By Rick Lear, Lear Investment Management

He Went to Paris

Jimmy Buffett

The great singer/song-writer Jimmy Buffett tells storied tales - taking the listener on a journey to a different place and time. Buffett’s tune He Went to Paris is about a man escaping to find “answers to questions.” In this SOTW we escape the US in search of lessons on how investors behave in the face of declining economic growth and negative interest rates.

The 2019 European stock market and economy is explored in the following three sections:

- The current state of affairs in Europe

- Possible reasons for strong equity returns

- Lessons we may learn for 2020 and beyond

Current State - How have European stocks performed in 2019?

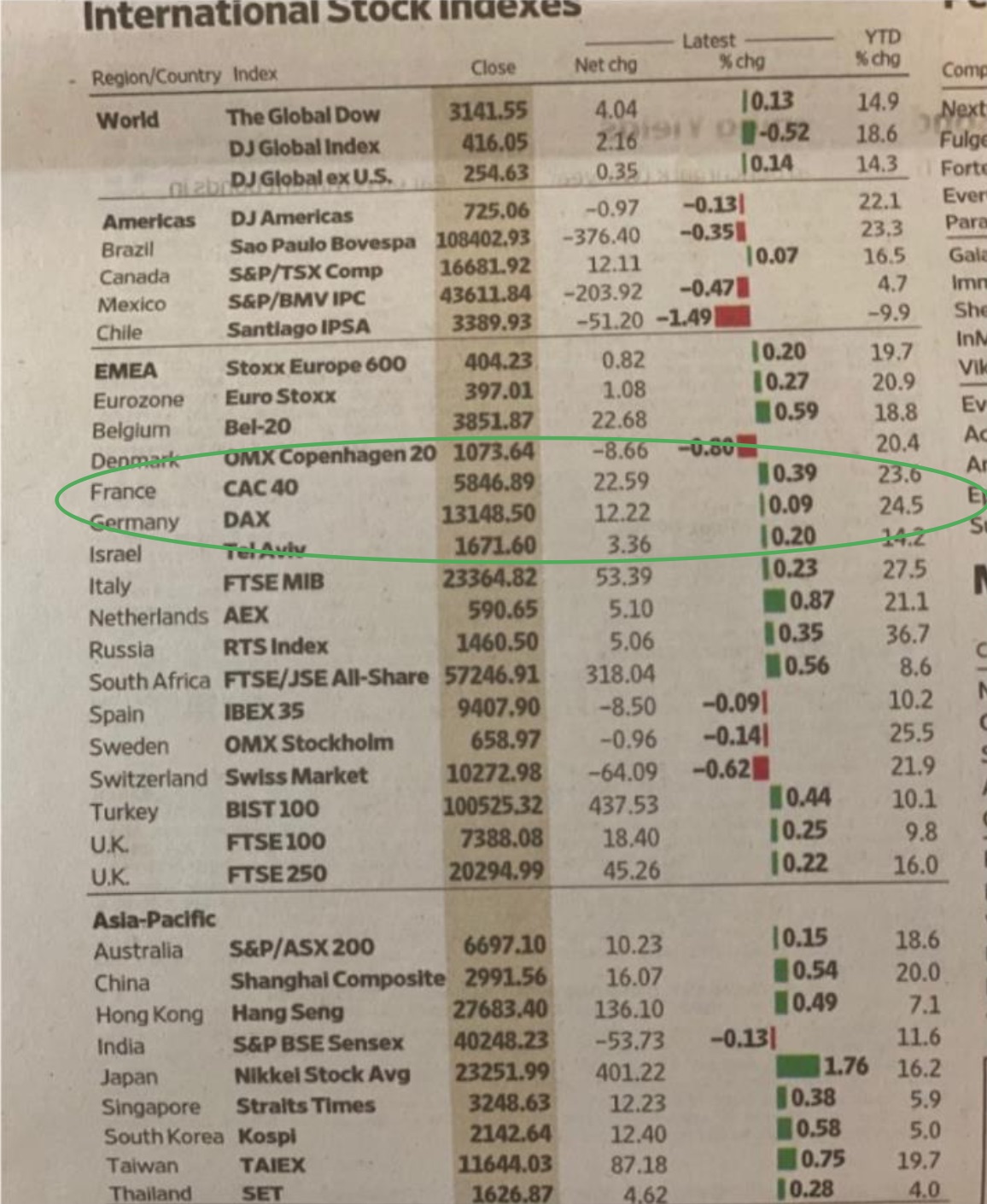

From November 5, 2019 Wall Street Journal.

Note the YTD percentage changes for European stocks. How can the German and French stock market be up so much? After all, 2019 has been littered with worries:

- Brexit confusion continues

- Slowing manufacturing and GDP

- Uncertainty over the US-China trade war

- Slowdown in global economic growth

In France and Germany, the GDP in the past quarter was 0.3% and -0.1% respectively. This data is consistent with the struggling manufacturing data in these countries. Those solely using economic metrics (and no thought) to make investment decisions, missed an opportunity.

Reasons for Performance - What is the reason for the strong returns and why did we feel confident investing in European stocks despite frightening headlines?

The interest rates in Europe are low-to-negative. Thus, investors are forced to look to stocks for returns as the alternative is taking negative yields on fixed income assets. Plus, select stocks are paying nice dividends with strong secular tailwinds driving their earnings - like telecom company Orange France – currently in the portfolio.

We certainly understand there are real risks in Europe. However, there are opportunities to make money as most investors do not understand how to adjust to the new rules of investing. While others were selling, we were happy buyers.

Further, Europe has 740 million people and a GDP of $18.8 trillion. This is one of the most populous and largest economies in the world. It is possible Central Banks, in coordination with governments, can take actions to right-the-ship.

Lessons Learned - As mentioned, we are not blind to possible declines in Europe and the struggles still facing the region. However, it is important to note the central bank action of negative interest rates have had profound effects on investing. If investors are looking to grow wealth to meet future obligations, then at some point stocks are a better risk-adjusted return opportunity than negative yielding fixed income. We realize the rates are artificial and cannot last, but the returns achieved for our investors are very real.

The lesson for the US investor - gains can be made in equities in a declining overall economy. And, those fleeing to bonds as a safe haven can lose money once the tide shifts.

Conclusion - We believe many professional advisors forget the reason they are investing for their clients. Our purpose is to grow assets (with measured risk) to meet future spending needs. Today, we believe there is more risk in many bonds than in select stocks.

We urge both professional and private clients to be careful when using wealth planning tools. The tools are only as good as the assumptions used to forecast returns. If the assumptions are based on the past, there could be flaws in the forecast. The world has changed and Europe is an example of how new investment rules can achieve returns for measured risk.

We will leave you with my favorite line from the song which describes life and investing… “Some of it’s magic, some of it’s tragic, but had a good time all the way.”

Wishing you all more magic than tragic and the presence to enjoy the ride through both.

Rick Lear is the Founder and Chief Investment Officer of Lear Investment Management. Lear is a pure investment firm founded in 2015 with focus on generating returns with measured risk. With over two decades of experience, his ability to identify global investment trends has resulted in superior outcomes for clients.

The Lear Global Vigilance Strategy is rated 5 Stars by Morningstar and ranks in the 5th percentile of managers in the Tactical Allocation category.

INFORMATION PRESENTED IS FOR EDUCATIONAL PURPOSES ONLY AND DOES NOT INTEND TO MAKE AN OFFER OR SOLICITATION FOR THE SALE OR PURCHASE OF ANY SPECIFIC SECURITIES, INVESTMENTS OR INVESTMENT STRATEGIES. BLOOMBERG IS THE SOURCE OF MARKET DATA. INVESTMENTS INVOLVE RISK AND ARE NOT GUARANTEED. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RETURNS. BE SURE TO FIRST CONSULT WITH A QUALIFIED FINANCIAL ADVISER AND/OR TAX PROFESSIONAL BEFORE IMPLEMENTING ANY STRATEGY DISCUSSED HEREIN.