By Rick Lear, Lear Investment Management

The Game Stop Phenomena

The first concert I attended – without parents – was the Beastie Boys’ “License to Ill Tour” in 1987. It was an eye-opening experience. And since that night, the band has held a special place on my playlist and in my heart.

It would be almost a decade later when the group released the song "Sabotage" on their fourth studio album, “Ill Communication.” The band no doubt grew up and evolved their sound since that first tour, but it was clear they were still pushing the boundaries and rebelling against the establishment.

On February 18, as I watched the hearing on Capitol Hill (via Zoom) with the key players from GameStop and Reddit taking the stage, I couldn't help but think about this song, especially the following lines:

“You're scheming on a thing that's a mirage

I'm trying to tell you now, it's sabotage”

On February 24th, the story took another turn as the GME stock rebounded and the story gained new life.

It's been a long time since the stock market captured the attention of mainstream news outlets, social media and the imagination of the country. It was also refreshing to not talk about COVID-19 for a couple of weeks and see an investing topic replace the pandemic in the mainstream news headlines. So, here's what unfolded, and our take on what occurred.

The Situation - Long story short, a Reddit forum of amateur investors and day-traders called WallStreetBets worked together to drive up the GameStop (GME) stock price.

Their efforts resulted in skyrocketing the share price, which then put pressure on short-sellers who were betting for declines in the stock. This forced the short-sellers to repurchase those shares which — you guessed it — pushed prices even higher.

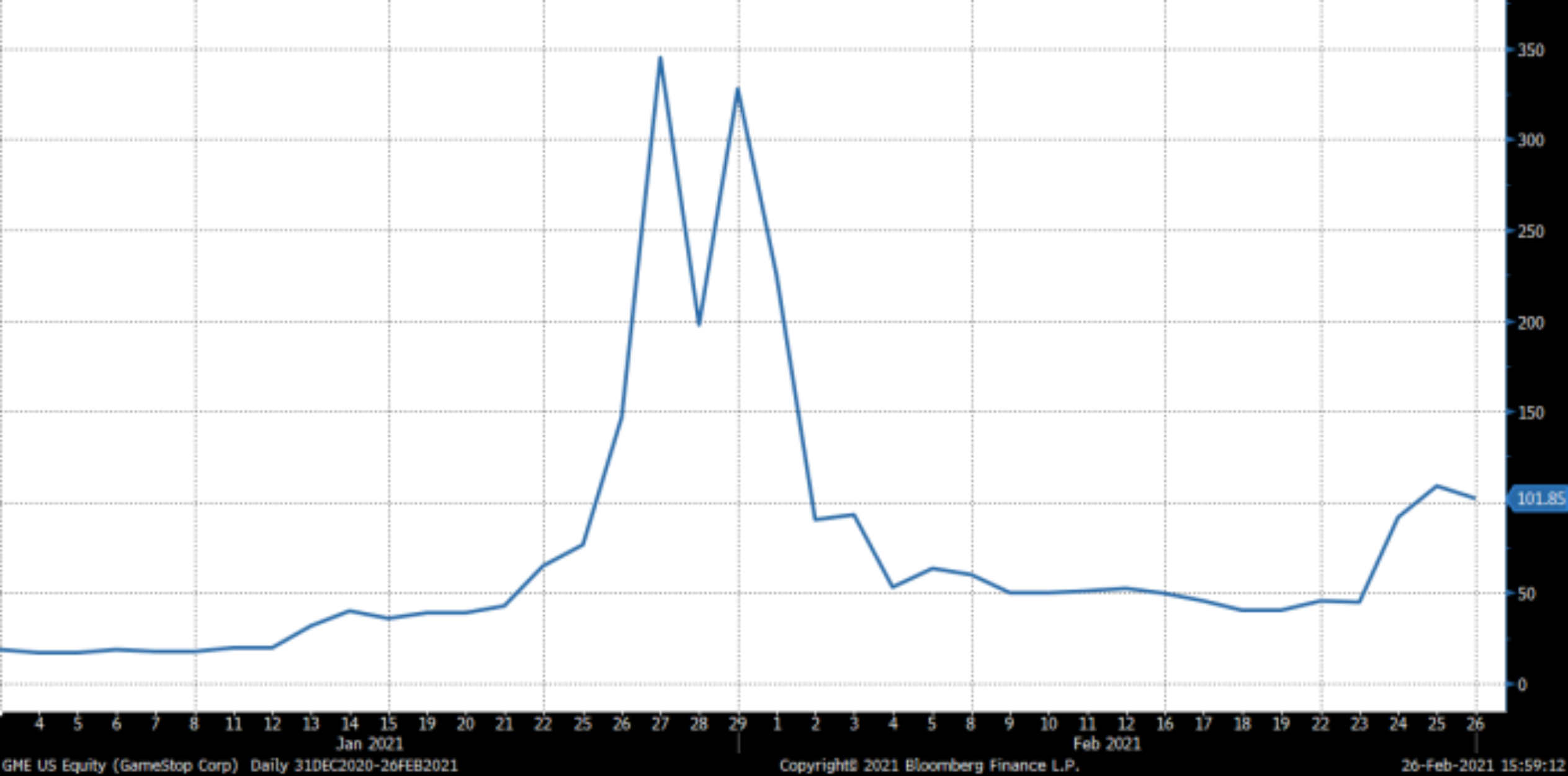

The GME stock shot from $10 per share to $350 at its peak. The stock went back down to $40 a share. But just when you thought the story was winding down, the Reddit rally reheated this week and the stock rebounded to $180/share. As we type on February 26, the stock price is $101/share.

The chart below displays the wild ride for GME in 2021.

(As of 2/26/21: source Bloomberg)

The stock sabotage was this generation’s version of the Occupy Wall Street movement. But, instead of drum circles and protest signs, buying stocks to manipulate the market and anti-establishment memes served as the flash mob’s weapons.

It's ironic that the very system the group rebelled against was used as its weapon of protest.

While the stock's movement and resulting pain felt by short-sellers captured the headlines, the quick- lived phenomenon was not much more than interesting news for a small number of professional investors.

Our Take - We have mixed feelings about this situation. On one hand, it is refreshing to see the individual investor win one against a hedge fund billionaire. On the other hand, the real losers are the investors in the hedge funds, which are often large pension funds. These hedge funds often invest on behalf of retirement plans, thus the participants would suffer.

Further, unless the individual investors sell their shares, it’s not certain there will be profits made by the masses buying the stock. In fact, we speculate that many investors lost money on the GME trade.

But, after reading the message board of WallStreetBets, it appears this movement is about more than making money. The GME situation is about standing up against the establishment – much like the Beastie Boys.

Robinhood - Ironically, one of the victims of the wild price action was the popular trading platform Robinhood, which offers no-cost trades and allows low minimum account sizes. Using the platform, investors can buy as little as one share of a stock or even fractional shares.

Robinhood got into hot water when the GME price fluctuations forced it to raise $3 billion to support capital requirements by regulators. This exposed how vulnerable the Robinhood business model is to adverse stock market events.

To make matters worse, Robinhood decided at the height of the frenzy to temporarily limit the purchase of GME shares in an attempt to stop the bleeding. The decision, however, shut out the very investors the company aims to serve from accomplishing their goals.

This situation further proves the point that if you are not paying for a service (free trades), then you are the product.

Effects on the Stock Market - During the week of significant increases in GME stock prices, there was a minor deleveraging of hedge fund holdings, which resulted in pressure-selling of many popular stocks. The specific hedge funds, which were short GME, needed to raise funds to offset the losses, forcing them to sell winning positions. The selling may have caused brief pressure on stocks. However, the popularity of stocks fueled record amounts of capital into the stock market, driving the S&P 500 to new highs.

Social Effects - The newfound love of the stock market is a result of a perfect cocktail of events, and the recipe is as follows:

- People sitting home, bored from months of lockdowns and quarantines

- Excess cash from government stimulus checks and less to spend on entertainment and travel

- Social media bringing like-minded people together to exchange ideas and coordinate actions.

In Conclusion - We are fans of the Beastie Boys and fans of rebelling against the establishment in a productive and positive way. However, we caution any investors from thinking they are “sticking it to the man” when buying stocks, as there is always someone else on the other end of the trade. And, in the game of investing it is often experience and hard work that lead to profits.

We encourage investing as opposed to speculating...and the ability and knowledge to know the difference between the two.

Rick Lear is the Founder and Chief Investment Officer of Lear Investment Management. Lear is an investment firm founded in 2015 with focus on generating equity returns with less than equity risk.

Lear Investment Management Who We Are video: https://www.youtube.com/watch?v=9uV4RpVN_RA

INFORMATION PRESENTED IS FOR EDUCATIONAL PURPOSES ONLY AND DOES NOT INTEND TO MAKE AN OFFER OR SOLICITATION FOR THE SALE OR PURCHASE OF ANY SPECIFIC SECURITIES, INVESTMENTS OR INVESTMENT STRATEGIES. BLOOMBERG IS THE SOURCE OF MARKET DATA. INVESTMENTS INVOLVE RISK AND ARE NOT GUARANTEED. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RETURNS. BE SURE TO FIRST CONSULT WITH A QUALIFIED FINANCIAL ADVISER AND/OR TAX PROFES- SIONAL BEFORE IMPLEMENTING ANY STRATEGY DISCUSSED HEREIN.