This rarely heard song is simply titled “Natural Gas.” Produced by the Wiess Energy Hall, it is a part of the Houston Museum of Natural Science’s “Energy Jukebox.” The tune has a Schoolhouse Rock vibe, but also a propaganda-like feel. Regardless, the song was an easy selection for the SOTW for our most exciting investment theme in 2022.

We have increased our exposure to natural gas in both the midstream and upstream sectors through four equity investments. While natural gas prices in North America have been anemic for the last several years, we believe that the commodity is transitioning from a regional market to a global one—similar to crude oil. As a result, events in Europe and Asia are now directly impacting North American gas prices and we believe that this impact will continue to grow.

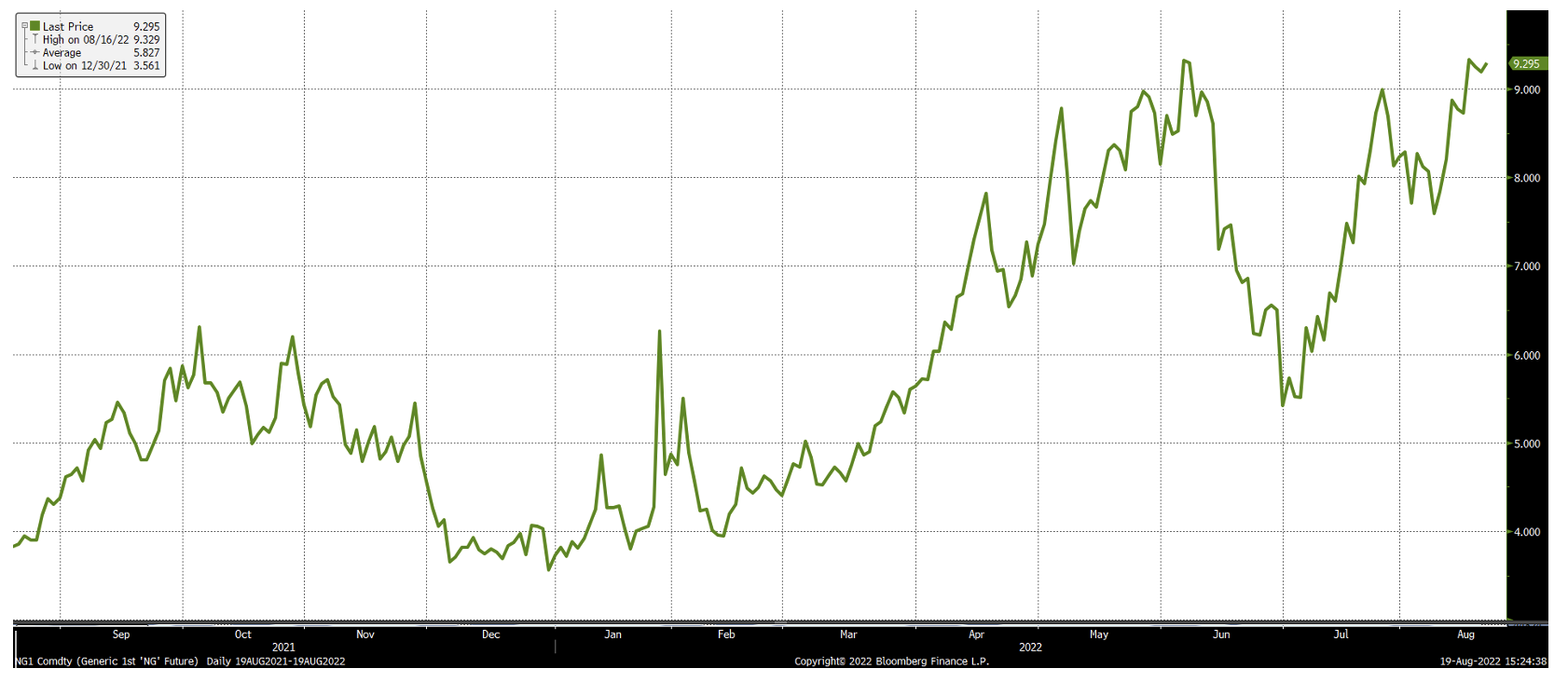

The recent rise in natural gas prices in the United States and around the world, in combination with the market-leading returns of related stocks, has made the investment community start to dust off their energy business models. The natural gas revenue model can be simple: Price X Production = Revenue. The chart below displays the rapid rise in the spot price of U.S. natural gas.

In addition to prices rising, the production has been rising to meet demand. While U.S. natural gas production continues to grow, this data set, taken by itself, is no longer a great indicator in predicting natural gas pricing. More production often leads to more supply and lower prices; however, in this cycle, production climbed and the price increased. This is good math for natural gas producers.

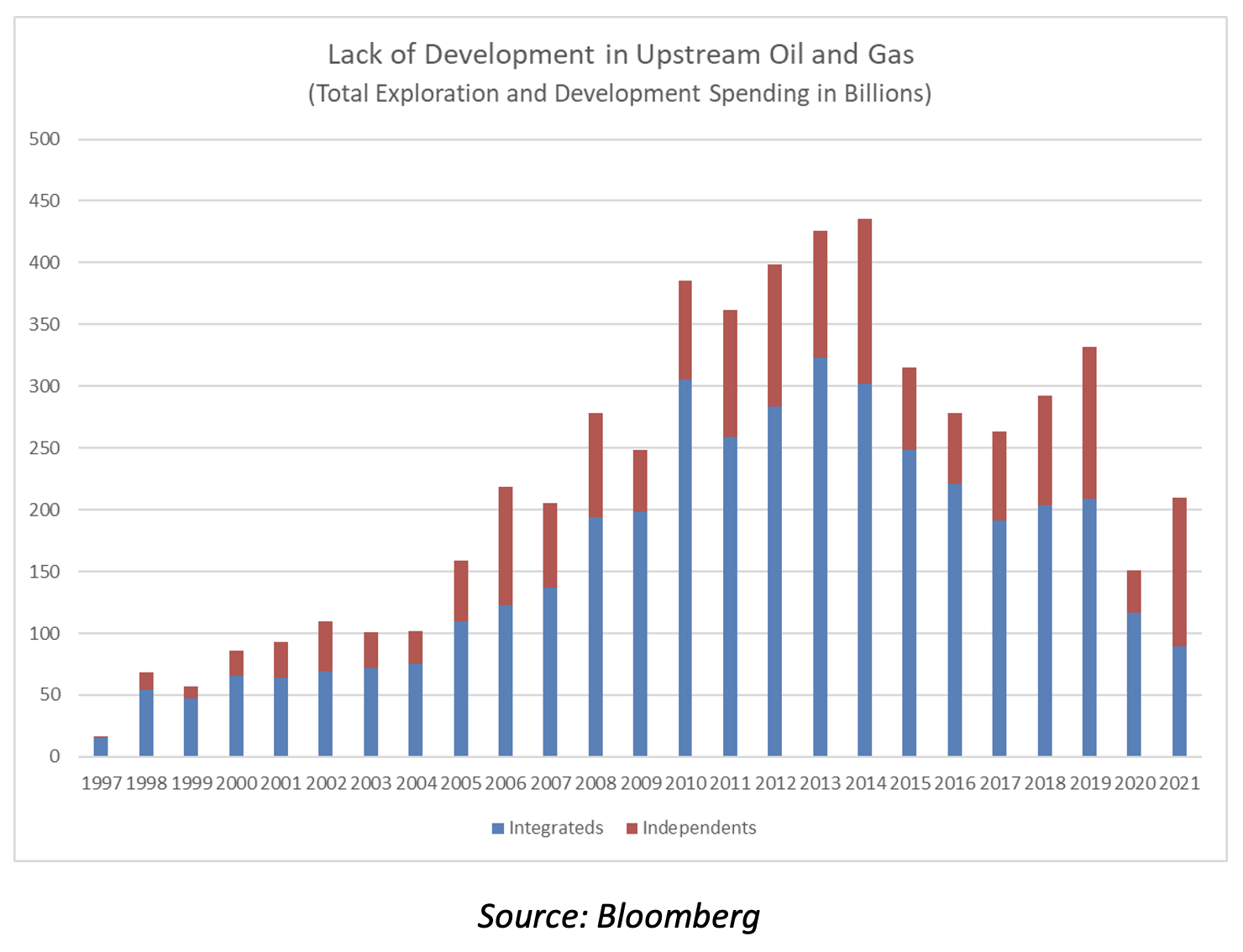

The New Look of Energy Companies: In addition to increased prices, the upstream energy industry has begun to adhere to a capital discipline strategy. The pivot has resulted in more focus on return of capital than production growth. Coupled with the COVID pandemic, both the absolute levels of upstream spending and the availability of ready inventory in drilled but uncompleted wells (DUCs) have declined precipitously the last few years. This is most evident in the Permian Basin, although an oil play, which accounts for 22% of U.S. shale gas production.

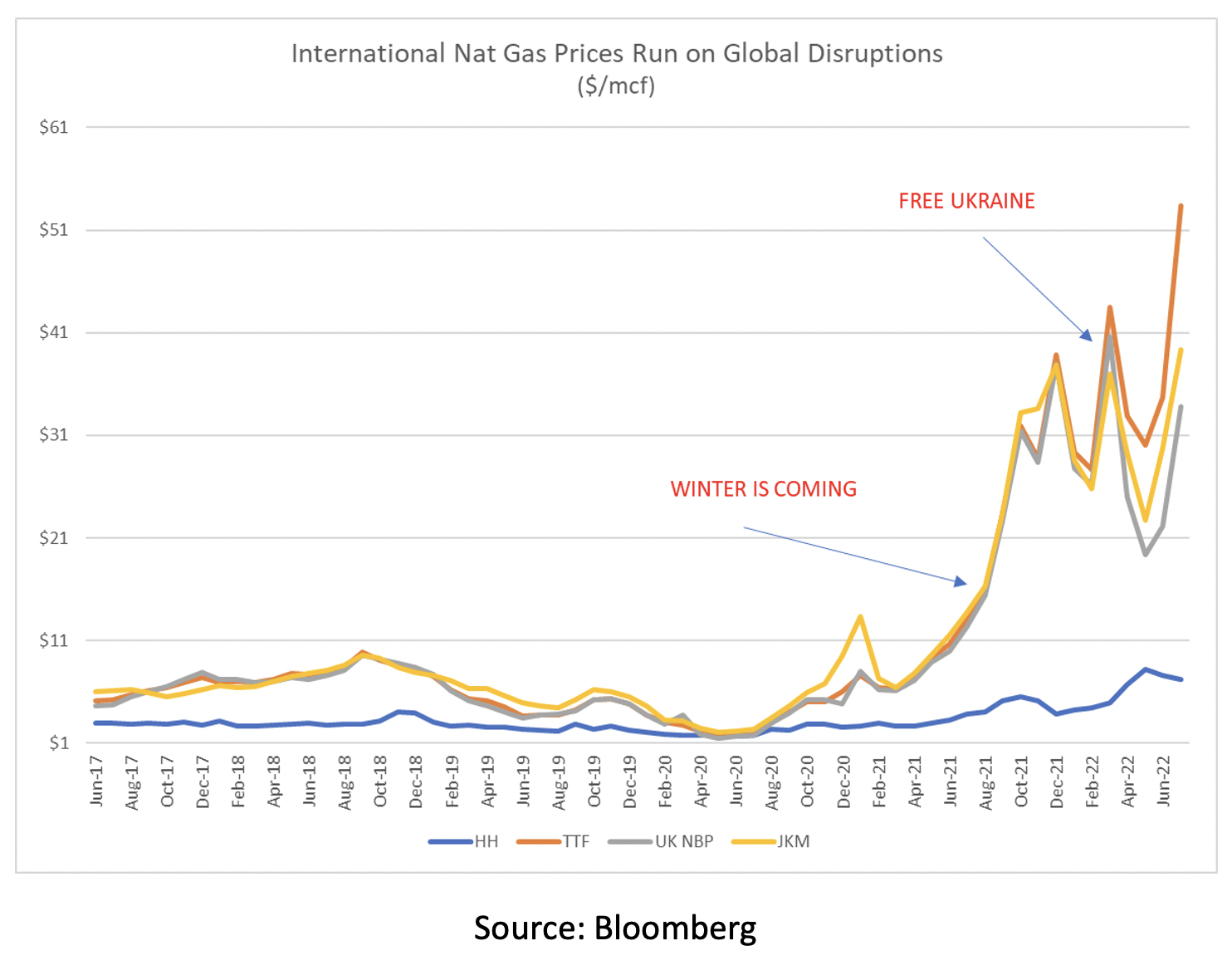

Across the Pond: The other large factor contributing to our thesis on natural gas is the increase in global demand. As we predicted in 2019 (see our research note - Warner’s Corner), liquid natural gas imports have been growing for several years as new liquefaction capacity came online. This has grown rapidly in the last year, as European demand for natural gas increased significantly last winter. Over-reliance on alternative sources of energy and a failure to fill European and UK storage suddenly led to an increased need for natural gas. The Russian invasion of Ukraine has only compounded the problem as pipeline exports from the region into Western Europe have declined.

Winter is Coming: Europe has significantly entered the spot market for LNG cargoes, creating competition with Asian buyers. This in turn has driven international natural gas prices to record highs, in some cases above $50/mcf. U.S. natural gas prices have rallied in recent weeks due to increased demand from excessive summer heat. With the current spot north of $9/mcf, it should also be noted that 2 Bcf/d of LNG export capacity has been down due to a fire earlier this summer at Freeport LNG in Texas. As a result, we expect LNG exports to increase in the fourth quarter and North American natural gas prices to remain elevated.

The following is a chart displaying the price of natural gas around the world. Notice the spike in European prices (orange line).

Our thesis is that longer-term demand for natural gas continues to strengthen in both Europe and Asia. This in turn will increase demand for LNG cargoes, which benefits both North American shippers and producers. As a result, we have increased exposure to two natural gas weighted producers with ample exposure to the European markets as well as one LNG producer and the midstream MLP space.

While the “Natural Gas” song is catchy and educational, we believe the higher prices of natural gas around the world will be just as catchy for the next several years. It is our hope that prices decline for Europeans as we enter the winter heating season; however, even at lower prices, select natural gas producers will still make record profits.

Please download LIM App to view market updates and other communications.

INFORMATION PRESENTED IS FOR EDUCATIONAL PURPOSES ONLY AND DOES NOT INTEND TO MAKE AN OFFER OR SOLICITATION FOR THE SALE OR PURCHASE OF ANY SPECIFIC SECURITIES, INVESTMENTS OR INVESTMENT STRATEGIES. BLOOMBERG IS THE SOURCE OF MARKET DATA. INVESTMENTS INVOLVE RISK AND ARE NOT GUARANTEED. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RETURNS. BE SURE TO FIRST CONSULT WITH A QUALIFIED FINANCIAL ADVISER AND/OR TAX PROFES- SIONAL BEFORE IMPLEMENTING ANY STRATEGY DISCUSSED HEREIN.