By Rick Lear, Lear Investment Management

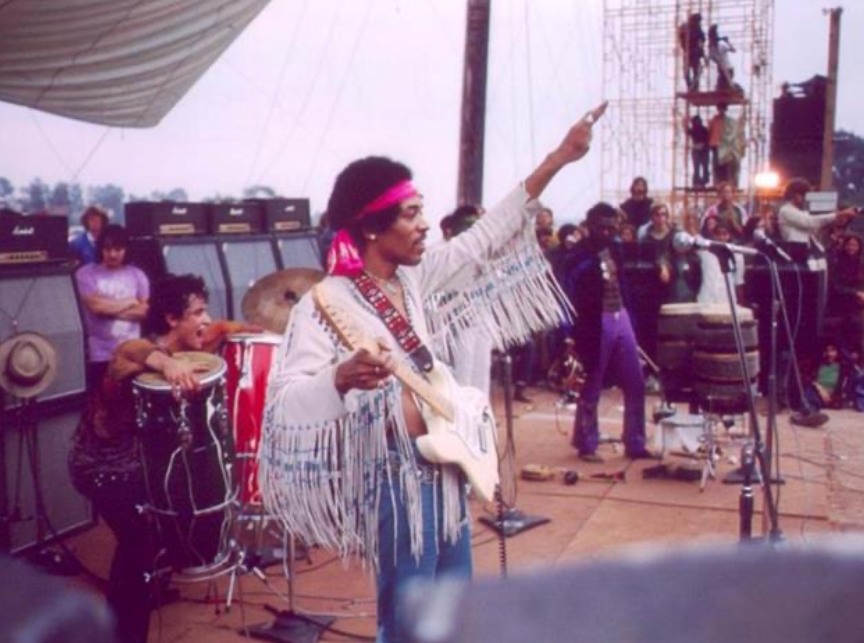

Last week’s SOTW was a salute to the opening act of Woodstock. Today, we celebrate the event’s 50th anniversary with the last act - Jimi Hendrix. On Monday, August 18, 1969, at 9:30am, the guitar legend took the stage to close the three-day festival.

Late in the set, Jimi unleashed a jaw-dropping, instrumental rendition of the Star-Spangled Banner. The irony was thick as the crowd was counter-cultural and not exactly big fans of the US government due to the Vietnam conflict. The performance of the song has been described as a fusion of horror, hope and patriotism.

In the capital markets today, there is a similar sense of fear, hope and patriotism: Fear that actions of our government (tariffs) will send the US economy into a recession; Hope that they get the trade negotiations right; and Patriotism insofar as the tariffs are an effort to defend our country’s intellectual capital and global supremacy for decades to come.

The trade war with China is blamed for the looming recession, according to consensus. Ironically, the goal of the trade war is to help our country negotiate a more equitable long-term trade agreement with China and other countries around the world.

Fears increased this week when the Treasury yield curve briefly inverted (the UST2Yr bond yield was higher the UST10Yr bond yield). A yield curve inversion is just another sign of a maturing economy but often presages a recession. Historically, a recession can develop 3 to 31 months after an inversion. We were surprised by the number of investors spooked by the inversion, which seemed to stoke more fear than the bankruptcy of Bear Stearns in 2008.

In the US, the economic data has declined, but is showing some signs of picking up. Further, unemployment remains low, interest rates are low and gas prices are reasonable. These are favorable conditions for the largest part of the economy - the US consumer.

After listening to several dozens of earnings calls, it is clear there is fear among CEOs that the global economy is slowing. Many such business leaders have cited uncertainty in not knowing the “rules” in this new global trade paradigm and the negative impact that has on spending decisions. However, it is also clear that there are companies effectively navigating this difficult environment.

This cocktail of fear and patriotism is not new. We use caution when listening to fear-mongers calling for a recession. A recession will indeed come someday, but its precise timing is yet unknown. Thus, we remain vigilant, balanced and nimble in order to adjust portfolio risk as needed.

Rick Lear is the Founder and Chief Investment Officer of Lear Investment Management. Lear is a pure investment firm founded in 2015 with focus on generating returns with measured risk. With over two decades of experience, his ability to identify global investment trends has resulted in superior outcomes for clients.

The Lear Global Vigilance Strategy is rated 5 Stars by Morningstar and ranks in the 5th percentile of managers in the Tactical Allocation category.

INFORMATION PRESENTED IS FOR EDUCATIONAL PURPOSES ONLY AND DOES NOT INTEND TO MAKE AN OFFER OR SOLICITATION FOR THE SALE OR PURCHASE OF ANY SPECIFIC SECURITIES, INVESTMENTS OR INVESTMENT STRATEGIES. INVESTMENTS INVOLVE RISK AND ARE NOT GUARANTEED. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RETURNS. BE SURE TO FIRST CONSULT WITH A QUALIFIED FINANCIAL ADVISER AND/OR TAX PROFESSIONAL BEFORE IMPLEMENTING ANY STRATEGY DISCUSSED HEREIN. THE PERFORMANCE ABOVE IS ESTIMATED BASED ON BLACK DIAMOND TRACKING OF LEAR GLOBAL VIGILANCE COMPOSITE. THIS IS FOR INSTITUTIONAL USE ONLY AND NOT DO DISTRIBUTION. THE LEAR GLOBAL VIGILANCE COMPOSITE IS ACOLLECTION OF SEPERATELY MANAGED ACCOUNTS MANAGED BY LEAR. THE CURRENT ALLOCATION IS APPROXIMATLEY 50% CASH, GOLD AND FIXED INCOME AND 50% EQUITIES.