By Rick Lear, Lear Investment Management

“Heart of Gold”

by Neil Young

In 1971, Neil Young suffered a back injury. During his recovery he favored playing seated acoustic guitar as opposed to standing with the electric. The result was a more folk brand of music on his next album. In fact, Bob Dylan once said the song “Heart of Gold” sounded like a Dylan tune. The exploration of the new folk style worked—the song reached #1 on the charts and remains a rock classic.

The title and change-of-tune to folk remind us of a very important piece of the Lear Global Vigilance portfolio. G O L D.

After not owning the commodity for the first 20 years of my investment career, the asset class of gold was implemented into the portfolio in 2018. The addition served investors well as the precious metal climbed to all-time highs. The SPDR Gold Shares (GLD) appreciated 28% in 2020 (ending 8-20-20). This has far outpaced the return of S&P 500 and most all other asset classes in this back-breaking year.

For two decades, we were quick to dismiss gold with reasons like: it does not have a yield, it has underperformed other asset classes, and the precious metal has little utility.

Well, “stuff ” happens and market conditions change. The decision was made to add gold to the portfolio as a hedge with the goal of increasing return and lowering risk.

For the majority of 2020, the combination of the gold ETF and a gold miner stock (Barrick Gold) accounted for 10% of the portfolio allocation. We recently trimmed the weighting target to 7% of portfolio.

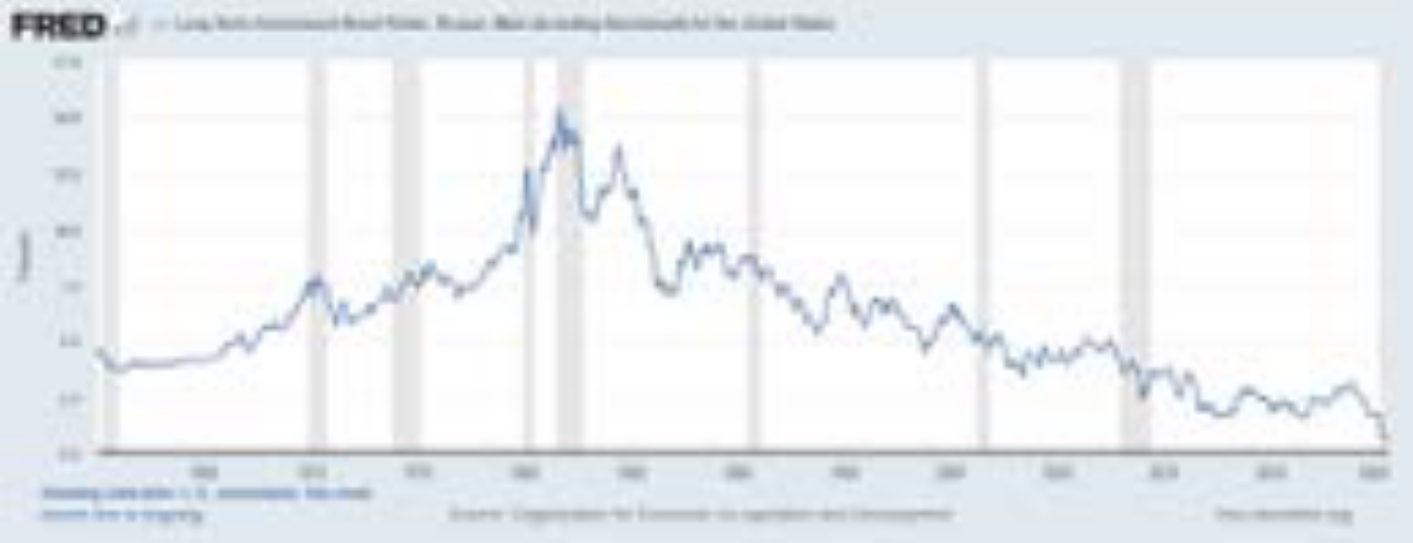

While gold has traditionally been used as a defensive asset class, a main reason for gold today is the low interest rate environment. The U.S. 10-year Treasury bond yield is the lowest in history. After inflation, this is a negative yield for the once popular defensive fixed income. The following is a chart of the U.S. 10-year yield:

Source FRED (not my dad, but St. Louis FED website)

Note the historically low level of current interest rates falling off of the chart. With the 10-year U.S. Government Bond at 0.6%, it left us seeking an alternative asset to protect against declines in stocks.

There are more reasons than just low interest rates. The uncertainty surrounding the U.S. dollar, rising U.S. budget deficits, and the possibility of inflation led to gold earning the status as a favored asset class for sophisticated investors.

In further support of the shift in sentiment toward gold, it was revealed that legendary investor Warren Buffet joined the party by purchasing Barrick Gold (GOLD). We were mining for a heart of gold well before Buffett. The legend has missed a large portion of the run-up in the stock. Regardless, we are happy to have him join the party and perhaps there are more gains to come.

In conclusion, we have always appreciated Neil Young (both electric and acoustic) and we have recently grown fond of gold as an appropriate asset class for the current market conditions. As the economy continues to recover, we will continue to trim the position in gold, but for now the asset holds a special place in our heart and the portfolio.

“You keep me searching and I’m growing old

Keep me searching for a heart of gold

I’ve been a miner for a heart of gold”

Rick Lear is the Founder and Chief Investment Officer of Lear Investment Management. Lear is an investment firm founded in 2015 with focus on generating equity returns with less than equity risk.

Lear Investment Management Who We Are video: https://www.youtube.com/watch?v=9uV4RpVN_RA

INFORMATION PRESENTED IS FOR EDUCATIONAL PURPOSES ONLY AND DOES NOT INTEND TO MAKE AN OFFER OR SOLICITATION FOR THE SALE OR PURCHASE OF ANY SPECIFIC SECURITIES, INVESTMENTS OR INVESTMENT STRATEGIES. BLOOMBERG IS THE SOURCE OF MARKET DATA. INVESTMENTS INVOLVE RISK AND ARE NOT GUARANTEED. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RETURNS. BE SURE TO FIRST CONSULT WITH A QUALIFIED FINANCIAL ADVISER AND/OR TAX PROFES- SIONAL BEFORE IMPLEMENTING ANY STRATEGY DISCUSSED HEREIN.