARANTEE OF FUTURE RESULTS. FORWARD-LOOKING STATEMENTS ARE SUBJECT TO CERTAIN RISKS AND UNCERTAINTIES. ACTUAL RESULTS, PERFORMANCE, OR ACHIEVEMENTS MAY DIFFER MATERIALLY FROM THOSE EXPRESSED OR IMPLIED. INFORMATION IS BASED ON DATA GATHERED FROM WHAT WE BELIEVE ARE RELIABLE SOURCES. IT IS NOT GUARANTEED AS TO ACCURACY, DOES NOT PURPORT TO BE COMPLETE AND IS NOT INTENDED TO BE USED AS A PRIMARY BASIS FOR INVESTMENT DECISIONS. IT SHOULD ALSO NOT BE CONSTRUED AS ADVICE MEETING THE PARTICULAR INVESTMENT NEEDS OF ANY INVESTOR.

THE STANDARD & POOR'S 500 (S&P 500) IS AN UNMANAGED GROUP OF SECURITIES CONSIDERED TO BE REPRESENTATIVE OF THE STOCK MARKET IN GENERAL. IT IS A MARKET VALUE WEIGHTED INDEX WITH EACH STOCK'S WEIGHT IN THE INDEX PROPORTIONATE TO ITS MARKET VALUE.

PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS. INVESTING INVOLVES RISK, INCLUDING THE LOSS OF PRINCIPAL.

THIS DOCUMENT MAY CONTAIN FORWARD-LOOKING STATEMENTS BASED ON LEAR INVESTMENT MANAGEMENT’S EXPECTATIONS AND PROJECTIONS ABOUT THE METHODS BY WHICH IT EXPECTS TO INVEST. THOSE STATEMENTS ARE SOMETIMES INDICATED BY WORDS SUCH AS “EXPECTS,” “BELIEVES,” “WILL” AND SIMILAR EXPRESSIONS. IN ADDITION, ANY STATEMENTS THAT REFER TO EXPECTATIONS, PROJECTIONS OR CHARACTERIZATIONS OF FUTURE EVENTS OR CIRCUMSTANCES, INCLUDING ANY UNDERLYING ASSUMPTIONS, ARE FORWARD-LOOKING STATEMENTS. SUCH STATEMENTS ARE NOT GUARANTIES OF FUTURE PERFORMANCE AND ARE SUBJECT TO CERTAIN RISKS, UNCERTAINTIES AND ASSUMPTIONS THAT ARE DIFFICULT TO PREDICT. THEREFORE, ACTUAL RETURNS COULD DIFFER MATERIALLY AND ADVERSELY FROM THOSE EXPRESSED OR IMPLIED IN ANY FORWARD-LOOKING STATEMENTS AS A RESULT OF VARIOUS FACTORS.

NEITHER ASSET ALLOCATION NOR DIVERSIFICATION GUARANTEE A PROFIT OR PROTECT AGAINST A LOSS IN A DECLINING MARKET. THEY ARE METHODS USED TO HELP MANAGE INVESTMENT RISK. INVESTING INTERNATIONALLY CARRIES ADDITIONAL RISKS SUCH AS DIFFERENCES IN FINANCIAL REPORTING, CURRENCY EXCHANGE RISK, AS WELL AS ECONOMIC AND POLITICAL RISK UNIQUE TO THE SPECIFIC COUNTRY. THIS MAY RESULT IN GREATER SHARE PRICE VOLATILITY. SHARES, WHEN SOLD, MAY BE WORTH MORE OR LESS THAN THEIR ORIGINAL COST.

NOTHING CONTAINED HEREIN IS TO BE CONSIDERED A SOLICITATION, RESEARCH MATERIAL, AN INVESTMENT RECOMMENDATION OR ADVICE OF ANY KIND. THE INFORMATION CONTAINED HEREIN MAY CONTAIN INFORMATION THAT IS SUBJECT TO CHANGE WITHOUT NOTICE. ANY INVESTMENTS OR STRATEGIES REFERENCED HEREIN DO NOT TAKE INTO ACCOUNT THE INVESTMENT OBJECTIVES, FINANCIAL SITUATION OR PARTICULAR NEEDS OF ANY SPECIFIC PERSON. PRODUCT SUITABILITY MUST BE INDEPENDENTLY DETERMINED FOR EACH INDIVIDUAL INVESTOR.