Four weeks ago, we published a report entitled “Predicting the Next U.S. Recession” to communicate how we are evaluating the timing of the next recession, the data we are evaluating and the issues we are closely monitoring. This report is an update after new economic data points were released of which many were disappointing. For additional context, some of these data points were released prior to the Fed’s decision on September 18th to cut rates another 25bps.

As mentioned in the last report, we are hyper-focused on Non-Farm payrolls. The first negative month-over-month net change (seasonally adjusted) could be the penultimate sign that a recession is imminent and asset prices are prepped to rollover. We currently believe the market is another step closer to that day. But not yet.

Last Friday, the Non-Farm payroll report revealed the economy added 136,000 jobs in September. This report was slightly disappointing relative to consensus estimates but still not negative. In fact, the market rallied indicating investors were relieved it was not worse. And, our canary in the coal mine, Temporary Staffing payrolls, remained at all-time high levels. Let’s dive into recent data points.

Recent Economic Data

Since our last report, there was a slew of U.S. economic data released. Here’s what we learned.

The Good

Inflation

CPI and PPI ex Food and Energy looks really solid. At 2.4% and 2.3% y/y, respectively, these reflect a healthy economy with pricing power. Inflation is running nicely ahead of the Fed’s historical inflation target of 2%, so this may explain the split decision at the Fed on reducing interest rates at their meeting which followed several days after these stats were reported. We discuss the Fed later in this report, but it does seem this inflation data could prevent the Fed from lowering rates much further.

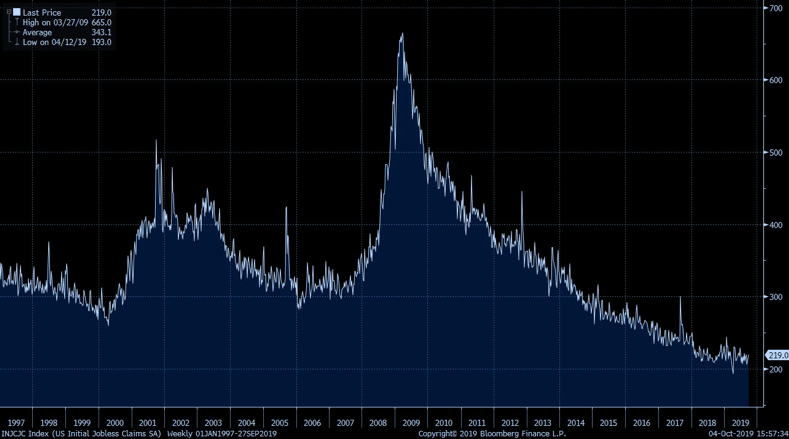

Jobless Claims

Weekly Jobless Claims for the newly unemployed remained steady at record lows. It is really astonishing just how few people are losing their jobs. As evident in the chart below, Jobless Claims today are at levels well below the best levels that preceded the Dotcom recession and the Great Financial Crisis. We think a big driver of today’s lower levels of claims is that far fewer jobs – mostly manufacturing – are being offshored to places like China or Mexico. That offshoring wave seems to have abated.

Source: Bloomberg (chart). Bureau of Labor Statistics (data).

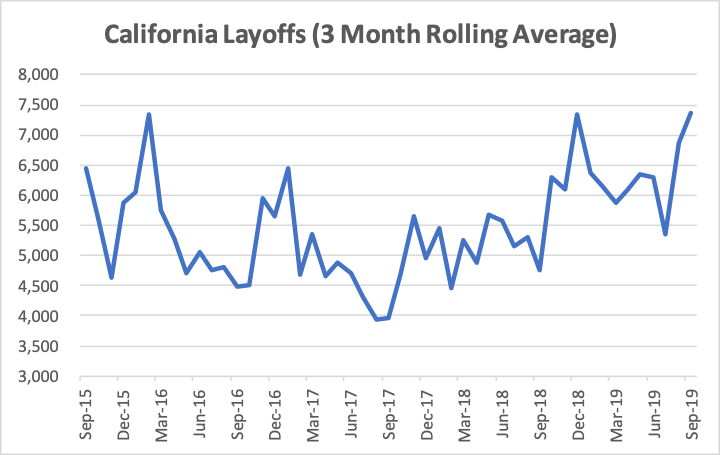

We are closely monitoring layoff notices down to the state level. Under the WARN Act, every state must maintain a database of future layoffs and, therefore, companies are required to file a WARN notice ahead of any layoff of employees (permanent or temporary). Layoffs are beginning to increase but not so much that we can declare it a trend. The chart below shows the 3-month rolling average of jobs affected by layoffs in California. It is possible we are on the cusp of a surge in layoffs. Last Thursday, for example, Hewlett Packard announced that it will cut its workforce by 7,000 – 9,000 workers.

Source: Employment Development Department, State of California

Consumer Optimism

Consumer sentiment on the economy is weakening somewhat but from cyclically high levels so no real concern. This is a lagging indicator, however. How many people know ahead of time that they are getting laid off?

Real Estate

Lower mortgage rates in September supported better than expected Existing Home Sales, home prices and mortgage applications. This is one area of the economy that is responding favorably to lower interest rates. But as they say, all real estate is local. So, you really have to dig into each MSA to understand real estate. For example, try selling a $5 million home in Greenwich, CT or even here in Dallas, TX. Days on the market for luxury homes are increasing. All in all, real estate is hanging in there, so no red flag yet.

Retail Sales

August retail sales were slightly better than expected supported by solid wage growth. Again, a lagging indicator but things are chugging along. After listening to Best Buy’s recent earnings call, it will be interesting to see how tariffs are going to play out. Our best guess is that consumers will not see higher prices at the register during the Christmas shopping period. Retailers are ordering products early to avoid tariffs that kick in on December 15th on a lot of “Made in China” consumer goods – such as clothing, TVs, smartphones, etc. The real question is - what happens in 2020? Assuming these tariffs are still in place and if supply chains have not been moved out of China, then retailers will be forced to pass through price increases where they can or pay the tariff and hurt their margins. As a result, we may see an increase in retailer bankruptcies next year.

The Bad

U.S. ISM Surveys

Last week the market received some unwelcomed news from the Institute of Supply Management both here and abroad. With regard to the U.S., as we stated in the last Warner’s Corner, we believe the ISM Manufacturing data is far less informative on the direction of the economy than the market does. Nevertheless, the market fell hard on Tuesday when the ISM Manufacturing survey reported 47.8 versus an expectation of 50. Recall, that below 50 means that Manufacturing is contracting. Our reaction: Not surprised but that alone cannot tip the U.S. into recession. The Manufacturing sector is not large enough. Let’s also not forget that Boeing and its suppliers are struggling with 737 MAX production as it is out of service and GM went on strike during the last week of September. These factors will continue in October, so if you care about this figure then brace yourself for a really bad number in the next report.

Way more important and way more concerning to us was last Thursday’s September ISM Non-manufacturing report. Recall, that this piece of data represents a composite index of four indicators of equal weight: Business Activity, New Orders, Employment and Supplier Deliveries. It is a good barometer of the health of the Services sector, which is 80% of U.S. GDP. The index reported 52.6 vs. an expectation of 55.0 and last month’s 56.4. We have not seen a number this low since August 2016 (right before Trump’s election). To be fair, this number bounces around with some degree of volatility in a range of 5060 in normal expansionary times, so this data point is not conclusive. Nevertheless, it bears close watching.

European “ISM” Surveys

Europe is truly on the brink or already in a recession. The Markit surveys of the Manufacturing and Services sectors, which are similar to the ISM surveys, for September were super underwhelming. Germany (41.7), Spain (47.7) and Italy (47.8) are all experiencing contraction in Manufacturing. France may start contracting next month. The Services sectors are all teetering on contraction as well. Some of this weakness is undoubtedly related to a slowdown in China’s economy and, therefore, connected to the U.S.-China trade war.

The Chinese Economy

When we think about China, there is only one word that comes to mind: Uninvestable. There is clearly damage to China’s economy as a result of the U.S.-China trade war. However, it is unclear how to quantify the damage. With supply chains leaving China, surging food prices and tariffs on exports to the U.S., there is great deal of pressure on the Chinese economy. We are closely monitoring these developments and the potential drag on corporate earnings.

Upcoming Notable Events

Impeachment of President Trump

The market is currently ignoring the impeachment inquiry. As of now, even if the inquiry led to an actual impeachment process and a pro-impeachment vote in the House, there does not seem to be enough evidence to get the minimum required 67 votes in the Senate. This process itself will take a long time and we will be watching closely. For now, we discount the probability of Trump’s impeachment.

The Fed & Interest Rates

The Fed will next meet on October 30th and the market is currently pricing in an 73% chance of an additional 25bps cut. For the December 11th meeting, the market is now pricing in an 89% probability of at least 25bps rate cut.

We believe three things with respect to interest rates. First, U.S. interest rates are too high relative to the rest of the world and whether or not the Fed cuts, the bond market will push down rates. Two weeks ago, the German bund auction went very poorly and that was followed by an equally poor auction of Japanese Government Bonds last week, which sent U.S. markets into a tizzy. The driver of poor demand is simple. Who wants to buy a bond with a negative yield?! In a related response, large Japanese pension funds are reportedly considering increasing their 19% foreign debt cap so they can go out and find some yield.

Second, we think a key driver of the next recession is business confidence. CEOs won’t invest if they don’t know the rules of the game. The ever-changing tariff situation with China and now the EU is creating havoc and uncertainty. Many businesses are getting caught offsides having agreed to sell goods at one price only to have the cost of said good surge upon the application of a new tariff. The confusion caused by tariffs impacts business decisions (discussed in greater detail below). So, in short, we think lowering rates will have very little stimulative effect on business spending.

Third, in the last thirty years, the Fed has never prevented a recession from occurring. The Fed’s track record is actually the opposite. They have habitually not recognized economic weakness early enough and, therefore, kept rates too high. So, we are skeptical of rallies driven by an expected rate cut. Rate cuts will not prevent revenue and margin damage from tariffs.

China-U.S. Trade Talks

Now that the Chinese have finished celebrating the 70th anniversary of the Communist Party coming to power, the U.S. and China trade representatives will convene again this week. We are probably in line with consensus in thinking that nothing significant will come out of these meetings. In September, the market expected an agriculture deal only to be thrown off the scent. It is possible we get some agreement from the Chinese to purchase American agricultural goods because the Chinese are facing huge potential food shortfalls. As we have discussed in other publications, the African Swine Flu has decimated pig herds, which is a problematic because pork is the main protein consumed in China. Reportedly, pork prices skyrocketed 50% in August with no relief in sight. So, this issue is the easiest to resolve and a resolution would help both Chairman Xi and President Trump assuage concerns from their respective constituencies.

Fun Fact

The QQQs are up approximately 23% this year. If you strip out Facebook, Microsoft and Apple – each of which are up 35-40% - the rest of the QQQs are up only 16% which trails the S&P 500 by nearly 2%.

3Q Earnings

Companies will begin announcing their September quarter earnings in the next few weeks. We were unjustifiably nervous about 2Q earnings. However, we are even more nervous about 3Q earnings for the market as a whole. Often on 3Q earnings calls investors do not receive guidance for the next year – in this case, 2020. But you can believe that there will be a lot of questions focused on 2020.

One area of weakness this quarter is a pause that seems to be occurring on large infrastructure and real estate projects - principally due to changing tariff policies, project managers are faced with higher material costs. Our anecdotal evidence was supported last Wednesday when Acuity Brands, a leading manufacturer of nonresidential lighting, reported disappointing earnings and provided weak guidance for 2020. Acuity is a terrific company with a great management team and excellent market position. So, for them to disappoint makes us sit up straight. This call was particularly poignant because they pointed to sluggish demand in nonresidential construction due to the uncertainty caused by tariffs on various components. We hope this is not a case of us seeking evidence to support our hypothesis, but we will get a lot more data points as additional companies report.

2020 Presidential Election

It is difficult to assess the outcome of the next presidential election. That said, stocks are starting to move in anticipation of the outcome. For example, the recent increase in Elizabeth Warren’s polling numbers caused healthcare stocks to react negatively. We would expect other sectors like Energy, Financial Services and Defense to face headwinds if the polls start pointing more conclusively to a Democratic victory.

Conclusion

The economic data has not conclusively informed us that a recession is imminent. There is certainly some deceleration and even some worrisome data points, but Non-Farm payrolls are still positive. It is possible that 3Q earnings could signal a turn for the worse. If CEOs think that 2020 earnings will weaken, they will lay workers off. We believe the next few months are critically important, and we will remain ever vigilant in our monitoring.

Jim Warner is the Managing Director, Head of Research of Lear Investment Management. Lear is an investment firm founded in 2015 focused on generating returns with measured risk. With a quarter century of experience, his ability to identify attractive investment ideas, construct portfolios and manage risk has resulted in superior outcomes for clients.

The Lear Global Vigilance Strategy is rated 5 Stars by Morningstar and ranks in the top 5% of managers in the Tactical Allocation category.

INFORMATION PRESENTED IS FOR EDUCATIONAL PURPOSES ONLY AND DOES NOT INTEND TO MAKE AN OFFER OR SOLICITATION FOR THE SALE OR PURCHASE OF ANY SPECIFIC SECURITIES, INVESTMENTS OR INVESTMENT STRATEGIES. INVESTMENTS INVOLVE RISK AND ARE NOT GUARANTEED. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RETURNS. BE SURE TO FIRST CONSULT WITH A QUALIFIED FINANCIAL ADVISER AND/OR TAX PROFESSIONAL BEFORE IMPLEMENTING ANY STRATEGY DISCUSSED HEREIN.