By Rick Lear, Lear Investment Management

The Notorious Bitcoin

Living in New York City in the 90s, you could hear the Notorious B.I.G.’s music playing in all corners of the Big Apple. Biggie captured imaginations, with his tales of excess and fighting for street credibility. But his popularity hit new heights after his sudden and too-early death in 1997. He was king of the city and certainly living up to the “notorious” title.

Which is why today, when we talk about Bitcoin, we are reminded of the main chorus from his song “Mo Money, Mo Problems,” a fitting Song of the Week to introduce our take on the Notorious Bitcoin:

“It’s like the more money we come across, the more problems we see.”

Bitcoin (BTC) is now a household name, so no explanation of the cryptocurrency is needed for this audience. However, we would like to discuss our views on this particular crypto through the lens of investment managers, as there is much confusion on what place BTC should have in our already-crowded financial lives.

But First, Is Bitcoin a Currency?

In 2018, we embarked on a research mission to find an answer to this question. In order to be a currency, a digital token should be usable to buy goods and services and be a store of value.

To test this, a first step was to purchase a modest amount of Bitcoin and then try using it to buy Christmas presents. Low and behold, we were not able to buy one single item online. At the time, the one retailer known for accepting BTC was Overstock.com. But even this BTC fan was not accepting the token as payment for products offered.

We suspected the reason for the lack of vendors accepting BTC was its wild price fluctuations. For example, BTC was fluctuating 5% to10% a day, which made it difficult to price match it to the value of a product at the time of transaction.

Bitcoin has come a long way since then, and it is now much more widely accepted. Today, Overstock.com and numerous other places currently accept BTC as payment along with fintech applications (such as PayPal and Square) that allow BTC to be used for transactions.

However, the use of BTC for transacting the purchase of goods and services still seems to be rare and impractical. Further, why would a BTC holder spend the token if they thought the value would increase? We certainly wouldn’t be giving away our shares of a stock we thought would appreciate in value for a cup of coffee.

So, what is the demand for BTC all about if it still isn’t used to transact commerce?

Bitcoin as an Asset Class

The rise of Bitcoin is more about the thought that cryptocurrency is an asset class – much like gold and other commodities are a distinct asset class. In the past year, several notable investors have revealed they have a small portion of their portfolio in BTC – not to use for purchases, but as a category of investments within their funds. For example, the legendary investor Paul Tudor Jones disclosed he invested around 1% of his billion-dollar-plus family assets in BTC. And, Elon Musk announced Tesla’s investment in the asset. But, if we have said it once, we have said it 100 times – we do NOT take investment advice from billionaires.

Regardless of Elon’s media stunt to be “cool” with the kids by owning BTC, we do believe Bitcoin has earned a seat at the table and can be considered as an asset class. But this is a rare asset class where the higher it gets in value, the more attractive it becomes.

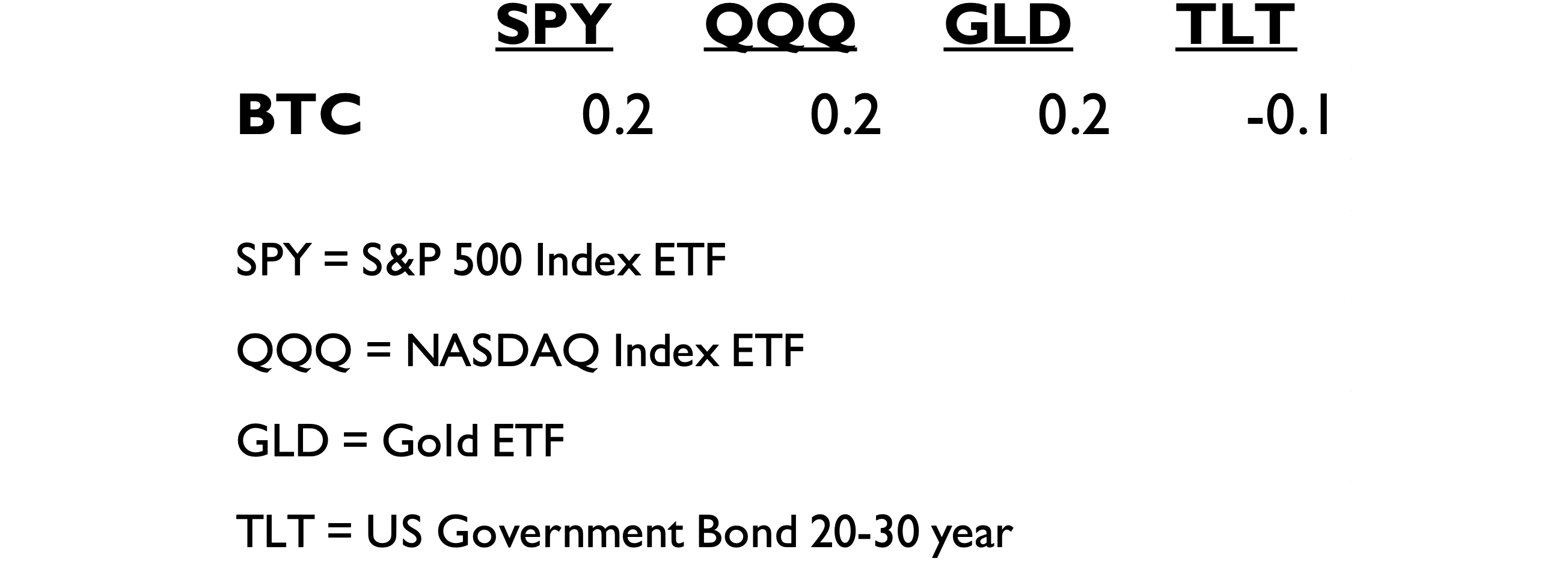

The feature of an interesting asset is the correlation of the asset to other asset classes. The following is a correlation of BTC to other widely held asset classes:

In conclusion, the asset of Bitcoin is not highly correlated to stocks, bonds or gold. Thus, the crypto passes the test of adding diversification to a portfolio. It is important to note, that the history of BTC is shorter than the other time-tested asset classes.

The Value

As investors, we are looking to make purchases of assets today that will have a higher value at some point in the future. When reviewing the value of BTC, investors must toss their financial textbooks out the window. There are no cash flows or earnings or any physical assets to examine in this financial model; instead, the imagination must be used when trying to project a valuation. This very reason is both the curse and the opportunity of BTC.

There are logical facts to consider when looking for reasons the asset could be worth more in the future. Most obvious, there is a limited supply of BTC. Today, the value of the entire asset class is $1 trillion. This compares to an estimated $10 trillion for the total market value of gold. Other than that comparison, it is difficult to put a value on the asset.

There are models predicting the future value of the asset based on increased demand by consumers and institutions. However, we have a reputation as serious securities analysts to protect, so we’ll refrain from taking the bait and publishing a valuation model.

A Social Dilemma

From general observation, there exist parallels among those with extreme political views and those who believe BTC will become the only currency in the world, should the dollar ever become worthless.

Once a person begins reading social media posts on the importance of BTC, social media algorithms will continue to feed you more and more pro-BTC messages. The path is slow and steady, but the brain- washing is real. We advise exercising caution when going down the social-media rabbit hole too far in any direction on any topic.

In investing and politics, we prefer a balanced approach. Our goal is not only to help you make money, but also to keep you out of a Viking helmet on the floor of the Capitol Building.

BTC Risks

The title “Mo Money, Mo Problems” seems most appropriate because as the crypto market grows, it faces more obstacles. For example, currently, BTC is unregulated. But as the market expands, this may cause problems for the good men and women around the world who create and regulate monetary, fiscal and legal policies.

In our opinion, the greatest risk to BTC is increased regulation by governing bodies. We believe it’s only a matter of time before regulation makes investing in BTC more complicated and less profitable.

Aside from possible government regulation, the following are additional risks of owning BTC:

- Losing access to the site that holds your BTC

- High volatility creating wild price swings

- Lack of adoption of the asset

- Large holders selling their positions

- Did we mention government regulation?

A Guide to Owning BTC

There are several ways to own BTC. If you’re looking to hold BTC directly, we believe Coinbase.com is the best option. You can create a Coinbase.com account to begin the experience. This process will give you a first-hand education in owning crypto.

Another option is to invest in a security that is backed by BTC. The Grayscale Bitcoin Trust (GBTC) is an efficient way to get exposure to the crypto. This stock can be purchased at almost any brokerage firm. The problem: The security trades at a premium to the value of the currency. For example, you will pay approximately 20% more for GBTC than the actual value of the underlying BTC. However, in many cases, the ease of investing can be worth the premium.

In Conclusion

Investors able to accept the wild swings in BTC might do well with a small amount of exposure to the cryptocurrency asset class. We would suggest 1% to 3% of total liquid assets.

While there is no intrinsic value, we believe opening your mind and your digital wallet for BTC could be beneficial. But, like everything else, we recommend not getting too excited about the crypto, as there is a chance it will be worth significantly less in the future.

Much like Biggie, Bitcoin has done a great job to capture our imagination and attention.

But when it comes to your portfolio, we hope the opposite is true when it comes to “Mo Money, Mo Problems.”

Rick Lear is the Founder and Chief Investment Officer of Lear Investment Management. Lear is an investment firm founded in 2015 with focus on generating equity returns with less than equity risk.

Lear Investment Management Who We Are video: https://www.youtube.com/watch?v=9uV4RpVN_RA

INFORMATION PRESENTED IS FOR EDUCATIONAL PURPOSES ONLY AND DOES NOT INTEND TO MAKE AN OFFER OR SOLICITATION FOR THE SALE OR PURCHASE OF ANY SPECIFIC SECURITIES, INVESTMENTS OR INVESTMENT STRATEGIES. BLOOMBERG IS THE SOURCE OF MARKET DATA. INVESTMENTS INVOLVE RISK AND ARE NOT GUARANTEED. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RETURNS. BE SURE TO FIRST CONSULT WITH A QUALIFIED FINANCIAL ADVISER AND/OR TAX PROFES- SIONAL BEFORE IMPLEMENTING ANY STRATEGY DISCUSSED HEREIN.