By Rick Lear, Lear Investment Management

The Return of the U.S. Economy

The first few chords of “Gonna Fly Now,” often known as the “Rocky” theme song, are all it takes to get fired up enough to start shadow-boxing around the house

If you’re a fan, then you already know all of the movies in the beloved “Rocky” franchise (including 2015’s “Creed”) have a similar storyline: underdog fighter is defeated, said fighter does some soul-searching, puts in the hard work and training, and, ultimately, sees a glorious, well-deserved victory over a giant.

No matter how many times you see these movies, the tale of the underdog defeating the giant is a story worth cheering for again and again.

Music practically plays a character role in these films. “Gonna Fly Now” by American composer Bill Conti is played during a pivotal scene — a training montage that symbolizes the phoenix rising from the ashes — a shift in status from being down-and-out to possessing the confidence and hope of an anticipated victory.

In the real world, the stock market cycle feels a lot like Rocky’s story. It was true back in the most underappreciated bull market of the 2010s and remains true in the stock market recovery today.

In this current cycle, we can think of the stock market as our hero, Rocky, and COVID-19 as the first opponent. Luckily, although a tough contender, the stock market was able to triumph over COVID-19. But the next fighter on the card is up — and it’s monetary and government policy. Who’s going to win this battle?

After watching one “Rocky” movie, viewers know to anticipate a knockdown before the big victory in the end. Likewise, many investors today are bracing for a knock-out punch in the economy, but we believe this tale of redemption is in the early rounds. You can just hear the lyrics in your head:

“Getting strong now

Won't be long now

Getting strong now”

The economy and stock market rebounded from 2020 lows, and we believe it still has more room to run higher. It is time for the U.S. economy to fly and stocks to continue to outperform bonds. However, we recognize that it will be a tough road, and there will be some blood, sweat, and tears along the path.

The proof we offer comes from three key macroeconomic areas:

- GDP Growth

- Interest Rates

- Unemployment

Without further ado, let’s ring the bell … “DING, DING!” (in Apollo’s voice, muffled from a mouth guard)

Round 1: GDP Growth Rate

Gross Domestic Product (GDP) is the total value of goods and services produced in a country. This is the most common economic factor used to gauge a country’s growth from one year to the next. It is our opinion, and that of many others in the investment business, that the GDP growth rate in 2021 will be the largest in decades. In fact, we believe the U.S. could see 7.5% growth in GDP this year. The chart below displays the nation’s annual GDP for each year over the past several decades.

A 7.5% growth rate in U.S. GDP is significantly higher than any year out of the past two decades. However, this is a result of the massive government stimulus and record amounts of liquidity produced by the Central Bank and low interest rates. Regardless of the reason, the growth is big. We often say, we do not buy GDP growth; we buy stocks. Because of this, we reference a large expansion as a reason for optimism and to display the magnitude of the growth in front of our country. The significant expansion must be put into context — and for that, we turn to the next macro item on our list — interest rates.

Round 2: Interest Rates

One of the biggest concerns we hear today about why the economy may be slower to bounce back is higher interest rates. While higher rates have killed many bull markets, we do not believe the current rise in rates is dangerous — yet. For interest rates, we use the 10-year U.S. Treasury bond to support our stance. The chart below displays the yield of a 10-year Treasury for the past five years. The current yield of 1.73% is still lower than it is in much of history. In fact, the stock market has done exceptionally well in periods when yields have been this low. (Source: Bloomberg)

We believe yields will continue to climb higher and for all the right reasons. It is highly probable the economy will improve, and the 10-year yield will increase further. Indeed, this is how the economy should function. Next, we turn to our last and perhaps the most important macroeconomic factor — unemployment.

Round 3: Unemployment

Seventy percent of U.S. GDP comes from consumer spending.

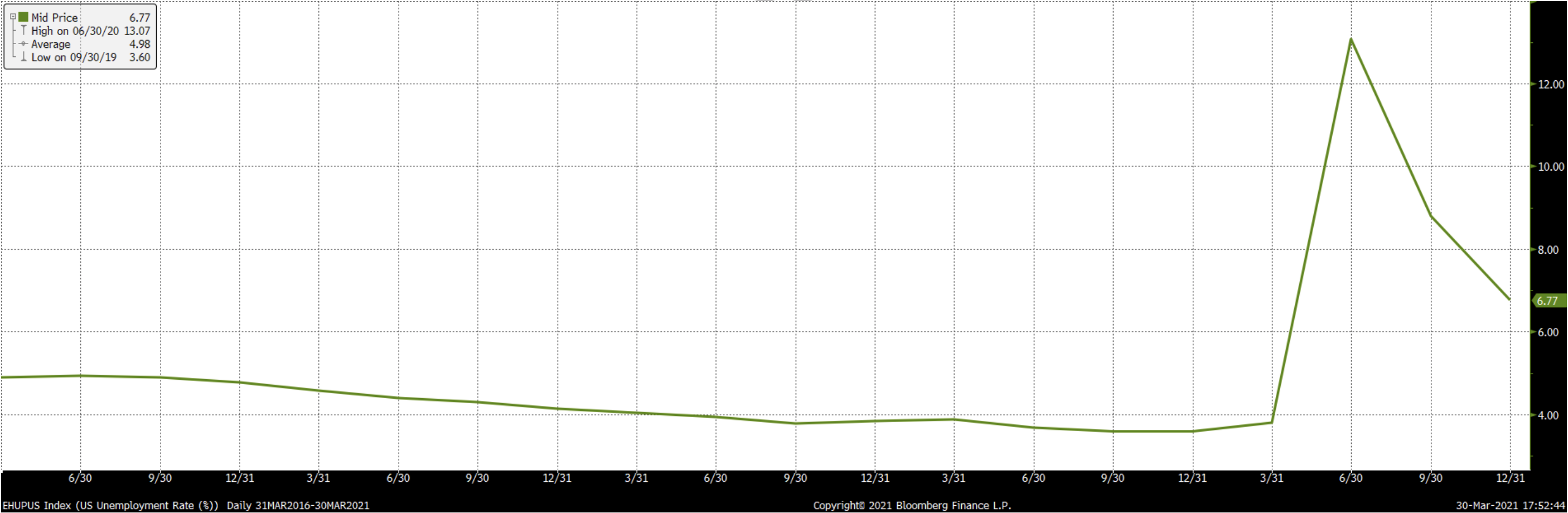

But in order to spend money, people must have income (usually from work, though it can also be from government stimulus). This chart represents the U.S. unemployment rate, which is tallied monthly by the U.S. Bureau of Labor Statistics (Source: Bloomberg):

The unemployment rate hovered around 4% for several years before skyrocketing to more than 13% during the pandemic and, as a result, the ensuing lockdown. Today, it has since returned to 6% at a rapid pace and continues to decline. In fact, we forecast there were approximately one million jobs added during March.

The Rebound Victory

With GDP growing at the fastest pace in decades, rates to borrow money near historic lows, and an increase in the number of Americans with money in their pockets, we believe the earnings of select stocks could exceed the expectations of many investors as we potentially enter a “Roaring 20s” era of our own. There are events on the horizon that we’ll certainly monitor as potential worthy opponents to the economy, like inflation and higher taxes. But, as of today, the positives outweigh the negatives

We have seen this movie before, and we’re singing these lyrics ...

“Gonna fly now

Flying high now

Gonna fly, fly, fly”

Rick Lear is the Founder and Chief Investment Officer of Lear Investment Management. Lear is an investment firm founded in 2015 with focus on generating equity returns with less than equity risk.

Lear Investment Management Who We Are video: https://www.youtube.com/watch?v=9uV4RpVN_RA

INFORMATION PRESENTED IS FOR EDUCATIONAL PURPOSES ONLY AND DOES NOT INTEND TO MAKE AN OFFER OR SOLICITATION FOR THE SALE OR PURCHASE OF ANY SPECIFIC SECURITIES, INVESTMENTS OR INVESTMENT STRATEGIES. BLOOMBERG IS THE SOURCE OF MARKET DATA. INVESTMENTS INVOLVE RISK AND ARE NOT GUARANTEED. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RETURNS. BE SURE TO FIRST CONSULT WITH A QUALIFIED FINANCIAL ADVISER AND/OR TAX PROFESSIONAL BEFORE IMPLEMENTING ANY STRATEGY DISCUSSED HEREIN.