In 2023, technology took a giant leap forward, the power of music created a global megastar, dreams of weight loss became a reality, inflation was tamed, and the world was reminded that evil regimes still exist. It was a year characterized by wild swings and great paradox.

One of the most interesting swings occurred when a Chinese spy balloon dropped in on America in February. Then, Chinese President Xi visited for the first time since 2017. Perhaps the most bizarre paradox of 2023 —Silicon Valley Bank, the most popular technology bank, failed due to a panic-fueled “run on the bank”. Meanwhile, tech stocks soared due to panic buying of tech stocks. It was a bizarre year marked by irrational behavior and manias. The capital markets were not immune.

2023 Economics and Markets – Key Points

- The Federal Reserve made progress on fighting inflation. (inflation declined)

- Long-term interest rates fell from a peak of 5% to 4%.

- Mega-cap technology stocks recovered from 2022. (Magnificent 7)

- Economic growth surprised the Wall Street talking heads (not us).

- Labor markets remained strong despite “productive” layoffs.

- Begin 2023 defensive, but ready to add risk upon declines or changes in data.

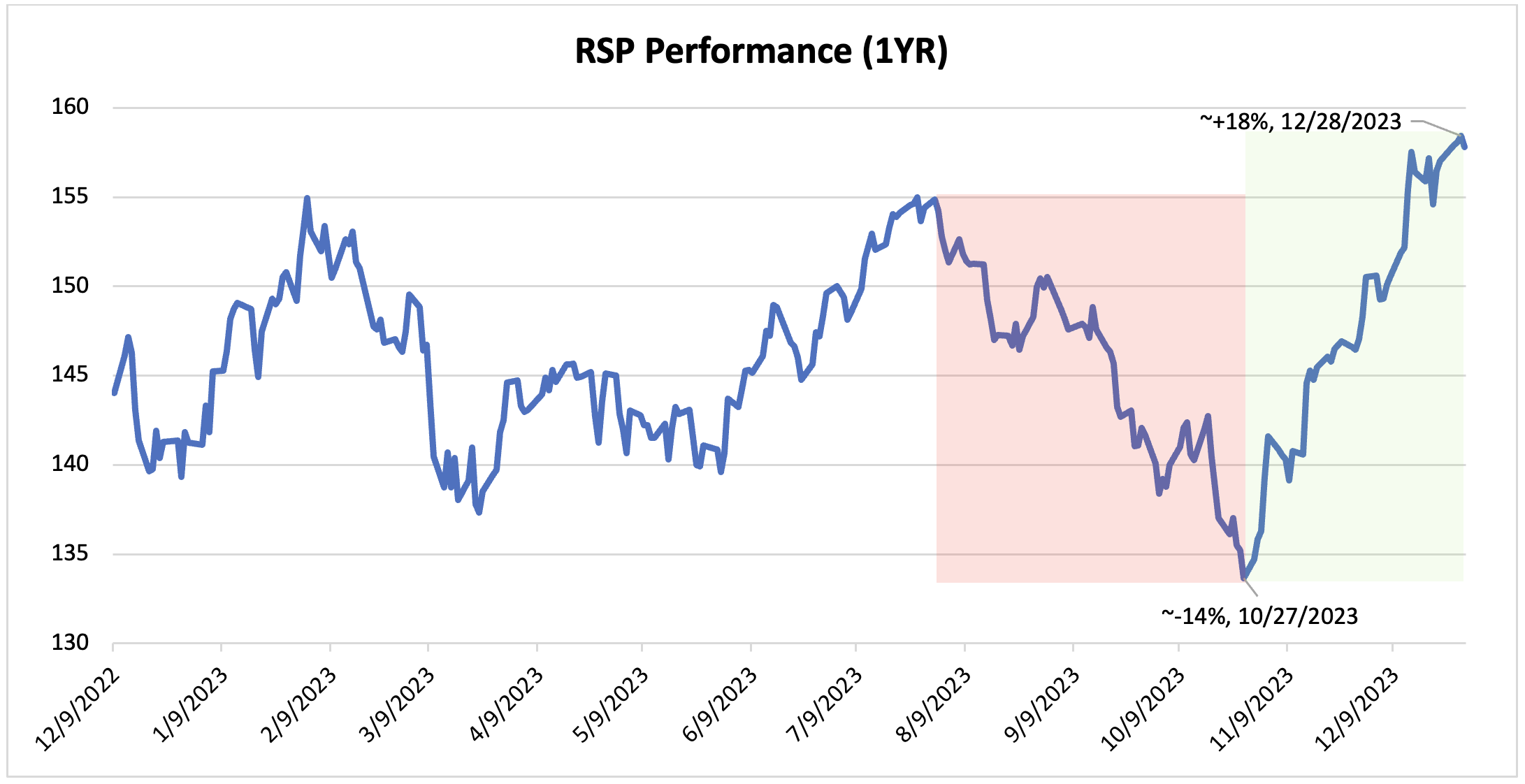

It was a year when speculators battled with investors causing wild swings. The behavior reminded us of the difference between “speculators” and “investors” — speculators are short-term focused and chase prices without doing much research, meanwhile investors are the opposite. Being an investor was spooky until Halloween as the equal weight S&P 500 declined 14% from the peak. Thankfully, November began a year-end rally of 18% from the 2023 low. The chart below displays the wild ride of the equal weight S&P 500 (RSP):

How it Started

Our research suggested something different than the calls for recession. The following excerpt is from our 2022 year-end letter titled “World in Transition (WIT) – Part 2,” which summarized our thoughts in January 2023:

Inflation Nation

We were not alone in focusing on inflation and Fed policy. It was our forecast for lower inflation that was distinctive. This view is now consensus.

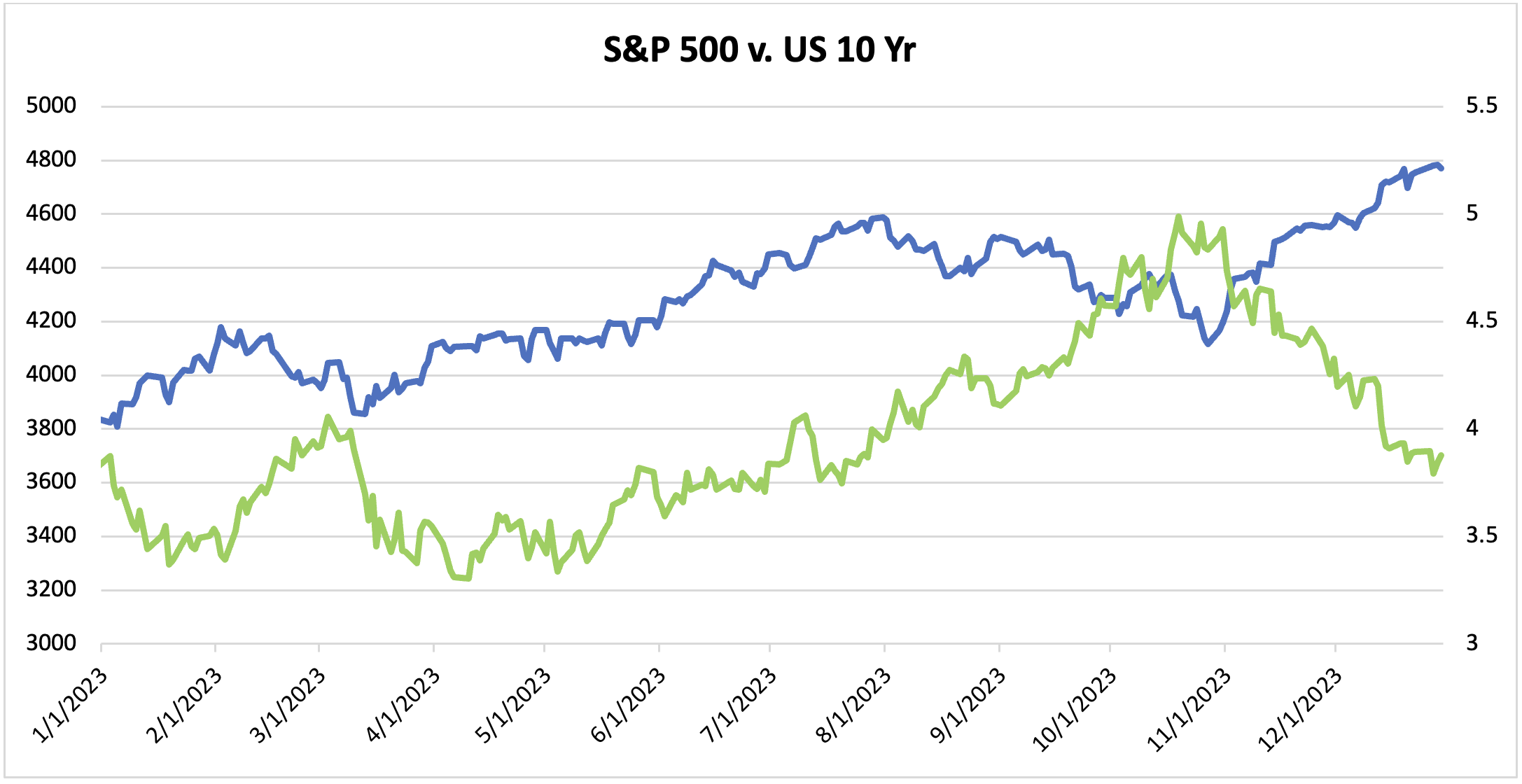

Stocks can move in short, violent bursts. The last two months of the year demonstrated that phenomenon. What changed in November to fuel the monster rally? An accurate predictor of stock returns was the direction of long-term interest rates. The chart below displays the yield of the 10-year U.S. government bond versus the S&P 500 Index.

The blue line is the S&P 500 Index, and the green line is the yield of the U.S. 10-year Treasury bond. Notice the inverse relationship between stocks and interest rates. The stock index bottomed when yields peaked.

With interest rates falling, fixed income joined the party and posted the first positive return in three years. The Bloomberg Aggregate Bond Index was up 5.5%, but this did not even erase half of the declines of the previous two years.

A Market of Stocks

We do not invest in markets; we invest in specific stocks. Over longer periods, earnings determine the direction of a stock. The earnings growth of technology stocks exceeded expectations. Thus, we believe the outsized appreciation of technology stocks was logical. The question is: can 2024 earnings keep pace with lofty expectations?

We remained true to our research and stayed invested in technology stocks at the start of 2023. As stated in the excerpt below from the 2022-year end letter, technology remained our favorite theme for 2023.

The irony of the tech bull market—it occurred in the face of higher interest rates. In 2022, technology stocks suffered a crash as interest rates climbed. However, Artificial Intelligence and a focus on profitability changed the narrative in 2023. As interest rates rose in the first part of the year, tech stocks surged. Our U.S. tech investments produced strong returns, as did our two international investments (India and Japan).

Not all Dandelions and Rainbows

Not all sectors performed well. Utilities and Energy were among the worst performers, especially clean energy stocks. Our portfolios were negatively impacted by higher interest rates paired with the reality that the clean energy transition will take more time than previously forecasted.

2024 Outlook – The Windshield is Bigger Than Rear-View Mirror

The combination of lower borrowing costs and lower cost of goods/services is a welcome relief for corporations and consumers. However, many stocks already experienced a bounce in anticipation of the improved conditions. The “easy” money was made in the 2023 rally; thus, the actual stocks and bonds owned will be more important in 2024.

The Pace of the Rise

The stock market price is a function of two factors: earnings and the multiple investors pay for those earnings (Price-to-Earnings Ratio or P/E). The P/E of the S&P 500 at the end of the year was 19.5 times 2024 earnings projections. As comparison, the P/E at start of 2023 was 21.4x. The overall stock market is less expensive than it was at the start of last year. This is due to the large earnings increases in the mega cap tech names in the S&P 500 Index.

The market does not always portray the entire picture. If the largest 10 stocks are removed from the index, the remaining stocks have a P/E of 17x. There are opportunities for favorable valuations beyond the largest stocks.

The other side of the equation is earnings. The consensus earnings growth forecast for the S&P 500 is 11% for the year of 2024. If earnings grow less, then the stock market would most likely fall. What are possible headwinds? Elections, inflation, deflation, a Fed error, AI disappointments, national debt, and a bouquet of geopolitical issues are all potential growth busters. Let’s dig into the concerns and the opportunities of 2024.

Fighting the Fed?

How will central bank policy affect markets in 2024? The beauty of markets is that current prices reveal consensus thinking. It is our job to determine if we agree or disagree with the masses. At the start of the year, the market is pricing in eight interest rate cuts in 2024. The market expects the Fed funds rate to drop from the current 5.3% to 3.6% by year-end. Again, we differ from the consensus and believe there will be fewer cuts.

It’s the Economy, Stupid

The economy is slowing, but not all the companies in all the countries are slowing. The consensus view for the U.S. economy is slowing growth, but no recession. Our view is that the recent pattern of rolling recessions will continue. The slowdowns would most likely be isolated to certain sectors while others flourish.

The number of people employed will be a good indicator of the health of an economy. Recessions often occur when the consumer is hurting. A warning sign is usually in the jobs and wage data. Today, there are little signs of concern, but this is an area we will be watching closely.

Debt Collectors

The COVID stimulus caused the U.S. national debt to skyrocket to 125% debt-to-GDP. We are concerned about the growing national debt over a long period, but not right now. If not contained, the debt will be a problem in the future. There will be a day of reckoning, but it’s not today. We will watch long term interest rates for signs that investors are demanding higher interest rates for US debt due to the larger deficit and higher interest payments.

The Great Equalizer

With all the noise, how can investors sleep at night? Knowledge is the antidote to fear. Earnings are the great equalizer to concerns about a stock. Earnings serve as a measuring stick for our thesis on a stock. The following section explores trends that we favor for next year and beyond as our earnings outlook is favorable.

Pet Rock or iPhone

Artificial Intelligence went mainstream in 2023. ChatGPT entered the scene and captured imaginations for the new AI world. The transformation is not just about talking robots and ChatGPT. The real digital revolution is already very much engrained in our daily lives. The proliferation of AI will further enhance productivity.

The difference in 2024? The world now comprehends the power of the digital revolution. After the strong rebound for technology stocks in 2023, it has become more difficult to find out-of-consensus ideas. Therefore, we look to add more creative ideas to compliment the mega cap leaders in the portfolio.

In conclusion, the next phase of growth in stocks could be “fringe” technology companies. After the rapid rise of the Magnificent 7, we search for companies that are not household names yet. We remain bullish on technology.

Dude, Where’s My Charger?

How is the world going to provide power and energy for this exciting future? The following is an excerpt from an article we wrote titled AI’s Power Play:

Artificial Intelligence is stoking a new era of optimism, as the potential applications of AI across all sectors have energized the markets. But while the intelligence may be artificial, the power required to fuel it is real.

Today, we believe the most exciting opportunities are in natural gas and favor leading U.S. companies that are both supplying the U.S. grid and exporting natural gas. We also think pipeline and infrastructure companies could be winners. And with the growing need not only to supply the grid but to improve and expand it, companies that build and supply components for electricity infrastructure stand to benefit.

The portfolio remains positioned in energy and power stocks. These stocks trade at favorable valuations and have healthy balance sheets. In addition, this sector is under owned by many investors, making for a good set-up for higher prices once the world realizes the power and energy required to fuel our exciting new world.

Golden Age of Healthcare

A global focus on longevity, innovation, and the aging population makes for an exciting time. The rise of GLP-1 drugs has created lower stock prices for medical device companies in fear of fewer surgeries taking place due to weight loss. We disagree and remain invested in this trend in 2024. After a period of shortage for workers, high prices for inputs and disruption across the healthcare landscape caused by COVID, we could be entering the golden age of medical technology.

The Other 7 Billion

US Investors often forget about the rest of the world. There are 8 billion people in the world and only 330 million in America. There are opportunities outside our borders as other regions are at different stages of their economic cycle. Specifically, we have identified investments in Japan and India. We continue to avoid China, Europe, and Russia.

Extend Duration

Interest rate cuts are coming, inflation is cooling, and yields are attractive for the first time in a decade. We have dusted off the fixed income playbook and began to add more creative and opportunistic fixed income. Mortgage bonds are among our most favored fixed income investments.

The large national debt is still of concern and could cause this thesis to change, but today we believe bonds can deliver a favorable risk-adjusted return and should be a larger portion of a portfolio.

Global Remilitarization

Military conflicts in several areas of the world escalated last year and continue today. While the effects on the economy were not meaningful, we do get more concerned about the financial ramifications when Houthis fires missiles upon US shipping vessels. The Red Sea is a concern to the global economy.

In response to the threat of war around the world and de-globalization, countries are racing to restock weapons. Last year we added military defense position(s) to the portfolio.

Stock the Vote

Elections will most certainly be a hot topic of discussion this year. The outcome of the U.S. elections could have an impact on taxes, debt, health care, foreign policy, technology regulation, climate change, and military spending. In the end, the outcome of the election rarely has an impact on the direction of the stock market.

In addition to the 60th presidential election of the United States of America, India and Mexico will also hold national elections.

In Conclusion

All eyes will be on the Federal Reserve as the focus shifts from curbing inflation to management of the business cycle. We believe the economic cycle will be more important in the end than the Presidential election, but the uncertainty of both could cause enhanced volatility. For this reason, we remain invested in themes with strong secular growth tailwinds and stay poised to adjust as the year unfolds and opportunities are created.

We wish you and your family much peace, health, and happiness in the new year.

The Team at Lear Investment Management

This letter is for informational purposes only. The content herein contains the observations and opinions of the author, is not intended to provide investment advice, and should not be relied upon for any investment decisions. Past performance is no guarantee of future results and information pertaining to our processes is subject to change at any time without notice.