Disruption was more rampant in 2025 than any year we can remember. The recipe for the disruption cocktail was one-part new administration in D.C. and one-part exponential advances from artificial intelligence.

In Washington D.C., the Disruptor-in-Chief rewrote the rules for global trade while issuing hundreds of executive orders aimed at crushing the status quo. This overhaul of traditional norms was highly televised and debated along party lines. Political blinders again hurt many investors. We prefer process over politics.

In Silicon Valley, the radical leaps forward in AI went oddly underappreciated. In the end, the changes rewarded those embracing the new-tech world while punishing the chicken littles.

Disruption has always been a characteristic of this great country, but 2025 was a year when decades of advances occurred in months.

The Results

At Lear, we thrive in periods of disruption. Change creates uncertainty. This creates dislocation in the price of assets. In 2025, we delivered exceptional returns, increased our assets under management to $1.2 billion and celebrated our 10-year anniversary.

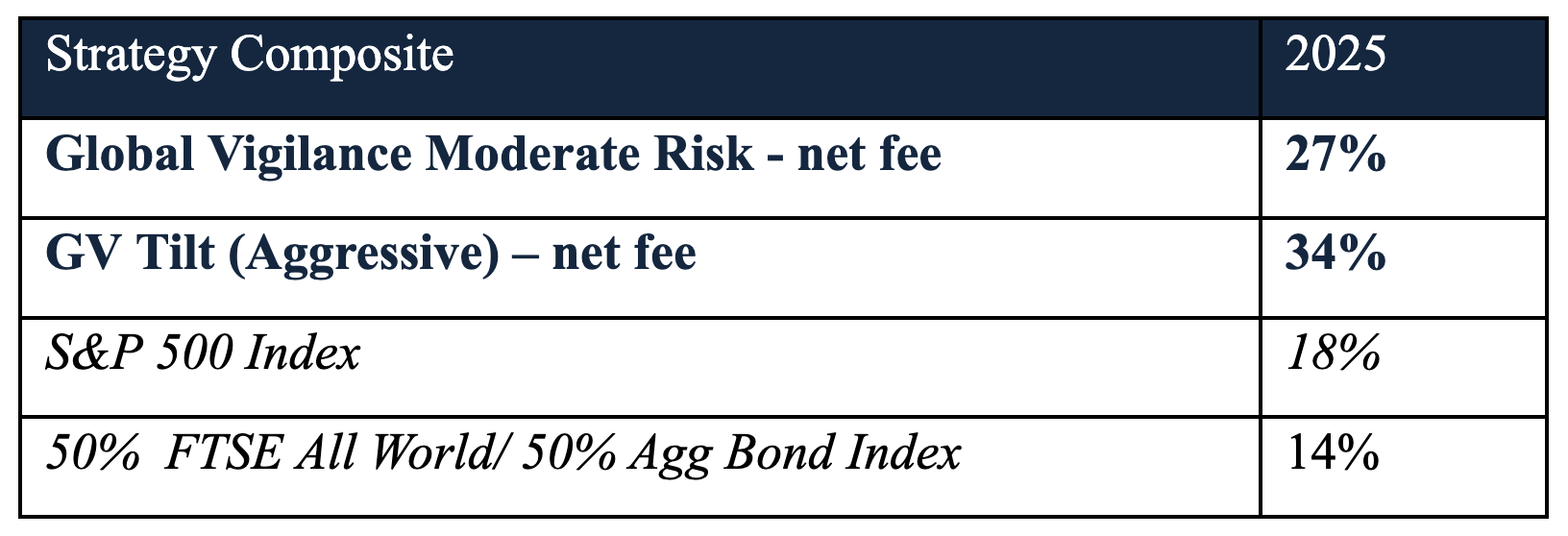

The following is a summary of our two most popular strategies:

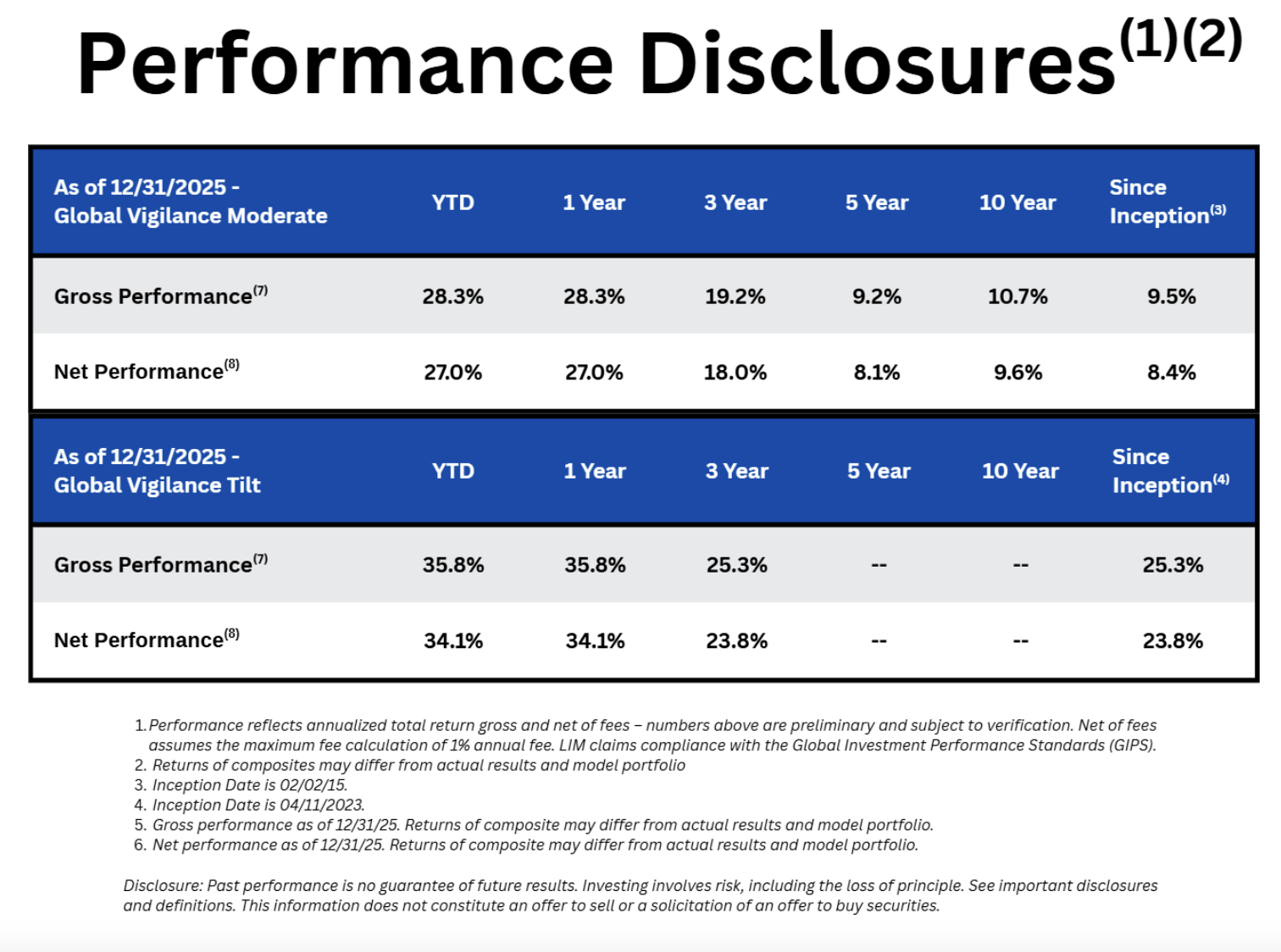

Please see performance chart at the end of letter for additional performance details.

Highlights of the portfolio this year:

- Gold and gold miners had a banner year beating most asset classes (by a large amount)

- Uranium themes thrived under new administration and need for power

- Micron was one of the best performing stocks in S&P 500

- IREN began its conversion from bitcoin miner to data center

- Copper’s supply and demand imbalance became apparent

- Mortgage REITs attractive yields were rewarded

Cut Off the Sleeves

Most of our outperforming securities were not in the S&P 500 Index (like gold, uranium, IREN and mortgage REITS)1. This is a sign the new style of investing is disrupting the old style of using index-hugging sleeves to create portfolios of hundreds of stocks with no clear direction or conviction.

Stock Shocks

Markets around the world appreciated in 2025. At home, the 18% return for the S&P 500 was higher than the two previous solid years. But there was much more to the story - it took conviction to thrive through negative noise and volatility.

The year began with a shock to the system. Chinese AI company DeepSeek captured the market’s attention with a low-cost large language model (LLM). The news resulted in a sharp repricing of the U.S. tech trade. Tech darling Nvidia (NVDA) declined 17% the day of the news. But that was just an appetizer for the main course.

April brought "Liberation Day." The announcement of far-reaching tariffs triggered a 15% market dip, driven by the fear that tariffs would spark runaway inflation and/or hurt the economy.

- The Consensus View: Tariffs = Inflation and slow economy.

- The Lear View: History shows no direct correlation between tariffs and sustained inflation - especially in the modern economy.

Markets crashed, then rallied back in short order after Scott Bessent (our pick for person of the year) brought a calming voice to the disruption. As inflation cooled, earnings accelerated and the Fed cut rates, and stocks rallied back to end the year 1% off all-time highs.

How We Played It?

We began the year cautiously as documented in our previous annual letter. Coming off a two-year bull market, we anticipated an early decline as the new administration started "breaking things." We held high levels of cash, fixed income, and gold in a defensive posture. Then came the chaos - and the opportunity.

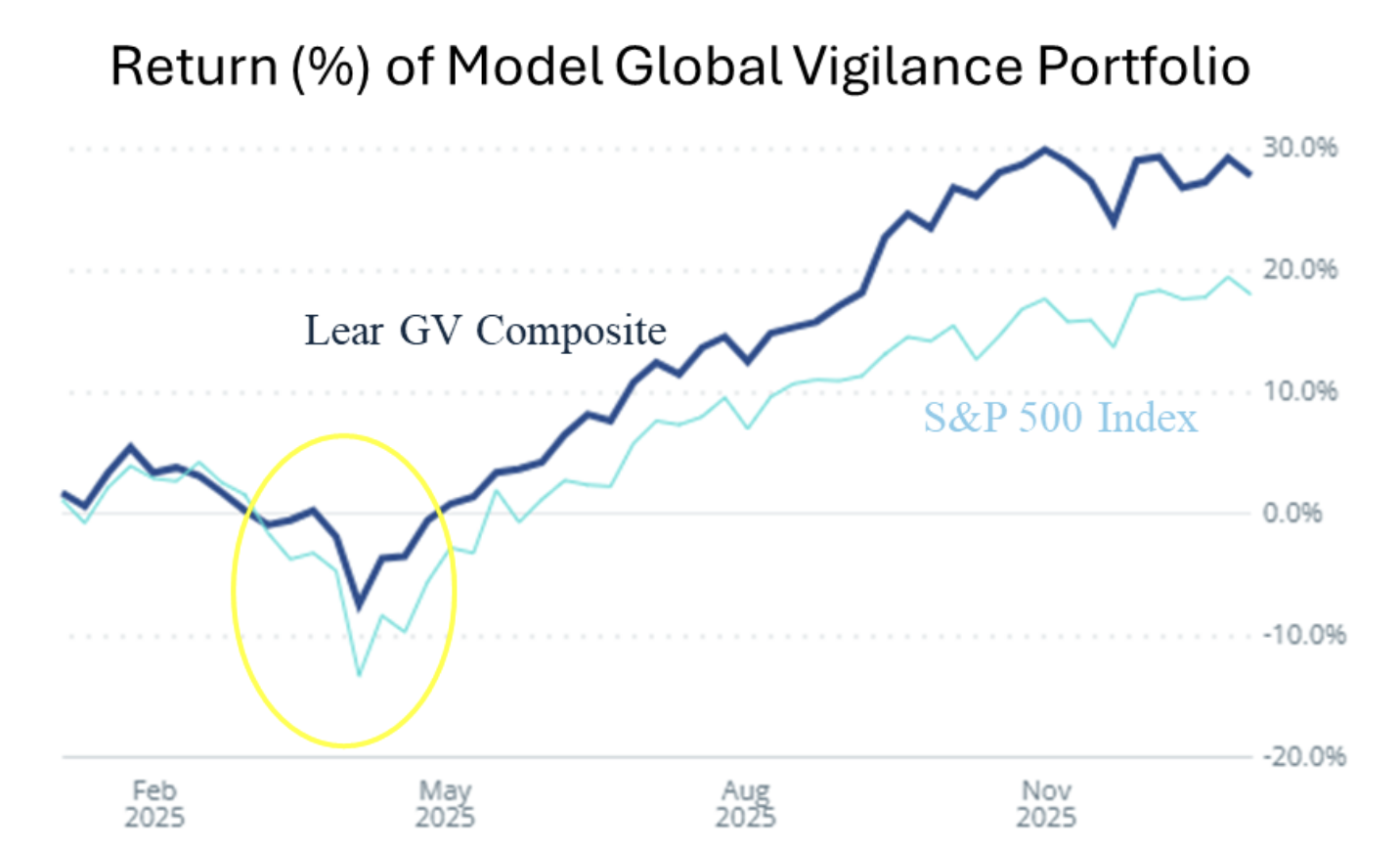

When the market panicked, our flagship portfolio drew down half as much as the index. Then we deployed cash into the fear. When the disruption was digested, our outperformance accelerated. The following chart displays our flagship strategy (Global Vigilance – moderate risk) the dark blue line compared to the S&P 500 (light blue line).

Please see performance chart at the end of letter for additional performance detail.

The yellow circle shows the Liberation Day outperformance. Then, it was off to the races. The result was outperformance on the way down (protection) and outperformance on the way up (opportunistic). This is what our style of investing is all about.

The Art of Unlearning

Why is disruption so hard for many people to accept? It is often difficult for people over a certain age to unlearn the old ways. And Wall Street is run by this demographic. The following is from Douglas Adams, author of The Hitchhiker's Guide to the Galaxy, and captures the spirit of this phenomenon:

"1. Anything that is in the world when you’re born is normal and ordinary and is just a natural part of the way the world works. 2. Anything that's invented between when you’re fifteen and thirty-five is new and exciting and revolutionary and you can probably get a career in it. 3. Anything invented after you're thirty-five is against the natural order of things."

AI Needs a New PR Agent

We continue to be surprised how little the public believes in AI. Perhaps because much of what America thinks about AI is based on movies. Blockbusters like “The Terminator” have tainted the average person’s perception. But we live in reality - not sci-fi.

However, there will be negatives like all innovations. Car crashes did not exist before the automobile. Brain rotted screenagers (6 7) are another example resulting from iPhones.

There will be negative side effects but so far not one negative sci-fi fantasy has become reality. If you are looking for Hollywood to shape your investing, we suggest watching Landman.

2026 Outlook: Prediction Nation

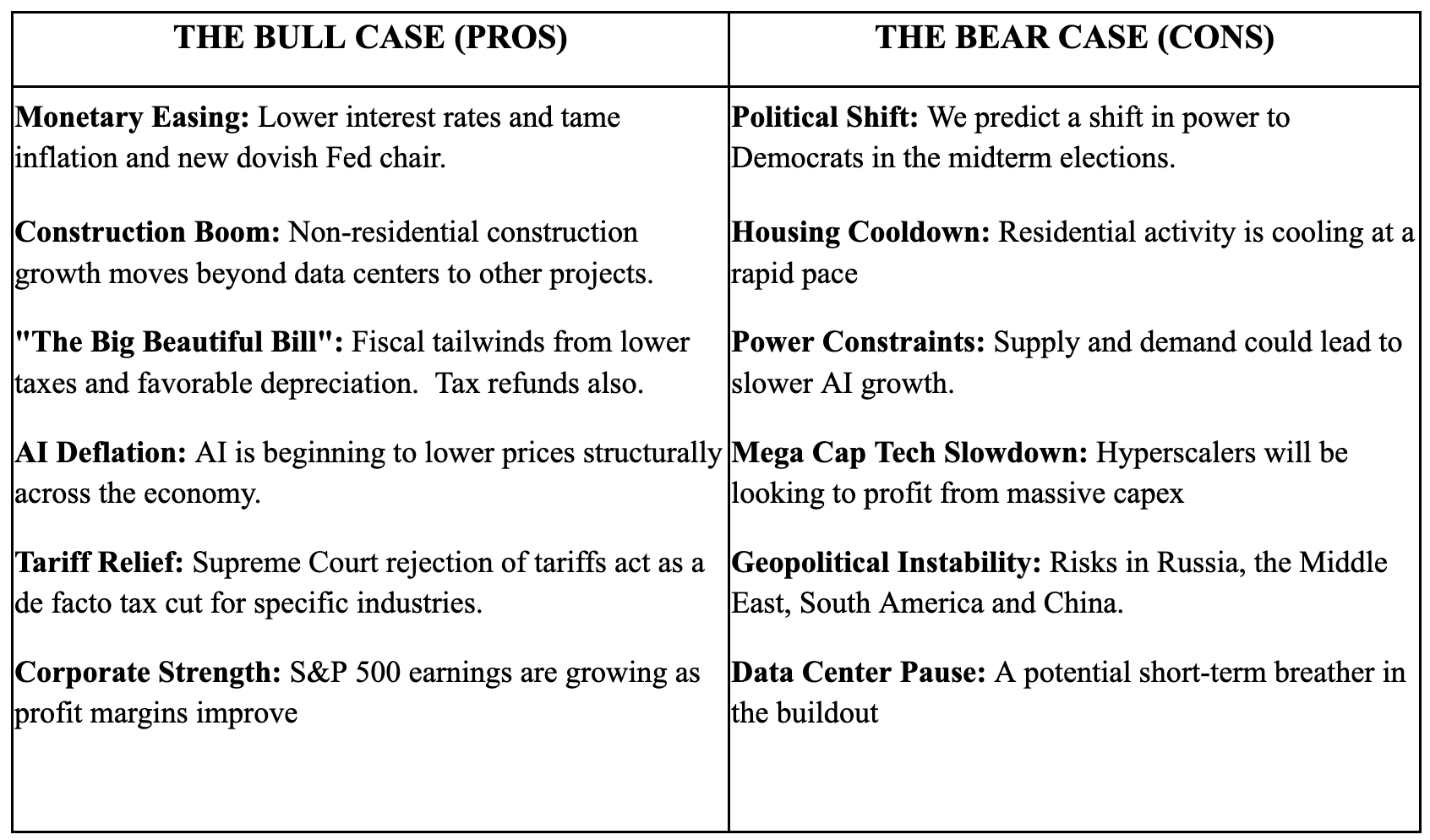

Our default position is to be bullish, but it is concerning that our optimism is now shared by the majority of Wall Street. The past years we were above-average bullish as many did not understand the bright future. Today, there are many more believers in AI-related stocks, gold, copper and power…this makes us uncomfortable as many of our favorite trades are now “mainstream”.

The Contrarian Concern:

Currently, market sentiment is positive. Consensus expects lower rates, tame inflation, growing GDP, and deregulation. In our business, when everyone agrees on the bull case, it is usually a signal to be cautious. Below we explore the bull and bear cases:

2026 will require a newly shaped portfolio to navigate the evolving economic environment. Less risk, careful security selection and the ability to be nimble. Many of the same themes from last year should continue and evolve. There are new themes developing as AI’s revolution moves to a new stage.

Investment Themes for 2026

For 2026, our capital is flowing toward the Industrial Build-Out and the Modernization of the Economy. Below is a summary of themes for the new year.

1. Power Thirsty - The main limitation to AI is electricity. The race to convert electrons into profits should hit a fever pitch in 2026. We are “long” the energy infrastructure value chain:

- Nuclear & Uranium: Global demand is now undeniable.

- Grid Storage: Companies like solving the off-grid power puzzle.

- Infrastructure: We are investing in the backlog of grid modernization

- Natural gas pipelines: Moving gas around country remains vital

2. Compute & Hardware - The engine of the economy remains AI chips and GPUs. The trade is simple: Who has the computing power? We remain focused on the hardware and memory manufacturers fueling the engine.

3. Real World AI & Robotics - We are moving beyond chatbots. This is the year AI applies to the physical world.

- Humanoids: The reality of robots in warehouses and offices is setting in.

- Autonomy: Self-driving technology is maturing rapidly.

4. Apps to Agents - Agents will change the “operating system” of business. We want exposure to:

- The infrastructure enabling it (compute, power, security),

- And the companies turning AI into measurable productivity and profit.

5. Healthcare Golden Age - Healthcare may be one of the most underappreciated AI beneficiaries:

- Administrative automation (billing, coding, scheduling)

- Imaging workflow and diagnostics support

- Drug discovery and faster iteration cycles

- Margin expansion through throughput and labor efficiency

6. The Construction Boom - Thus far in the economic cycle, the rebuild has been driven by data center construction. This will continue but it is possible that non-residential construction could also accelerate outside of data center space.

The "One Big Beautiful Bill Act" (OBBBA), signed into law by President Donald Trump on July 4, 2025, is widely expected to drive significant construction activity in the U.S. throughout 2026. However, unlike traditional infrastructure bills that rely on direct government spending (like building roads), the OBBBA largely stimulates construction through tax incentives, deregulation, and deadlines that force developers to act quickly.

7. Modernization of Warfare - The battlefield is being rewritten:

- Drones and autonomy

- Cybersecurity

- Software-defined defense

- Intelligence, surveillance, and decision acceleration

Whether we like it or not, capital is flowing here—and the modern threat landscape makes it a durable theme.

8. Hard Assets – Periodic Table - Gold, gold miners, and copper are the assets that led performance in 2025 and could continue into the new year. Each share similar macroeconomic drivers but have different use cases. Both should work with a falling dollar

Closing Thought

At Lear, our mindset requires humility and vigilance. We are not betting on a perfect world - we are betting on innovation's ability to solve problems. As we move into 2026, we remain untethered to any singular investing style and are focused entirely on finding the best way forward for your capital. Thank you for your continued trust.

Disclosures

LIM is a Registered Investment Advisor based in Dallas, Texas and registered with the Securities and Exchange Commission. Registration does not imply a certain level of skills or training. This document may contain forward-looking statements based on LIM’s expectations and projections about the methods by which it expects to invest. Those statements are sometimes indicated by words such as “expects,” “believes,” “will” and similar expressions. In addition, any statements that refer to expectations, projections or characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. Such statements are not guarantees of future performance and are subject to certain risks, uncertainties and assumptions that are difficult to predict. Therefore, actual returns could differ materially and adversely from those expressed or implied in any forward-looking statements as a result of various factors. This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results.

This document is intended for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy any securities. The information contained herein is not intended to be, and should not be construed as, investment advice. The views and opinions expressed in this document are those of the authors and do not necessarily reflect the official policy or position of any SEC registered investment firm.

1. For illustrative purposes only. For a complete list of holdings please contact your Lear representative.