The Economy Begins the Initial Descent

Welcome to 2022. Before we dive into our forecast for the year ahead, let’s recap on the year past. In last year’s letter, we mused 2021 would be akin to an extended spring break as the country reopened for business. Turns out, that forecast was accurate.

Cooped-up Americans hit the Leave button on Zoom happy hours and returned to in-person events, dining out, traveling, and spending money — lots of it. With stimulus checks flowing like vaccines in the bloodstream, 2021 saw a booming, consumer-led economy.

People are also returning to air travel. Regardless of how this industry has changed during the pandemic, there’s one reassuring constant — the “fasten seat belt” alert. The illuminated belt and accompanying sound effect (ding!) serve as an important communication from the pilot that conditions are changing, which is an appropriate analogy for the theme of our 2022 outlook.

After cruising along at high elevations, it’s time for the economy to return to more normal levels.

The U.S. economy and stock market soared in 2021. The stock market average return was strong, but as usual, there was more to the story. The stock market average return for the year reminded us of the story of the fisherman that drowned in lake with an average depth of one foot.

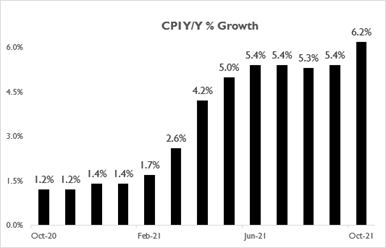

The transition in the characteristics of the outperforming stocks changed throughout the year. In addition to the Delta variant causing a shift in stock leadership, a string of Consumer Price Index readings (a gauge of inflation) surpassed 5%, proving that higher prices are not going away quietly.

Many equity managers were unable to transition from stay-at-home Covid stocks, like Peloton and Teladoc, to reopening stocks such as Carnival Cruise and American Airlines. The result was large declines under the surface of the index as the shift from speculative technology to deep value was violent.

Let’s take the highly publicized ARK Investment Innovation Fund (ARKK) as an example of high-flying technology stock performance. After 2020’s return of +149%, the same fund was down -24% in 2021. On the flip side, Warren Buffet’s Berkshire Hathaway (BRK/B) returned +29% in 2021 after a measly +2.4% in 2020. The vast difference between the technology and value manager serves as an example of the disparity of returns.

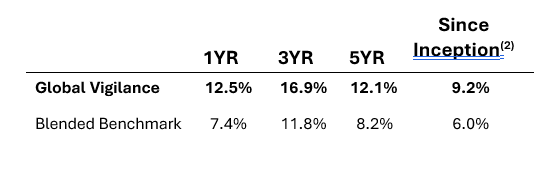

The Lear Global Vigilance portfolio was not immune to this phenomenon. Several of the names which fueled our outperformance in 2020 delivered lackluster returns in 2021. However, the mean reversion works on both sides — the areas that were losers in 2020 became winners in 2021. The result for Lear Global Vigilance Composite was a solid, steady return in line with our five-year average of +12% net of fees.

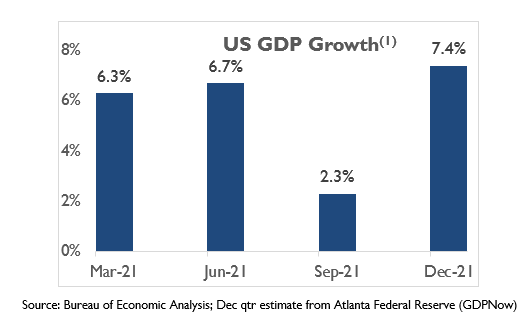

Going Greek – Who would have thought that knowledge of the Greek alphabet would be so important over the past year? The emergence of new Covid-19 variants warned the world that the pandemic may not be over just yet. The Alpha variant gave way to Delta, and Omicron soon followed. Thankfully, the virus did not affect the economy or spending in 2021. The following chart displays the growth of US Gross Domestic Product by quarter.

As we enter the third year of the pandemic, and with the possibility of Covid-19 becoming endemic, we believe there are other non-pandemic-related factors to keep us up at night, hindering our optimistic outlook for 2022.

The Year Ahead

Several factors combine to determine whether the seat belt sign is just a warning for minor turbulence, or we’re headed toward a crash landing of the economy — a recession. Here’s our take: While we do see potential turbulence, we are cautiously optimistic for 2022 and believe select stocks could continue to climb.

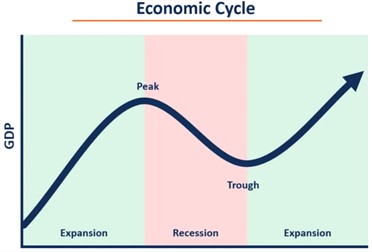

It appears the economy is mid-cycle, and there is still time left in this bullish journey. This mid-cycle phase will be characterized by a return to more normal levels of growth, thus allowing the “flight” to continue at a more sustainable level.

Flight Plan – The Lear philosophy is to adjust the portfolio’s risk based on current market conditions. The following are the most important economic factors and questions to consider as we monitor for 2022 to determine the appropriate amount of risk in the portfolio:

- Inflation: Will supply chain troubles ease and will demand for goods normalize?

- The Federal Reserve: How fast will rate hikes occur, and how many will actually happen?

- Employment: Will consumers continue to spend as more jobs become available?

Two other factors worth monitoring are the midterm elections in November and the decline in Bitcoin. It appears Republicans will pick-up seats making probability of any legislation getting passed lower than when Democrats held both Houses. Further, we are concerned the steep declines in cryptocurrencies could spill over to other parts of the capital markets.

Inflate-gate – In 2021, inflation reached levels not seen since the early 80s. The following chart displays the Consumer Price Index (a measure of inflation) since October of 2020:

The “transitory” label Federal Reserve Chairman Jerome Powell infamously used to characterize inflation was dumped in late 2021. Inflation causes concern in the stock market because it means interest rates will likely rise, thus lowering the valuation of certain stocks.

Further, higher rates typically lead to higher borrowing costs and less economic activity. However, we do not believe raising short-term rates from near zero to around 1% will affect much, let alone cause a recession. On the contrary, if policy works effectively, higher rates should calm inflation and leave the economy at a more sustainable cruising altitude.

So Good It Was Bad – The hot and highly stimulated economy was so strong it actually negatively affected some businesses that couldn’t keep up with demand. Some industries were impacted by severe supply chain disruptions and shortages of goods. We believe the economy will adjust from “so good it is bad” to “so okay it is good,” which again will allow the economy to reach a more comfortable trajectory.

Since the 2008 financial crisis, investors looking to grow their assets have been forced into riskier investments by the Fed’s actions. This remains the case in the new year. However, we believe investors should consider being more selective with the higher-risk assets they own at this stage of early tightening.

The Central Bank’s mandate is two-fold: 1) full employment and 2) maintain approximately 2% inflation. Inflation is now about three times as high as the Fed’s target, and catch-up rate hikes are their top focus. Let’s explore the other half of the mandate – employment?

Help Wanted – The pandemic and government’s response of providing income subsidies for the unemployed created a unique employment situation. While the unemployment rate reached just over 6%, government stimulus programs artificially made the unemployment rate closer to 0%, as all Americans of working age or retired were getting additional benefits. Now, most benefit programs have ended, and the labor market is left to return to its natural course.

The record number of “help wanted” signs in store windows signals it will take time for the labor market to detangle. If normalization continues, we believe it is possible America will reach full employment before the end of 2022. Full employment would signal we are close to the end of the economic cycle, but first, it could lead to higher wages and increased consumer spending, which would have a positive effect on the economy and markets.

Stuck in the Middle With You – As noted earlier, our indicators reveal we’re in the middle of the economic cycle. Thus, we continue to favor stocks over bonds and prefer commodities and hard assets. With our overweight to stocks still in place, we now focus on the keys to investing at this stage. The question is, which stocks are worthwhile?

2022 Themes and the Decade – We begin the year with carefully curated exposure to both growth and value with a focus on specific stock situations within the following five themes:

Clean Energy: After a strong 2020, the clean energy universe took a breather last year. The iShares Global Clean Energy ETF (ICLN) was down -15% in 2021. However, this theme is here to stay, and we remain bullish for the following reasons:

- Social Concern: Consumers and corporations have made it a priority to be green or support companies dedicated to this initiative.

- Governmental Policies: Leaders around the globe have announced their commitment to decarbonization and green energy.

- Cost: Clean energy costs are becoming better for the bottom line.

As the world of electric vehicles, data centers, and connected devices continues to expand, the global demand for electricity will rise. Therefore, we continue to look for opportunities to increase exposure to the clean energy megatrend.

Innovation and Digital Transformation: High-flying technology stocks, such as DocuSign, Peloton, Zoom, and Rivian, corrected in the latter half of 2021, leaving prices at levels last seen before the summer, though they were still stretched in some cases. The quandary in 2022 will be if the stocks involved in the largest shift to the digital economy perform yet again, or will higher interest rates continue to force valuations lower, despite the exciting business models and bright future?

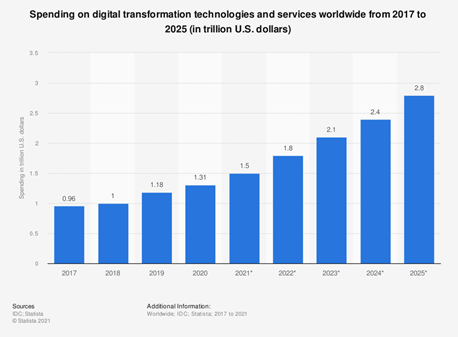

We believe in the technology theme and tech companies' profitable business models. However, the transition to a more digital economy is still in the early stages. The chart below illustrates the forecasted expansion of spending in digital technologies over the next several years.

Technology will likely continue to be a theme for the decade. Therefore, we feel it’s important to remain invested in select names involved in this trend. We acknowledge and accept there will be more volatility in this sector in the year ahead, and as such, have limited the number of names and position sizes.

Infrastructure: Clean energy is important, but we question whether it will provide enough power to charge all those Tesla’s and iPhones. We also believe there will still be a need for oil and natural gas. The pipelines that move oil and gas across the country are vital, and the companies that own these pipelines also have attractive and predictable cash flows.

Financials: The Fed is expected to raise interest rates three or four times in 2022. And in a rising interest rate environment, we typically increase our exposure to select financial stocks. This move allows us to participate in the higher interest rates and the corresponding lift to financial companies’ bottom lines.

Commodities: While we don’t expect inflation to be as high as in 2021, we believe there is still a demand for select commodities. Commodities play an essential role in the portfolio to protect against inflation and are the building blocks for the future digital, clean energy world.

The Other 7 Billion People in the World: The portfolio themes discussed are not exclusive to the U.S. Thus, we span the globe for more attractive valuations in the above-listed sectors. Here are our thoughts on major international markets:

- India continues to be a place for opportunity with large population and strong economy

- China’s Government has created a challenging environment for investors

- Europe looks attractive based on valuation when compared to US markets

The Roaring 20s: The team at Lear remains confident this decade will be among the best in our lifetime because of the megatrends expressed above. The decade is off to a good start so far, with a 48% return for the S&P 500 Index since 2020 began.

We strongly believe the most important key to investment success is understanding risk. Volatility will be heightened, and the conviction of stock investors tested — especially those heavily involved in technology stocks. Nevertheless, we are willing to accept the price fluctuations in companies we believe have strong secular tailwinds in solid themes.

In Conclusion - The Fed tightening financial conditions will be the biggest concern for the year ahead. The massive returns of the 2020 to 2021 recovery are in the rearview mirror, and the “easy” money has been made. We predict 2022 will be a grind higher, littered with 5%, 10%, and 15% declines as the world makes sense of the normalization of the global economy.

Our team continues to trust the process that produced Lear Global Vigilance Composite’s strong returns since our inception seven years ago. We will continue to adjust the risk in the portfolio as economic conditions change and evolve. Our research will be critical to understanding the securities that will win at this stage of the cycle.

We know you have many investment choices, so we thank you for flying with Lear.

Wishing you peace, health, and happiness in 2022.

— The Team at Lear Investment Management

Disclosures for material:

This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions.

Information is intended as an illustration of our recent investment outlook and not intended as investment advice or a recommendation of any strategy or security. It does not take into account an investor's specific objectives, risk tolerance, tax situation, or other circumstances and is subject to change without notice.

Customized Composite Benchmark is currently 50% Bloomberg Barclays Aggregate Bond Index & 50% FTSE Global All-World (gross of foreign withholding taxes on dividends), calculated daily.