As we bid farewell to 2024 and welcome 2025, the LearIM team contemplates how to navigate the investment world in the new year. The process includes exploring research by highly respected thinkers. We are fascinated by how highly educated, experienced investors can have such different views of the same picture. This phenomenon reminds us of the Rorschach test.

The Rorschach test is a psychological assessment tool where individuals are shown a series of inkblots and asked to describe what they see. This test is used to uncover underlying thought disorders and to understand an individual's emotional functioning.

Some are programmed to see the negative while others the positive. Past trauma, political views, sales agendas, or other biases can taint the perception. Our goal is to remove biases that do not serve our investors. Below we review 2024 and then move to our interpretation of the 2025 inkblots.

Summary of Questions Explored

- Will stock market gains continue for a third year?

- Will large technology stocks continue their epic run?

- What will the Federal Reserve’s policy be regarding interest rates?

- How will Trump and his gang of disruptors impact the economy?

The Party Is Still Going

The U.S. stock party kept raging into the new year. It should not have been a big surprise since the good times just got rolling in November of ‘23. The 25% climb by the S&P 500 faced minimal resistance. There was a 5% dip in April followed by an 8% decline in August. This year felt like a “cake walk” compared to ‘23 when the market dipped 20% from its peak.

Technology stocks dominated again and drove the S&P 500 to all-time highs. The Magnificent 7 soared 67% for the year. The equal-weight stock market was 13%. The seven mega cap tech stocks returned 5x the average stock.

In commodities, our favorite portfolio diversifier (gold) had an epic year gaining 27% while Bitcoin doubled, again. And our declared commodity winner of the power wars, natural gas, closed the year on a high note and fueled nice gains for natural gas pipelines and liquid natural gas exporters.

Bueller, Bueller (Yawn)

It was a boring year for bonds with the Aggregate Bond Index returning 1.3%. Longer dated bonds ended with higher yields causing the price of bonds to decline, almost offsetting the higher yields many cheered at the start of the year. Proudly, we held a low level of traditional bonds as fixed income continued to be a “sucker's bet.”

Jumbo Shrimp (Hawkish Cut)

In 2024, the Fed lowered the overnight borrowing rate by 1% from 5.5% to 4.5%. While lower rates were welcomed by corporations and consumers, the cuts fell short of the consensus. We stated in our 2023 letter that there would be fewer cuts than consensus.

The final cut arrived in December, but the act was more Grinch than Santa. The traditionally cheered rate cut was labeled a “Hawkish Cut.” This phrase felt like an oxymoron. We believe a lower borrowing rate is positive.

Red Wave

The U.S. election cycle was the biggest event of 2024. There were bullets dodged, mind-numbing debates, and a Democratic coup. In the end, Americans voted for change again.

It was the year of rebels. Elon Musk, Joe Rogan, and Trump, all former Democrats, prevailed with their anti-establishment views. Buckle up for disruption as the changes will create uncertainty and cause asset prices to fluctuate, but U.S. corporations should benefit in the end.

ChatGPT It

Innovation occurred at a dizzying pace as generative AI took a giant leap forward. Meanwhile, the narrative evolved to focus on the power required to run this futuristic world. The attention to energy helped many investments in this space move higher. The world now understands what we have been shouting from the rooftops for years — the world needs power!

The Following Is a List of Innovation for 2024

- Quantum Computing (Supercomputer) – exponentially accelerating computing power

- AI-generated Video – ChatGPT Sora went live

- Generative AI – ChatGPT new model and several others made AI a reality for daily tasks

- Medical Advances – people living longer and at a lower weight

- Warfare changed as unmanned aircraft did the fighting – AI is a national security matter

- Nvidia is releasing a new GPU able to process exponentially faster

- Self-driving cars entered more major cities

Globe Trotting

The second-largest global economy (China) stimulated its economy, and a nice bounce followed. We continued to avoid China. The country will be closely watched in the new year for tariffs, consumption of commodities, and foreign policy (Taiwan). We prefer neighboring India, which continued impressive growth albeit at a slower pace. We anticipate lower interest rates in India and a solid year for stocks. Japan continued progress on a structural turnaround and produced one of our best performing stocks of the year.

Red Light, Green Light: A Look Into 2025

There are several positive catalysts for 2025, but areas for concern exist. Selecting investment themes more powerful than those concerns gives us confidence 2025 will be a productive year. We see the positives and the negatives in the inkblots — the good outweighs the bad today.

Afterall, it is a low probability bet to go against U.S. stocks in any given year. Since 1928, the S&P 500 has been positive 65% of the time (annually). In the last 30 years, the S&P 500 was positive 70% of the time. The big exceptions are the large declines in 2000 and 2008. The 50% declines are what investors are worried about, but such a decline is rare.

Fed Light, Green Light

The direction of interest rates is a factor in the economy every year. Why was the Fed hawkish in the December meeting? Inflation was the main reason cited for the potential pause in future cuts. We believe there will be more cuts than forecasted currently because inflation will decline. This would be a pleasant surprise for stocks. Pay particular attention to real estate as the main driver of lower inflation.

Not So Fast

The rise of stocks could hit a speed bump. We anticipate a 5-10% pullback at some point in the year. The earnings of the mega-cap technology stocks could be a catalyst, but the pullback could be caused by nothing more than human behavior. Sometimes there are just more sellers than buyers when everybody’s cup is full.

DC = Disruption Central

The new administration pledged to eliminate red tape and improve efficiency. We believe it will accomplish this goal. However, there is often volatility associated with disruption. One example is tariffs. There will certainly be anxiety in the markets resulting from tariff negotiations. Many are worried that tariffs will produce inflation or trade wars. We will watch this closely, but we see a scenario where inflation is tame.

For an example of disruption, let’s look at the energy sector. The nominee for Secretary of Energy is Chris Wright, a natural gas and uranium executive. This is a big shift. Be ready for some new ideas and projects for powering our future, like nuclear energy.

Tax reform is another area for optimism for corporations. We do not believe taxes will increase and there is a possibility that taxes will be lowered for some businesses.

Profit Margins

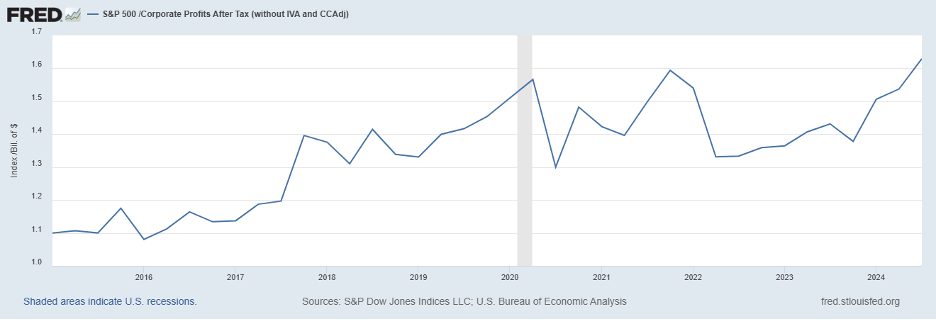

The Nvidia GPUs have been purchased, the large language models are trained, so now what? Will companies use AI to help their bottom line? In 2024, the S&P 500 had high profit margins. We look for this to continue in 2025. The side effect could be fewer jobs as companies learn to do more with fewer people (and less costs).

The profit margins lead to higher earnings growth. There will be companies benefiting from this trend in almost every industry. Look for further increases in productivity.

Longer-Term Concerns Building

Deficit and interest payments on the debt can no longer be ignored. The potential for a problem in the future is building, but it is too early to make major adjustments in the portfolio. We own gold as a hedge for inflation or a fall in the dollar.

Foreign policy and military conflict make the list of more imminent concerns. However, these concerns are present every year. They certainly feel worse today and we have included a military defense company and a cyber security company as protection.

Redefining Risk

We were struck by the quote above by Jeff Bezos. Many view the inkblots with an unhealthy level of fear. Fear of having portfolio values fluctuate too much often clouds the opportunity. We are aware of risk but also value the opportunity in specific investment opportunities. The following are the themes:

- Digital Revolution – the next phase of AI will create more trillion-dollar companies

- Powering the Future – natural gas and uranium take center stage

- India – growth continues, look for lower interest rates

- Gold – inflation hedge and deficit hedge

- Golden Age of Healthcare – beneficiary of AI

- Opportunist Bonds – steepening of the yield curve

We are confident in these themes and accept that next year will not be as smooth as the last. It is important to have dry powder ready for the dips in the first part of the year and remain tactical to adjust as the year unfolds.

In Summary

Viewing the economic inkblots is a challenge in any year. In ’25, it is tempting to be negative because of the large increase in share prices in the past two years and the fear of change. However, we view the world with a strong faith in human nature to drive the world to a better place, thus the tie goes to the good to prevail over the bad.

We live in the greatest country in the world with the most innovative technology companies, freedom, and strong military. There are still many problems, but it is a special time to be alive and great time to be American.

The economic gap between the US and the rest of the world has continued to widen. It will certainly not be a straight line up in ’25. There will be struggles as politicians will make plenty of noise, but we remain optimistic about the future and will be buyers after the 5-10% dip.

Lear Investment Management (“LIM”) is a Registered Investment Advisor based in Dallas, Texas and registered with the Securities and Exchange Commission. Registration does not imply a certain level of skills or training. This content is for informational purposes only, contains the observations and opinions of LIM, is not intended to provide investment advice, and should not be relied upon for investment decisions. Past performance is no guarantee of future results and information pertaining to LIM’s processes is subject to change at any time without notice.

This document may contain forward-looking statements based on LIM’s expectations and projections about the methods by which it expects to invest. Those statements are sometimes indicated by words such as “expects,” “believes,” “will” and similar expressions. In addition, any statements that refer to expectations, projections or characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. Such statements are not guarantees of future performance and are subject to certain risks, uncertainties and assumptions that are difficult to predict. Therefore, actual returns could differ materially and adversely from those expressed or implied in any forward-looking statements as a result of various factors. This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results.

This document is intended for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy any securities. The information contained herein is not intended to be, and should not be construed as, investment advice. The views and opinions expressed in this document are those of the authors and do not necessarily reflect the official policy or position of any SEC registered investment firm.

Investing in digital assets, including Bitcoin, involves a high degree of risk and may not be suitable for all investors. The value of digital assets can be extremely volatile and may be affected by various factors, including regulatory developments, market conditions, and technological advancements. Investors should conduct their own research and consult with their financial advisors before making any investment decisions.