The Prince of Darkness, Ozzy Osbourne, passed away at 76. From biting the head off a bat (allegedly by accident) to starring in a Pepsi Super Bowl ad, Ozzy went from heavy metal rebel to America's wacky uncle. He never conformed - society bent to him. His anthem "Crazy Train" captures that wild ride:

"I'm going off the rails on a crazy train!"

There are parallels between Ozzy’s life and the AI revolution. The world is finally understanding the impact of AI, but there are still some late to get on board. It is time to adapt - or get left at the station.

The Gap: Tech Speeds Ahead, Humans Lag Behind

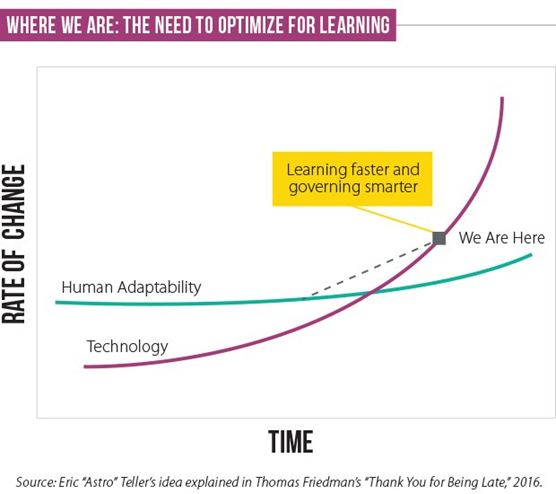

Technology evolves at warp speed, while human behavior takes time to adapt. For example, many consumers still present a physical credit card as opposed to tapping their phone at checkout. Thomas Friedman's 2016 book “Thank You for Being Late” nailed it with this chart, showing the widening chasm between tech capabilities and human adaptation.

Remember Mapsco? Many current business practices will soon be paper maps. Customer service, product development, marketing, mundane tasks, learning and security (to name a few) will take giant leaps forward. It will take time to adjust in your daily use, but don't wait with your portfolio.

Thesis: Power Up Your Portfolio - AI's Fuel Is Electricity, Not Just Code

In a nutshell: The U.S. economy boils down to converting energy into profits. Tech harnesses electrons for data magic. Software giants like Alphabet, Nvidia, Amazon, Meta, and Microsoft dominated the last decade’s stock market surge. The Technology explosion demands power. We've championed energy/power investments for years, and it's still early - despite 2025's strong returns. See 2023 research note: AI Power Play.

Why power? AI's biggest bottleneck isn't brains - it's juice. Data centers guzzle electricity like Ozzy guzzled... well, everything. Global AI capex is forecasted to be the largest investment in history. Next up: Handing off from build-out to business productivity.

Ditch the Old Tracks: New Thinking for a New Era

Many analysts cling to industrial-era metrics when valuing companies. But AI demands new thinking - it can code and teach itself (recursive learning), spawning 24/7 digital workers at a fraction-of-human costs. The adoption of AI could lead to higher productivity and improved margins for corporations.

Note of Recursive Learning: Eric Schmidt, former CEO and chairman of Google, has expressed strong optimism about recursive self-improvement in AI, viewing it as a pivotal mechanism driving rapid advancements. He describes it as a process where AI systems can iteratively enhance their own capabilities, such as by writing and improving code, leading to exponential progress. Schmidt predicts that this could enable AI to achieve artificial general intelligence (AGI) within 3-5 years.

Payments evolve too: Stablecoins are the future economy's currency. AI agents won't fuss with banks or credit cards when decentralized options exist.

And politics? The Trump administration is all-in on the AI race with China, assembling a dream team of CEOs (shoutout to Secretary Wright). This isn't just about corporate profits - it is vital to national defense. AI's already on battlefields, deciding war and peace.

All Aboard: Embrace the Madness

Ozzy's life was disruption personified: From outcast to icon, teaching us:

"Maybe it's not too late to learn how to love and forget how to hate."

Same for AI investing - unlearn the past metrics that no longer serve investors and lean into the future. Power and productivity are the tickets to the most thrilling economic shift ever. Don't go off the rails missing it; ride the crazy train to profits. This movement is the greatest shift in human history and requires an open and imaginative mind.

Lear Investment Management (“LIM”) is a Registered Investment Advisor based in Dallas, Texas and registered with the Securities and Exchange Commission. Registration does not imply a certain level of skills or training. This content is for informational purposes only, contains the observations and opinions of LIM, is not intended to provide investment advice, and should not be relied upon for investment decisions. Past performance is no guarantee of future results and information pertaining to LIM’s processes is subject to change at any time without notice.

This document is intended for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy any securities. The information contained herein is not intended to be, and should not be construed as, investment advice. The views and opinions expressed in this document are those of the authors and do not necessarily reflect the official policy or position of any SEC registered investment firm.

Investing in digital assets, including Bitcoin, involves a high degree of risk and may not be suitable for all investors. The value of digital assets can be extremely volatile and may be affected by various factors, including regulatory developments, market conditions, and technological advancements. Investors should conduct their own research and consult with their financial advisors before making any investment decisions.