When natural gas is cooled to -260 degrees Fahrenheit, it transforms into a liquid state or liquified natural gas (“LNG”). In this state, LNG can be easily and economically stored and transported around the globe on specialized tanker ships. LNG is primarily used as a feedstock to power gas-fired electricity plants. In 1975, the Carter Administration banned U.S. companies from exporting oil and natural gas. In 2015, Congress reversed this prohibition unleashing an energy exportboom that continues to accelerate today. With the further discovery of abundant natural gas during the last decade in the Permian Basin, massive infrastructure investments were greenlighted to enable U.S. energy products to be exported to satisfy global demand.

What is driving demand for U.S. LNG?

The principal driver of LNG demand comes from European and Asian countries that seek to dramatically lower their pollution output. Specific to meeting these goals is the conversion from coal and oil-based electricity generation to much cleaner natural gas-fired electricity plants. The Paris Climate Accord and individual country actions across Europe and Asia have driven overall efforts to reduce emissions through the greater adoption of cleaner energy sources. The need for cleaner energy is dramatic. For instance, the pollution content of the air (PM2.5) in the city of Delhi, India was recently recorded as having the equivalent hazardous health effect as smoking 44 cigarettes every day, according to the Berkeley Earth science research group. Similarly, Chinese cities consistently report levels of pollution consistent with smoking approximately 10 cigarettes per day. To ameliorate this situation, China, for instance, has implemented various policies, including restricting car registrations, requiring ethanol in gasoline and closing coal-fired electricity plants. They have spent and committed billions of additional yuan to build gas-fired electricity plants, regassification terminals and other related Investment Theme Reducing Pollution through Cleaner Energy Region/Country US - Exporting to the Rest of the World Asset Class/Security Equity - Cheniere Energy (NYSE: LNG) - A US energy company WARNER’S CORNER June 28, 2019 Cheniere Energy and the LNG Export Boom 2 infrastructure to ensure this transition. These actions reflect tangible efforts to not only improve overall living standards and protect further environmental damage but to address the reality of burgeoning healthcare crises. LNG plays a critical role in achieving these goals.

For countries, such as Poland and other European nations, LNG demand is not only driven by similar pollution reduction initiatives but also by national security concerns as they seek to reduce or eliminate their reliance on Russian gas.

Satisfying these foreign needs is at the core of the LNG export thesis. That said, the exportation of U.S. LNG is in the very early innings. LNG export terminals cost billions of dollars and currently, there are only a handful of terminals operational in the U.S. of which Cheniere Energy (“Cheniere”) is the leading exporter with over 35 metric tons of capacity per annum (“mtpa”). Seventeen additional LNG terminals representing over 200 mtpa of new capacity are in various stages of construction, which is an indication of just how large the addressable market truly is and the willingness of investors to finance the tens of billions of capital required to construct these terminals.

Why Cheniere?

Cheniere was among the first companies to begin exporting LNG, as they were able to leverage existing infrastructure. They currently operate two facilities on the Gulf Coast at Sabine Pass and Corpus Christi. Cheniere is led by an outstanding management team that has delivered these massive construction projects under budget and on-time – a fairly remarkable feat. Since commencing operations in May 2016, Cheniere has loaded 309 LNG cargoes. Each facility consists of multiple “trains”, which refers to the train of compressors used in the liquefaction process and largely determines each facility’s production capacity. Cheniere has a total of six trains up and running of which two commenced operations last quarter. Each train can generate approximately $2bn of revenue per year or over $500mm of EBITDA. With the bulk of capacity now online and ramping up, Cheniere is financially transforming from a high capital-intensive investment story to a 3 significant generator of free cash flow. In other words, Cheniere is presently seeing the benefits of years of previous investment that should persist for years to come. From an equity perspective, the business is set to generate $8bn of cash flow over the next few years to repay debt, pay dividends and buyback stock. Cheniere is also likely to use some of this cash flow to add additional train capacity that should fuel (pardon the pun) future earnings growth.

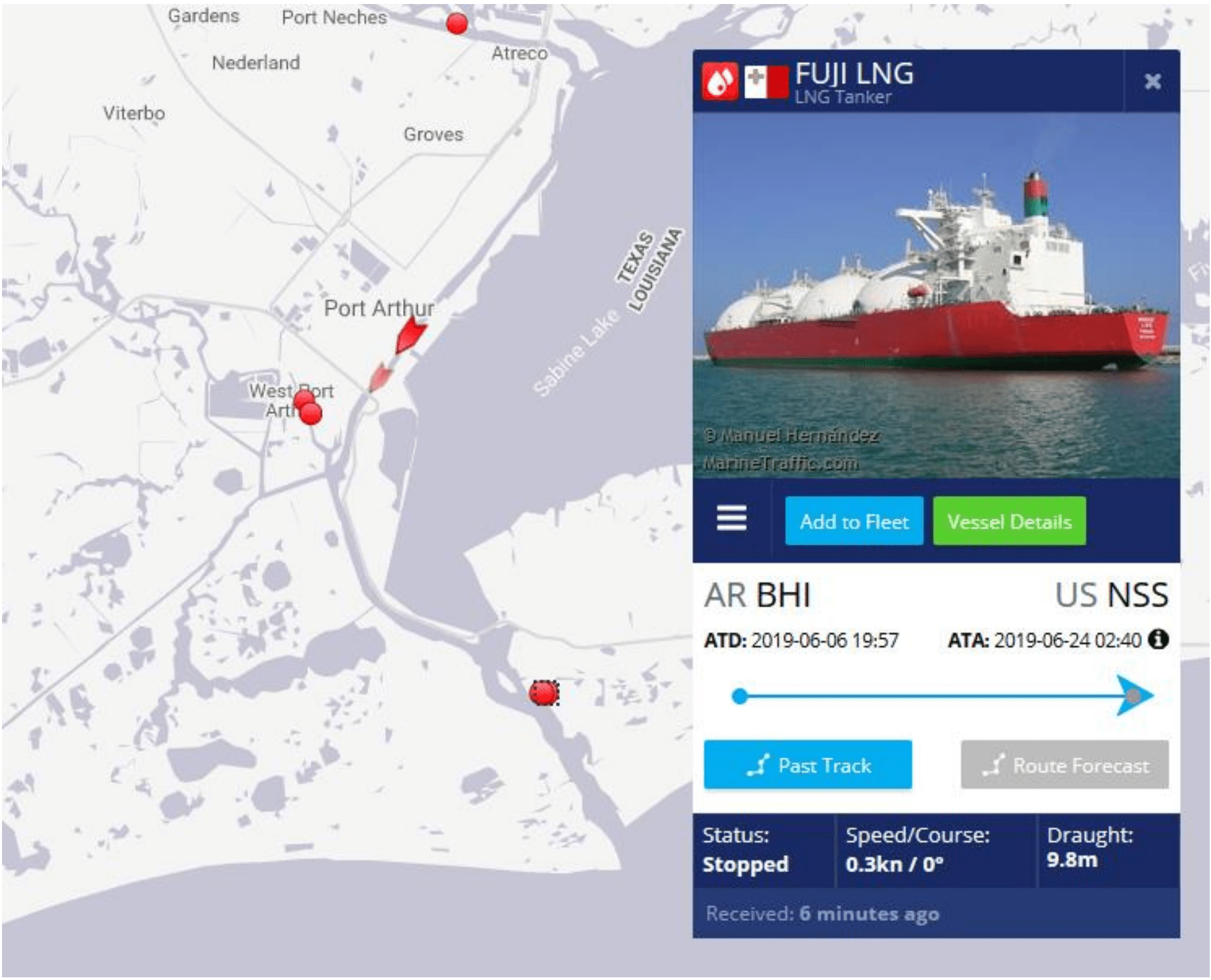

Depicted below is a snapshot from MarineTraffic.com of an LNG ship docked at Cheniere’s Sabine Pass facility - presumably taking on LNG. (We use creative intelligence gathering tools like this site in our research process.) With this tool, we can track LNG tankers coming and going from Cheniere’s terminals.

Source: marinetraffic.com

Four Key Points:

From an investment standpoint, we like this stock for several reasons:

- Earnings and distributable cash flows are accelerating dramatically;

- Nearly all of the current capacity is contracted out to investment grade customers, such as foreign utilities, with 20- year terms;

- Customer contracts have mandatory minimums that significantly mitigate against a decline in natural gas commodity pricing; and

- The extraordinary demand for LNG in the global anti-pollution fight as discussed above provides a further margin of safety were any individual customer to be lost.

Role in Portfolio:

We view owning stocks like Cheniere a bit like buying a bond for 50 cents on the dollar. As capacity ramps, so do the cash flows and given their long-term contractual nature, we are substantially insulated from recessionary or trade war pressures. As a result, we feel quite confident that this stock should continue to perform in any market environment

Effective communication is the cornerstone of strong relationships. Warner’s Corner is a new addition to our communications where Jim Warner (Managing Director) takes a deeper dive into the portfolio and comments on a specific holding. Warner’s Corner follows our investment process of theme identification, asset class selection and then security selection to express the theme. Which leads us to ask:

DOES YOUR FINANCIAL ADVISOR INVEST LIKE THIS?

IINFORMATION PRESENTED IS FOR EDUCATIONAL PURPOSES ONLY AND DOES NOT INTEND TO MAKE AN OFFER OR SOLICITATION FOR THE SALE OR PURCHASE OF ANY SPECIFIC SECURITIES, INVESTMENTS OR INVESTMENT STRATEGIES. INVESTMENTS INVOLVE RISK AND ARE NOT GUARANTEED. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RETURNS. BE SURE TO FIRST CONSULT WITH A QUALIFIED FINANCIAL ADVISER AND/OR TAX PROFESSIONAL BEFORE IMPLEMENTING ANY STRATEGY DISCUSSED HEREIN.