We are neither fearmongers nor fortune tellers, nevertheless we are concerned for market participants in light of the very real prospect that 15% tariffs on List 4B of Chinese imports will be implemented on December 15th. As we have written before, these tariffs could carry the fate of the U.S. economy and global asset prices. This list, which applies to approximately $160 billion of goods, comprises items that American consumers need to clothe, entertain and protect themselves. Items sold in a mall are on this list. The consequences for both the economy and the market could prove to be a major tipping point that can likely only be avoided by the resolution of Phase One of the U.S.-China trade dispute.

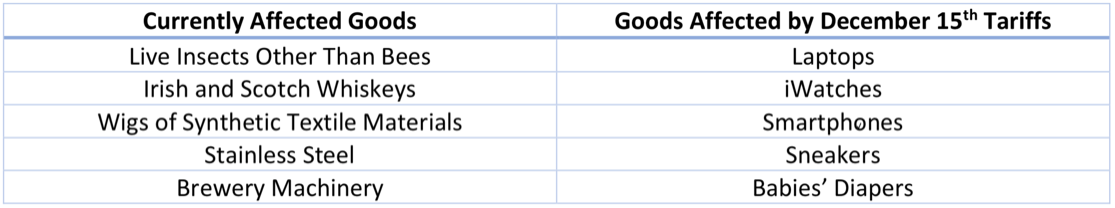

Examples of Selected Imported Chinese Goods Affected by Tariffs. Source: Office of the United States Trade Representative

What’s at Stake?

The Economy

In previous Warner’s Corners, we discussed our view that the U.S. economy remains at or near record strength across many metrics. Weakness in the U.S. is spotty and are in places like farming and manufacturing that are just not large enough to drag the rest of the economy into recession. Other manufacturing heavy economies that rely on Chinese purchases, such as Germany and South Korea, are in recession because China’s economy is slowing substantially and not in small part due to the impact of U.S. tariffs. The real key to continued U.S. economic growth hinges on U.S. consumers and their ability and willingness to spend. To date, all relevant data points remain hearty because the U.S. consumer has been largely insulated from this trade-related distress. Unemployment is low and, therefore, spending is strong.

Tariffs on List 4B goods is a potential game-changer because it draws the U.S. consumer directly into the trade war. List 4B is the Lusitania, in our opinion. The event itself will shift sentiment towards fear at least in the short term and we would then expect asset prices to decline and possibly substantially given current record highs. From there, is it is game of data points. Which companies can adjust and which cannot.

The real key to continued U.S. economic growth hinges on the consumer and their ability and willingness to spend.

To put this situation into perspective, we use a simple example of one such affected item: a pair of Nike golf shoes. (Note: we are not singling out Nike for any reason. According to research from Ohio State University, Nike uses approximately 785 contract factories across China, Vietnam, Indonesia and Thailand accounting for more than 1 million workers. So, let’s assume these shoes are being made by a contracted manufacturer in China.

Step one, which is already underway according to our friends in the broader apparel space, is for Nike to try to move production to a factory not in China. This is much easier said than done. Contracts, business relationships and logistics are disrupted and makes this transition more complex than meets the eye. From our standpoint, there will be companies nimble enough to make this shift and those that cannot due to the complexity of the manufacturing process, joint venture restrictions or even lack of foresight. There will be winners and losers.

What if Nike cannot move their production outside China, what are their options?

Option #1 – also underway – is to “stuff” the inventory channel ahead of December 15th. The easiest way to avoid tariffs tomorrow is to ship products today. So long as Chinese imports are on the water by December 15th, those products are not subject to the 15% tariff. The obvious solution then is to run their Chinese manufacturing production at full capacity and ship as many golf shoes now as Nike believes there to be sufficient demand over some future period of time. However, this business decision carries substantial risk as working capital investment surges and inventory obsolescence risks increase (i.e., inventory goes unbought if consumer demand is lower for any number of reasons than expected). This strategy can ultimately lead to lower corporate profits principally because demand is misjudged that then leads to major discounting and inventory charges to clear out unwanted SKUs. Consequently, profit margins decline putting pressure on stock and bond prices. Ironically, stuffing the channel also reintroduces supply chain inefficiencies that were common in prior decades and were often the main driver of recessions.

Option #2 is for Nike to maintain normal inventory ordering methodologies thereby subjecting more of their goods to the tariff and force their supply chain and distribution partners to bear the tariff burden. In other words, Nike could use its market power to subject weaker partners to provide price concessions to essentially reimburse Nike for associated tariff payments. The principal problem with this strategy is that many of their partners may not be able to survive a 15% hit to their gross margins. Many of these businesses survive on small margins having already been squeezed by Nike over the years. This strategy would likely put many business partners under severe financial pressure and potentially put many out of business altogether. That is not good business, so while this may seem to be an attractive short-term strategy, it is likely not sustainable over time.

Option #3 is to pass along all/some/none of the tariffs to the end consumer. Now, if you’re like me and get sticker shock every time you look at footwear prices, it becomes obvious that simply raising the price of Nike golf shoes by 15% is not so easy. In this example, switching costs are essentially zero. I can buy a different brand produced in a country not subject to tariffs. I could also just postpone my purchase if I think that the tariffs are temporary. Either way, this is a problematic issue for Nike. End consumer demand becomes distorted.

Option #4 is for Nike to bear the tariff burden entirely and take a direct hit to their margins. This is the most likely scenario. The critical question then becomes how long these tariffs could remain in place. The markets will look past extraordinary circumstances if they are truly temporary in nature. But the truth is no one will know how long Nike’s profits will be impacted and this will lead to de-risking. Not even Nike will know how long their profits will be affected and the longer the tariffs are in place the more likely more radical corporate restructuring steps must be taken such as laying off employees, eliminating redundancies, reducing travel expenses, consolidating real estate, decreasing capital investment, etc. You can see how the contagion spreads through the rest of the economy. Ultimately, Nike would be forced to revisit Option #2 above, which would spread pain to their entire ecosystem.

The Markets

One of the most common questions we get today from investors is why is the market making all-time highs considering the macro risks highlighted above? We would point to three key drivers:

Fear of Missing Out (“FOMO”)

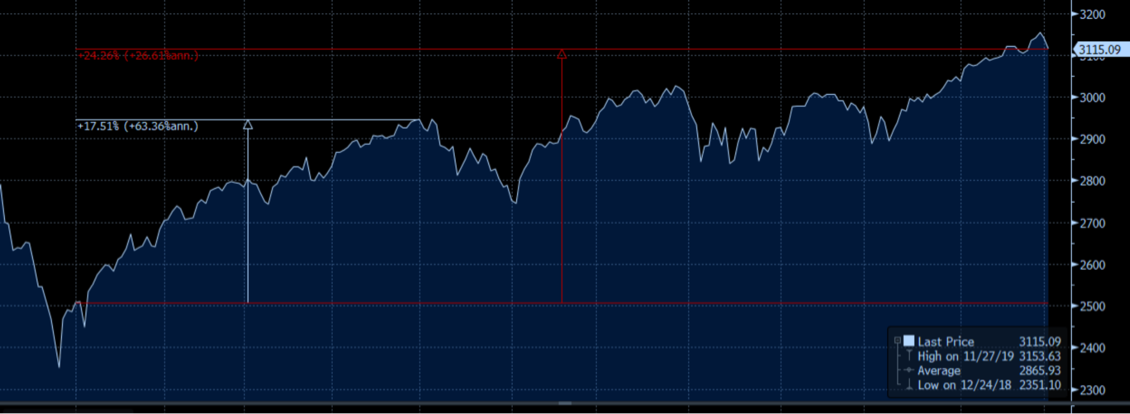

Investors are clearly chasing returns into year end. Many investors have been far too pessimistic this year and missed out on the market’s resilience. Recall as the end of 2018 approached, many investors ran for the exits. Alas, the sky was falling. In fact, it was an extraordinary buying opportunity. Persistent outflows of investor money from equity mutual funds and ETFs throughout 2019 suggest that many investors have completely missed the rebound. If you did not re-engage early this year you really missed out. The S&P500 – currently up 25% YTD – generated 75% of these gains through the first four months of the year. That coincides with when we were most bullish on equities because the risk-adjusted return profile was hard to pass up. The last 6% of the S&P’s return this year has required underwriting much more risk and is driven by the Johnny-come-lately’s piling into a technical breakout. We think that this last leg up is based on generally foolish behavior accepting a poor risk/return relationship. In other words, we don’t chase returns because dumb buying begets dumb losses.

S&P500 Index YTD Performance. Source: Bloomberg

Concentrated Outperformance

As we have noted in prior Warner’s Corners, the S&P500’s YTD performance has been fairly concentrated in the hands of a few stocks, specifically: AAPL, MSFT, FB and AMZN. These four stocks accounted for 20% of the index’ increase this year. Since the most recent market bottom set on 10/8/19, these four stocks contributed to 26% of the market’s 8% rise. Moreover, the recent rally in semiconductor stocks – one of the most cyclically volatile sectors – have been another material driver. We see this sector move as more evidence that investors are chasing returns into year end.

Very Limited Tax Loss Selling

Every year investors sell their losers to offset taxable gains. Last year the market experienced extreme tax loss selling. This year proves to be the opposite. With approximately 65% Winners to Losers this year there is much less tax selling. Much of the losses are largely concentrated in Energy. As most mutual funds have an October 31st fiscal year end, we often seeing mutual funds dumping their losers in September and October. Individuals and their financial advisors tend to engage in tax-loss selling in December, which is now upon us, but we do not expect a lot. As a result, the market has had an easier time reaching new highs without this seasonal selling pressure.

Taken together, FOMO, concentrated outperformance and limited selling pressure from year-end tax loss selling propelled the market to new highs in the face of trade war and related economic concerns. In our opinion, the higher this market goes the more risk there is of a severe correction if the December 15th tariffs are implemented. As alluded to above, the recent rise is more driven by weak hands chasing returns under favorable technical conditions than real underlying corporate earnings fundamentals.

Discounting the Outcome

It is our belief that the implementation of the December 15th tariff is inextricably tied to the Phase One trade talks between the U.S. and China. The back-and-forth banter between the two parties is a confusing blend of threats and acquiescence. It seems each time President Trump announces an impending agreement, the Chinese appear to demand more. At the root of the proposed Phase One deal is Chinese purchases of U.S. agricultural products, intellectual property reform and U.S. access to Chinese financial markets. When initially announced, Phase One did not include any material rollback of existing tariffs on Chinese imports and zero mention was made regarding the December 15th tariff. Since then, China has demanded a full rollback of tariffs to which various conflicting responses have emerged from the Trump Administration.

At this very moment, we believe the bid-ask spread is too wide to reach an agreement by December 15th but this is really just a guess. We expect leading up to this date that President Trump will step up his rhetoric in order to pressure the Chinese to accept a deal by December 15th. These tariffs are his proverbial hammer to create a deadline for an agreement. We expect this political drama to play out very publicly over the next two weeks with increasing threats to use this hammer. It is possible that China blinks, Trump wins and the December 15th tariff is postponed. It is also likely that the deadline is missed, a new deadline is set and the tariffs are temporarily postponed. Very often we see this sort of “kick-the-can” approach to country-level negotiations. But that may not be good enough to keep markets at current levels. Investors may look to lock in gains for the year and take a more defensive approach to 2020.

The Fed Put

With all that said, any market correction could create a significant buying opportunity. As the old saying goes “Don’t fight the Fed.” The reliability of the Fed and other Central Banks globally to use all available tools to generate the conditions for risk-taking is indisputable. Look no further than the DAX’ or the CAC40’s performance this year. Despite the German and French economies entering recessions this year, their stock markets are up nearly 20% because of the ECB’s loose monetary policy. As we have put it before, Central Banks do not prevent recessions from occurring, but they do encourage risk-taking which supports asset prices. We are going to talk about this further in an upcoming Warner’s Corner. But, in short, the Fed can and will step in and support asset prices when the situation demands.

Conclusion

There is a lot riding on the next two weeks. Our mantra for 2019 of being Patient and Balanced has never been more important. December 15th looms large as a potential day of reckoning. Perhaps it will be known as “T-Day”. With weak hands pushing up the market, sentiment could swiftly shift negative. Preparations have been made as we stand globally vigilant to always seek returns for a controlled amount of risk.

Jim Warner is the Managing Director, Head of Research of Lear Investment Management. Lear is an investment firm founded in 2015 focused on generating returns with measured risk. With a quarter century of experience, his ability to identify attractive investment ideas, construct portfolios and manage risk has resulted in superior outcomes for clients.

The Lear Global Vigilance Strategy is rated 4 Stars by Morningstar and ranks in the top 12% of managers in the Tactical Allocation category.

INFORMATION PRESENTED IS FOR EDUCATIONAL PURPOSES ONLY AND DOES NOT INTEND TO MAKE AN OFFER OR SOLICITATION FOR THE SALE OR PURCHASE OF ANY SPECIFIC SECURITIES, INVESTMENTS OR INVESTMENT STRATEGIES. INVESTMENTS INVOLVE RISK AND ARE NOT GUARANTEED. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RETURNS. BE SURE TO FIRST CONSULT WITH A QUALIFIED FINANCIAL ADVISER AND/OR TAX PROFESSIONAL BEFORE IMPLEMENTING ANY STRATEGY DISCUSSED HEREIN.