Summary and Takeaways

- 2022 was difficult for stocks and bonds, but good for commodities.

- The “free” money era is over and risk assets were repriced.

- The selling may not be over but getting closer.

- Inflation peaked, so the Fed can pause soon.

- Higher rates cooled the economy and many sectors experienced significant declines.

- Begin 2023 defensive, but ready to add risk upon declines or changes in data.

The research team at Lear has experienced two paradigm shifts in our nearly three decades in the investment business. The first began in 2008 in response to the Great Financial Crisis when central banks lowered rates to near zero. This glorious era ended in 2022 as the Fed raised rates at a record pace. The rapid change has many investors feeling anxious as the economy experiences an awkward metamorphosis. Shifts of this magnitude, however, can create generational investment opportunities.

The First WIT

Almost a decade ago, we labeled the investment landscape as a World In Transition (WIT). This period was characterized by 1) lower interest rates, 2) lower energy prices, and 3) lower GDP growth. Technology stocks were the main drivers of growth as low borrowing rates fueled an era of explosive expansion and higher valuations for the riskiest assets. Like all cycles, this one ended. We label this new era as the WIT Part 2 and believe it will be characterized by:

- higher interest rates — free money is over, back to old normal rates.

- higher demand for natural resources (food, energy, and metals).

- higher productivity — doing more with less.

How was your Flight?

The title of our 2022 letter was “The Fasten Seatbelt Sign is On.” We warned turbulence was ahead as inflation climbed while the economy cooled. Add in the Ukraine-Russia situation, hawkish Fed, lockdowns in China, and you had a perfect cocktail for uncertainty.

Akin to the feeling of a plane bouncing around, watching the value of wealth fluctuate can leave a pit in your stomach even when the air pocket is anticipated. While we all know it is going to be okay in the end, it can be tough to navigate these emotions.

This was the worst year for the stock market since 2008. Many had never experienced this brand of extended, steep decline. We know what you’re thinking — if you knew this was coming, why not get out of the way? The answer — we did take aggressive action to navigate these markets; however, there were few places to hide. We still believe in many of the technology stocks that declined in 2022 and chose to weather the storm as opposed to trading in and out.

After three bear markets, the end of the cycle is not new to the team, but we do regret investors experienced such a bumpy ride. The 2022 returns were disappointing, but we remain proud of the Global Vigilance Composite performance since inception in 2015. Lear Global Vigilance GIPS Compliant returns have outpaced our index since the firm began.

Ready or Not…

There was a unique challenge in this bear market — there were few places to hide from declines. The Bloomberg Aggregate Bond Index was down -13% in 2022 – the worst year on record. Both equity and bond market declines in the same year is a rare occurrence.

Our views on the risks in bonds were highly publicized (including in Barron’s), but the declines were steeper and more widespread than anticipated. Further adding to the challenges was the monumental declines in technology stocks. The technology heavy NASDAQ was down -32% for the year — the worst since 2008.

As forecasted, commodities and healthcare were highlights of the year, and the portfolios capitalized on both.

The Pace of the Rise

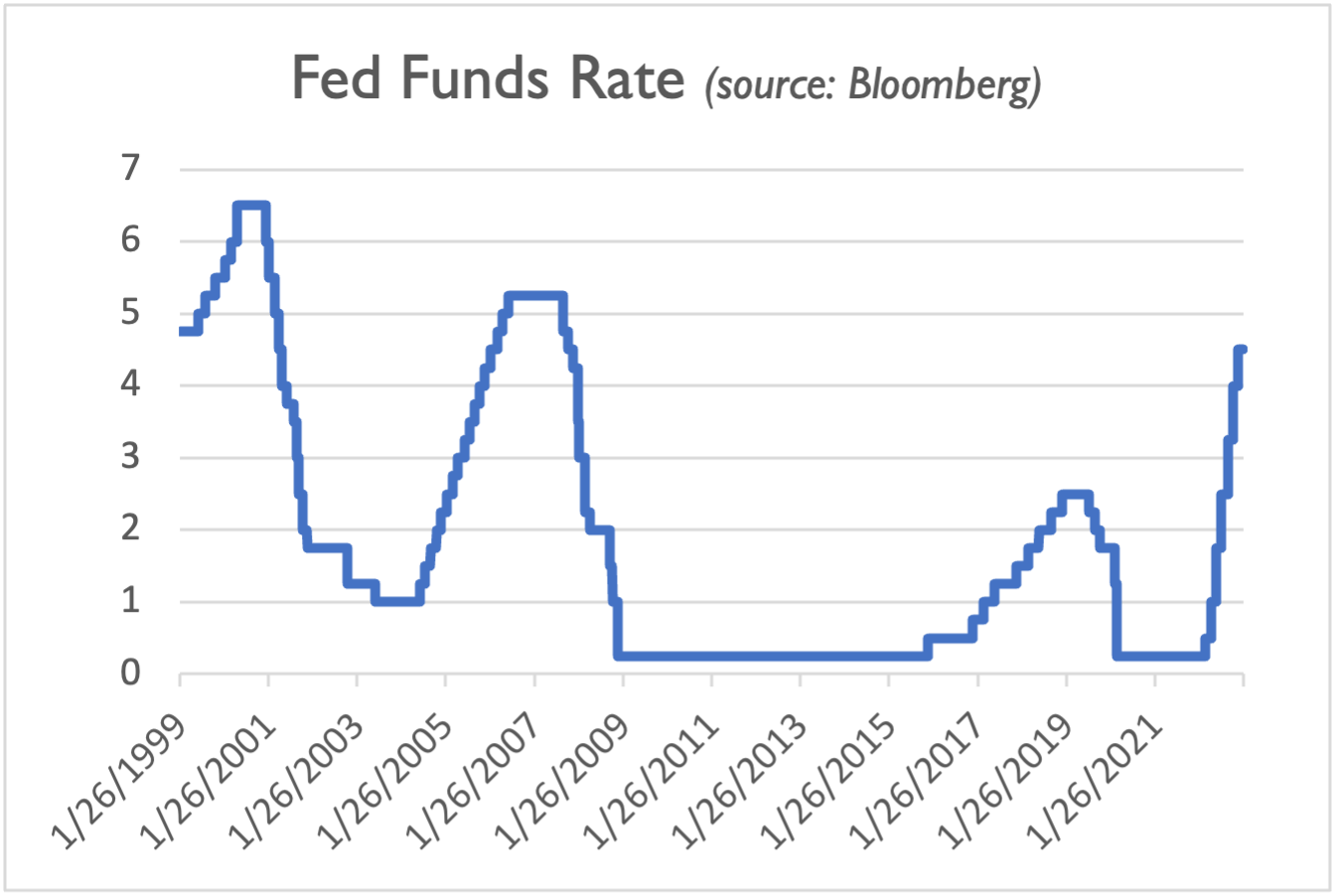

The Fed raised rates from 0.25% to 4.5%. This rapid rise in such a short time span was another dubious “first.” The chart below illustrates the historic rise in Federal Funds rate.

It seems clear this is the new normal unless there is another dramatic economic shock and the Fed is forced to lower rates.

Public Enemy #1

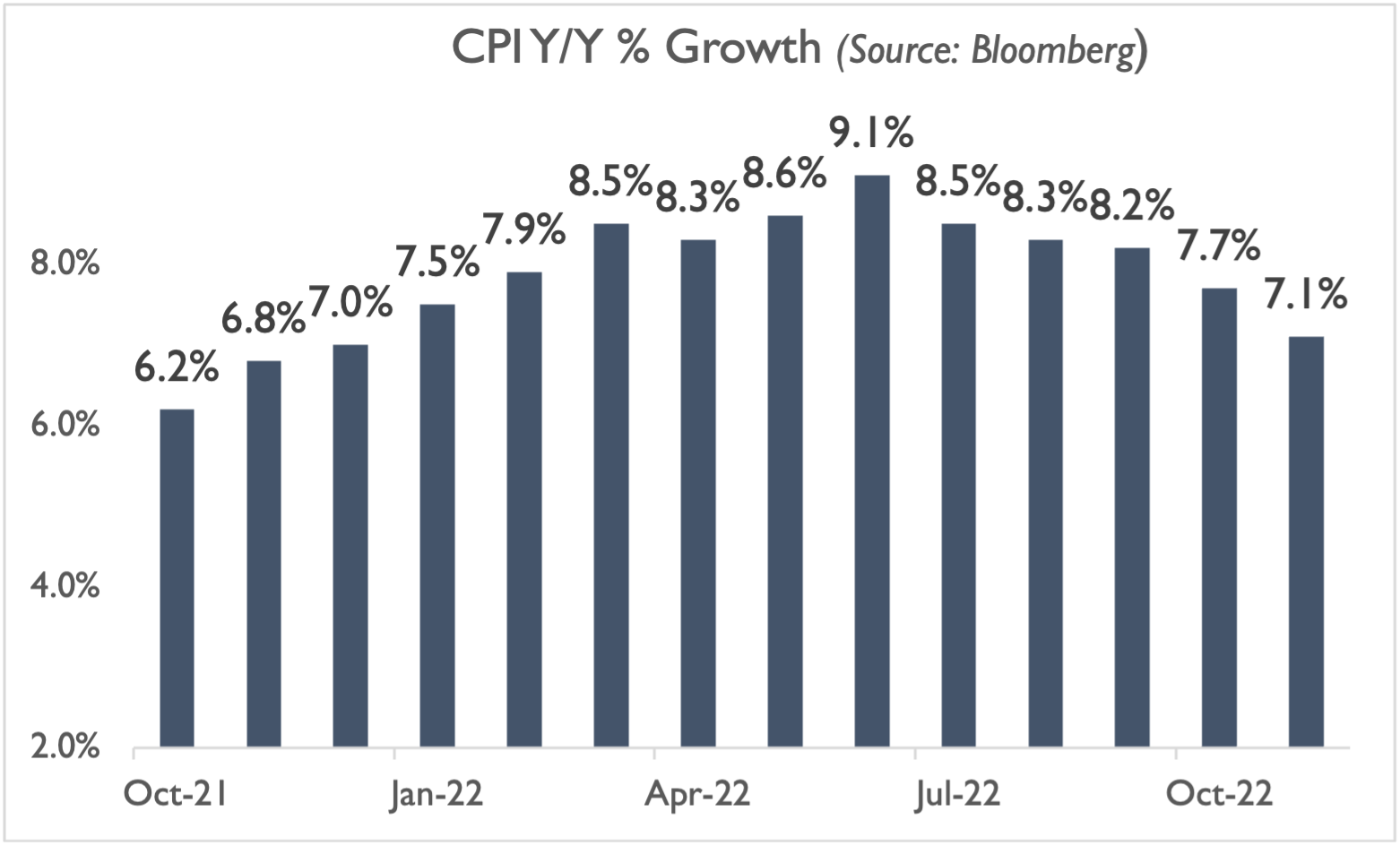

If you’re looking for one culprit to blame for the Fed action, look no further than inflation. The highest Consumer Price Index in 40 years is detailed in the chart below:

Fighting inflation was (and remains) the focus of the Fed. Our research indicates the Fed has accomplished its mission and prices are falling, maybe even faster than the CPI reading indicates.

The Days Between

Transitions from one cycle to the next are not always fast and orderly. Be patient. It can be rewarding for those who know where to look and have the conviction to act. Today, we find ourselves somewhere between the old landscape and the new.

Let’s now dive into how to invest in the ‘old normal’.

HAPPY NEW YEAR! NOW WHAT?

With 2022 in the rearview mirror, the focus is now on the road ahead. We cannot change the past, but we can control the current positioning of the portfolio. What matters now is when and how to capitalize on the opportunities created.

Hope in a Hopeless World

The great paradox of investing: when it feels the worst, it is often the best time to find opportunities. Many feel the need to buy stocks when the market is up and sell when it’s down; and we can understand this fear-based strategy, but…

KNOWLEDGE IS THE ANTIDOTE TO FEAR.

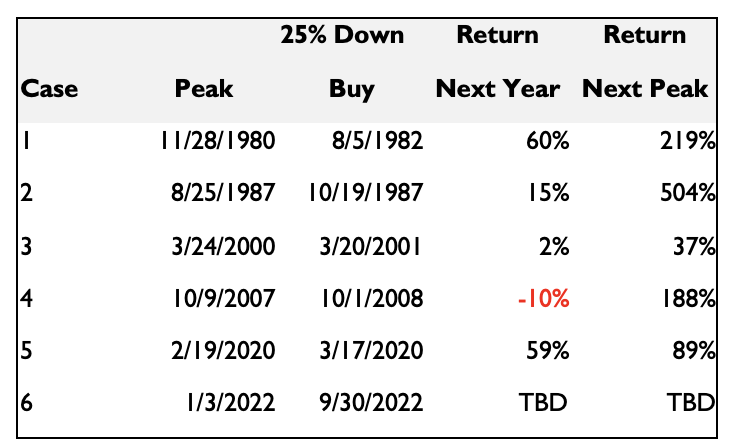

We studied past market declines of 25% or more in the S&P 500. The results are below. The conclusion? There is a high probability of positive returns in the next 12 months after a decline of this magnitude. However, it is also important to note that further declines are also possible. We are mindful of this fact after experiencing two 50% declines firsthand.

The study below explores 25% declines in the S&P 500 and resulting gains. It can be a nice entry point. (Source chart data is Bloomberg.)

While cautiously optimistic, we begin the year defensively positioned, poised to deploy cash in select securities upon further declines or when more data is revealed.

Recession Calls

The recession calls are loud and widespread. From usually bullish Wall Street strategists and high-profile CEOs to the Federal Reserve itself, a recession seems to be the consensus. Economists are conflicted over the timing of the effects of higher rates on the economy. We were taught there is a six-month lag for higher Fed funds rates to work through the system and slow the economy. Perhaps that is not entirely true for all parts of the modern economy though.

It is possible the recession-like downturn is already priced into many sectors. Maybe there has been a rolling recession moving from one sector to another. For example, we believe a durable goods recession is well under way and it may be time for a recovery in the coming quarters. On the other hand, the services sector is still doing quite well.

Perhaps investors are not worried about a recession, but more worried about a financial crisis. A financial crisis occurs when there is a break in the system. This usually occurs in the bond market first and then leads to indiscriminatory selling of stocks. It is possible for a recession to occur and stocks to avoid a full-blown crisis. Right now, there are no glaring signs of a crisis this year; however, we are carefully monitoring the credit markets for signs of stress.

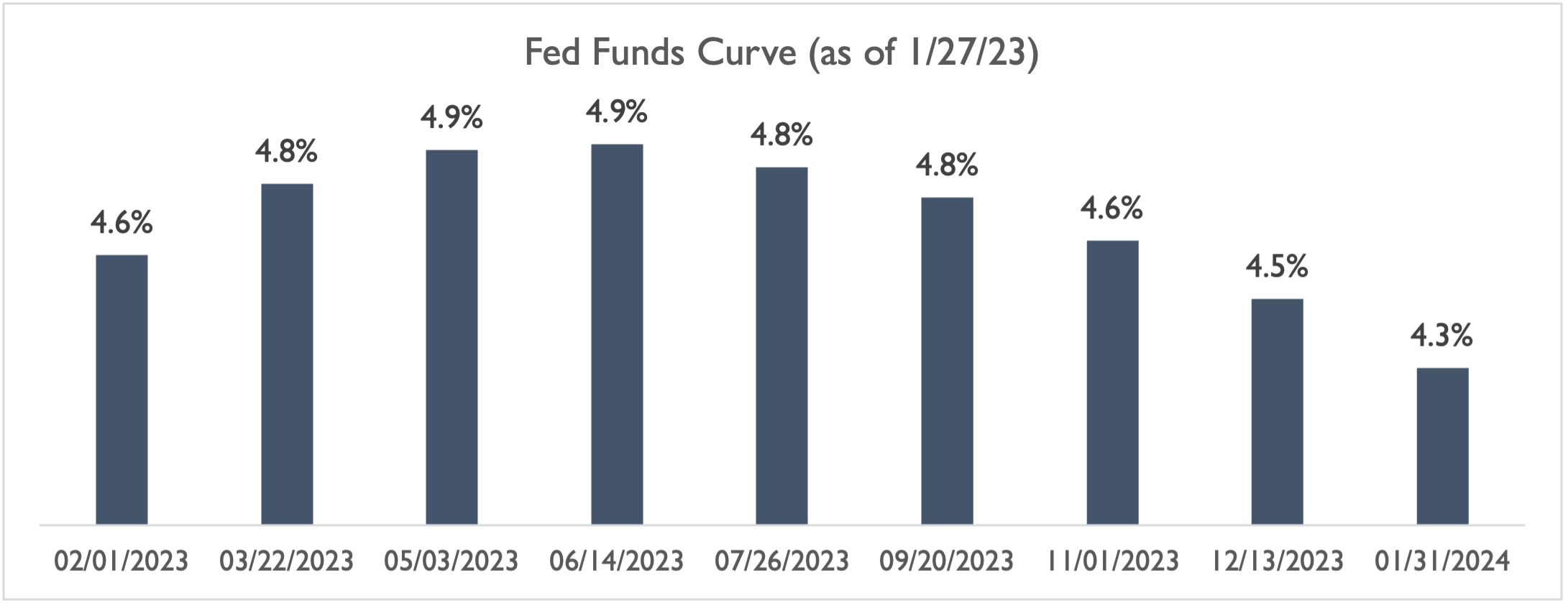

Don’t Fight the Fed

This notion of not investing against the Fed’s intentions has rung true in the past. It is important to understand what direction the Fed is heading, but more important is to understand what direction the fixed income market believes about direction of interest rates. The chart below illustrates what the bond market is pricing in for rate hikes this year. The graph reveals the market anticipates hikes to 5% and then cuts back to around 4.4% into early 2024. (Source: Bloomberg)

Thus far, the economy has held up okay in the face of higher interest rates. There are signs of a slowdown, but unemployment remains at low levels. It appears the workers laid off by technology companies are finding jobs at non-technology companies in technology roles.

It is the opinion of the firm that there are two possible scenarios in 2023:

- The Fed funds rate remains around the 5% level.

- Economic conditions deteriorate so bad that the Fed is forced to lower rates.

Today, it appears the rate will be raised to the 5% level. And that is okay for investors. Perhaps the economy can function at this level of current interest rates and there will not be the need to lower rates much below the implied 4.4% implied in the fixed income market. We just do not know yet and will wait patiently for more data.

The Training Wheels Are Off

The Fed’s commitment to lower rates served as a “put” for the past decade. In other words, each time stocks started to experience trouble, the Fed lowered rates and saved the day. This was especially true for technology stocks. However, WIT2 is a time without a Fed “put.” We firmly believe it is time to understand risk and volatility with the training wheels off. It is back to life in a normal environment. After reviewing macro-economic factors and central bank policy, let’s move to the positioning of the portfolio in the New Year.

Themes — Portfolio Positioning in 2023 WIT2

Below is a discussion of each of the three main themes for this WIT2. The first characteristic is higher interest rates.

‘Old Normal’ in Rates

The higher rates are good for those looking for income. We have added bonds to the portfolio to capitalize on the higher yields. Further, the rapid rise in rates in 2022 caused the price decline of many bonds resulting in a buying opportunity. We favor mortgage-backed bonds for both yield and potential appreciation. In addition, we are lowering the credit risk in the portfolio by exiting floating rate bank loans. There is also a portion of the bond portfolio in 1-3 Year U.S. Treasury bonds and investment grade corporate bonds to serve as an anchor.

Stocks are also affected by higher rates. The era of free money and borrowing at lower rates ended and those companies that depended on the lower rates will be hurt and could fall further. Doing homework on balance sheets, margins, and fundamentals is vital to success in WIT2.

The second factor of WIT2 is higher focus on natural resources.

Who Took My Charger?

Has a family member ever “borrowed” your big block to charge their device? The fear of having your phone “dead” is real. The great advances in technology over the past decade require energy. This is a profound shift in attention from the amazing technological advances to the power required to allow that tech to function.

The economy is the conversion of energy to profits. Steam engines, trains, trucks, computers, data centers, and factories require energy to power up. As technology became the main driver of growth in the U.S. economy, we lost sight of energy’s vital role. Energy was painted with a dirty brush with the rise of ESG. The events in Ukraine taught the world a valuable lesson — energy is vital to the functioning of the economy and safety of a country.

Of course, clean energy would be the ideal source of power for the environment. The challenge — there is simply not enough clean energy today to power the world. There have been great gains made in clean technology like solar and wind, but it is still a small fraction of production. In the U.S., the Inflation Reduction Act was an important piece of legislation to the future of green energy. We believe Wall Street has missed the full importance of these subsidies on several stocks.

The importance of the energy required to power our homes, iPhones, electric vehicles, data centers, and factories will take center stage in the next several years. Thus, we continue to invest in energy infrastructure like pipelines/infrastructure, natural gas exporters, biodiesel refiners and renewable energy generation.

Food in Focus

The potential food crisis in the next several years is serious. The Russian invasion of Ukraine will have far reaching effects for many years. The geopolitical conflicts separating the free world from the communist world creates pressures on the global agricultural supply chain. We invest in those looking to solve this problem.

Healthcare After COVID

Now that the COVID crisis is under control, the healthcare industry can refocus from vaccines and treatments for COVID to other health matters, like cancer, diabetes, and Alzheimer’s. The demographics of an aging baby boomer population is a long-term driver of this theme; however, several more attractive factors have been added to the list of positives for this theme.

First, in periods of slowing economic growth, investors tend to favor defensive sectors like healthcare. Second, the below-market valuations of many stocks appeal to value investors, which are back in favor. Advances in technology will fuel this sector.

Higher Focus of Productivity

Technology companies got the message in 2022 that profitability matters. To increase profits, companies must do more with less. This was a shift from the “grow at all costs” mentality of the past decade. This is also a result of higher energy prices and higher labor costs. Further, higher borrowing costs change the profit margins. We look for companies that are not growing at all costs, but that have a profitable business model. This sounds obvious but was not always the case in the previous cycle. Winners in tech will emerge and investors must own the right companies.

Fortunately, the benefits of technology are not going away. We believe the winners will be companies that transition to cash generated from powerful business models. And it is not just the companies providing the software to power machine learning, artificial intelligence, and big data analytics that will be winners; there are several non-tech companies that will use technology to make their business models more efficient.

Can tech be the solution and save the day from higher interest rates?

Other Important Opportunities

As we have stated since day one of the firm in 2015, it is important to understand the rest of the world outside the United States. There are many opportunities in countries outside of the U.S., such as India. After a long period of underperforming, international stocks look poised to gain ground on U.S. stocks. The themes discussed apply to companies domiciled in foreign countries as well.

The reopening of China is a major factor in global economic growth. The demand created by the 1.3 billion citizens of China could fuel growth in many areas, including commodities. Fuel, natural gas, food, and metals could also be in higher demand if China is in expansion mode.

Conclusion — The ‘Old Normal’ WIT2

2022 was a year of transition. It was a healthy cleansing process. Stock and bond prices reset. The era of free money is over, and investors must prepare for the new environment.

Declines are not fun, but part of the investment process. Today, we remain defensive, but watch for opportunities to add risk as valuations continue to come to us and more data is revealed.

The transition to the ‘old normal’ will create many investment opportunities in stocks, bonds, and commodities. We look for stocks that will benefit from the large secular themes we have identified. The timing of buying stocks will be tricky as the effects of higher interest rates may still not be fully priced into valuations.

This is a pivotal time for many stocks and those looking to model the valuation of a company. We anticipate many management teams discussing the possibility of a recession this earnings season in all sectors. While recessions sound scary, it is possible to make money in stocks and bonds in an economic downturn. Remember three important facts about recessions:

- Economic downturns affect different companies in different ways at different times.

- Recessions do not always lead to financial crisis.

- Stocks move in advance of a recession and anticipate a recovery.

After a decade of index funds stealing the show, we believe WIT2 will be characterized by the return of thoughtful stock and bond selection. Back in the 90s in NYC where we started, the larger-than-life stock picker ruled the Street. The 90s stock picker was ready to sharpen his pencil and do some actual math on the cash flows and valuation of a company. It was a time when earnings, margins, and balance sheets mattered as opposed to the lowest cost for an index fund. Most impressive about the old-school stock picker was the understanding of risk and the ability to remain convicted during declines in the price of a stock.

The goal is to weather the storm and be ready to capitalize when the tide turns.

We wish you all peace, health, and happiness in 2023.

LIM is a Registered Investment Advisor based in Dallas, Texas and registered with the Securities and Exchange Commission. Registration does not imply a certain level of skills or training. LIM is a company with purpose, dedicated to creative and unique thinking. We focus on portfolio valuation and research, along with a superior client experience. We seek to identify investment opportunities by looking at economic factors, security valuation and human behavior. We start with the fundamentals of portfolio management and valuation. Then we build on these fundamentals with unique thinking and creative intelligence gathering to form a viable investment thesis. We believe this approach leads to dynamic global portfolios with increased return and managed risk.

This document may contain forward-looking statements based on LIM’s expectations and projections about the methods by which it expects to invest. Those statements are sometimes indicated by words such as “expects,” “believes,” “will” and similar expressions. In addition, any statements that refer to expectations, projections or characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. Such statements are not guaranties of future performance and are subject to certain risks, uncertainties and assumptions that are difficult to predict. Therefore, actual returns could differ materially and adversely from those expressed or implied in any forward-looking statements as a result of various factors.

This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results.

Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions.

This document is a general communication being provided to you for information purposes only. The communication is educational in nature and not designed to be a recommendation for any specific investment product, strategy, plan design feature or any other purpose. By receiving this communication, you agree with the intended purpose described above. Any examples used in this material are completely hypothetical and for illustration only. The document is for the sole use of the person to whom it is addressed and is privileged and confidential. Use by anyone other than the addressee is strictly prohibited.