“24K Magic” is the title track of Bruno Mars’ 2016 album. The energetic hit drips with charisma. The tune is bold and flashy with a mix of funk and smooth vocals. We use this unique offering by Mars as inspiration for one of our most successful investment themes for the past several years — gold and gold miners.

We are dumbfounded that more “professional” investors omit gold from portfolios. Today, gold serves as a valuable piece of a portfolio for those looking to hedge against inflation, deficits, a falling dollar, and trade wars. Bonds will not work if those events occur…gold will.

Tonight

I just want to take you higher

Throw your hands up in the sky

Let's set this party off right

Players

This SOTW summarizes the case for gold as a portfolio diversifier, highlights its recent performance, and identifies reasons why it remains overlooked by many professional investors.

. . . . .

Gold has emerged as a dynamic yet underappreciated investment theme. Historically viewed as a lackluster asset, gold has undergone a renaissance, driven by shifting financial conditions and global economic trends.

In full disclosure, we did not always like gold as an investment. In fact, for two decades (90s and 00s) we believed gold was a bad investment, but financial conditions changed and so did our view on the commodity, prompting us to add it to the portfolio in 2018. (For a compete list of portfolio holdings, please e-mail rick@learim.com.)

Performance Analysis: Gold vs. Traditional Asset Classes

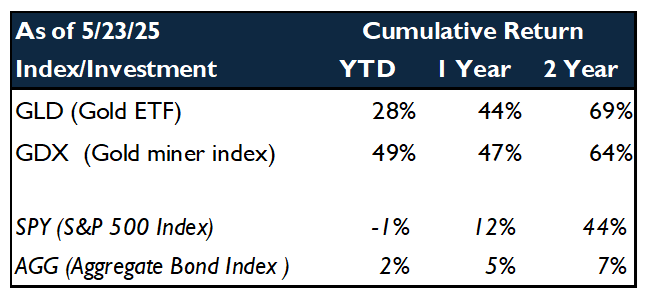

To display gold’s merit, we compare the performance of two gold-related investments — SPDR Gold Shares (GLD) and VanEck Vectors Gold Miners ETF (GDX) — against the S&P 500 Index (SPY) and the Bloomberg Barclays U.S. Aggregate Bond Index (AGG) over multiple time horizons as of May 23, 2025. (Source Bloomberg)

The chart is for illustrative purposes only and does not reflect the performance of Lear IM portfolio holdings.

Key Observations:

- Over the past two years, GLD and GDX have significantly outperformed the S&P 500, with cumulative returns of 69% and 64%, respectively, compared to 44% for SPY.

- In 2025, GDX’s 49% year-to-date return underscores the momentum in gold mining equities, while GLD’s 28% return highlights gold’s resilience amid market volatility.

- Gold’s performance has exhibited low correlation with equities and bonds, making it an effective portfolio diversifier.

- For gold to impact a portfolio, a minimum allocation of 5% is necessary. Allocations below 0.5%, as seen in some portfolios, do not make a difference.

The returns and diversification benefits are clear, so what else keeps “portfolio managers” from investing in gold?

Barriers to Gold Adoption in Professional Portfolios

Despite its compelling performance and diversification benefits, gold remains underrepresented in many investment portfolios. We identify five key reasons for this under allocation:

- Limited Marketing of Gold ETFs and mutual funds: Many ETF and mutual fund providers lack dedicated gold-focused products. This gives no incentive for mass marketed fund companies to promote the asset class. Plus, it is such a small allocation that it does not capture marketing dollars like stocks and bonds.

- Resistance to Economic Shifts: Some financial advisors remain anchored to outdated investment paradigms, failing to adapt to new realities favoring gold.

- Misconceptions About Risk: Gold is often perceived as a speculative or volatile asset, despite its historical role as a stabilizer during periods of market stress.

- Exclusion From Major Indices: Gold is not included in benchmark indices such as the S&P 500, Russell 1000, or MSCI EAFE, reducing its visibility among index-focused portfolio managers. There is only one gold miner in the S&P 500 and it is 0.3% of the index.

- Style Box Constraints: The style box framework, introduced in 1992 for mutual fund analysis, does not include a dedicated category for gold, marginalizing it in traditional asset allocation models using mindless style box investing.

These structural and perceptual barriers have hindered gold’s adoption, even as its investment case strengthens and the benefit to investors is clear.

The Changing Economic Landscape

Our perspective on gold has evolved significantly over the past decade. During the 1990s and 2000s, gold’s inflation-adjusted returns lagged stocks and bonds, leading us to view it as an unattractive investment. However, several macroeconomic and structural shifts have reshaped the economic landscape:

- Rising Inflation: Persistent inflationary pressures since 2020 have enhanced gold’s appeal as an inflation hedge.

- Falling Dollar and Rising Deficits: Gold will protect better than bonds in this environment — very different than a period with a rising dollar and stable government spending.

- Geopolitical and Currency Shifts: Several countries have diversified away from U.S. dollar reserves, increasing gold stockpiles as a hedge against currency risk.

- Tariff Uncertainty: The global economic disruptions caused by trade wars underscore gold’s safe-haven status.

These factors have collectively elevated gold’s strategic importance in portfolio construction.

Don’t Look Too Hard, Might Hurt Yourself

Gold is not just flashy and bold, but beneficial to a portfolio. Gold and gold miners embody an underappreciated opportunity in today’s investment landscape. With strong performance, low correlation to traditional assets, and a compelling macroeconomic backdrop, gold merits a strategic 5-10% allocation in diversified portfolios. As economic conditions continue to evolve, gold’s role as a stabilizer and value preserver is likely to shine brighter than ever — 24 karat magic in the air.

Lear Investment Management (“LIM”) is a Registered Investment Advisor based in Dallas, Texas and registered with the Securities and Exchange Commission. Registration does not imply a certain level of skills or training. This content is for informational purposes only, contains the observations and opinions of LIM, is not intended to provide investment advice, and should not be relied upon for investment decisions. Past performance is no guarantee of future results and information pertaining to LIM’s processes is subject to change at any time without notice.

This document is intended for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy any securities. The information contained herein is not intended to be, and should not be construed as, investment advice. The views and opinions expressed in this document are those of the authors and do not necessarily reflect the official policy or position of any SEC registered investment firm.

Investing in digital assets, including Bitcoin, involves a high degree of risk and may not be suitable for all investors. The value of digital assets can be extremely volatile and may be affected by various factors, including regulatory developments, market conditions, and technological advancements. Investors should conduct their own research and consult with their financial advisors before making any investment decisions.